Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) will release earnings results for the second quarter, after the closing bell on Monday, Aug. 4.

Analysts expect the Boston, Massachusetts-based company to report quarterly earnings at $4.25 per share, versus a year-ago loss of $12.83 per share. Vertex Pharmaceuticals projects to report quarterly revenue at $2.91 billion, compared to $2.65 billion a year earlier, according to data from Benzinga Pro.

On July 22, Vertex announced marketing authorization in Canada for ALYFTREK, a once-daily next-generation CFTR modulator for the treatment of cystic fibrosis.

Vertex Pharmaceuticals shares rose 1.2% to close at $462.13 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

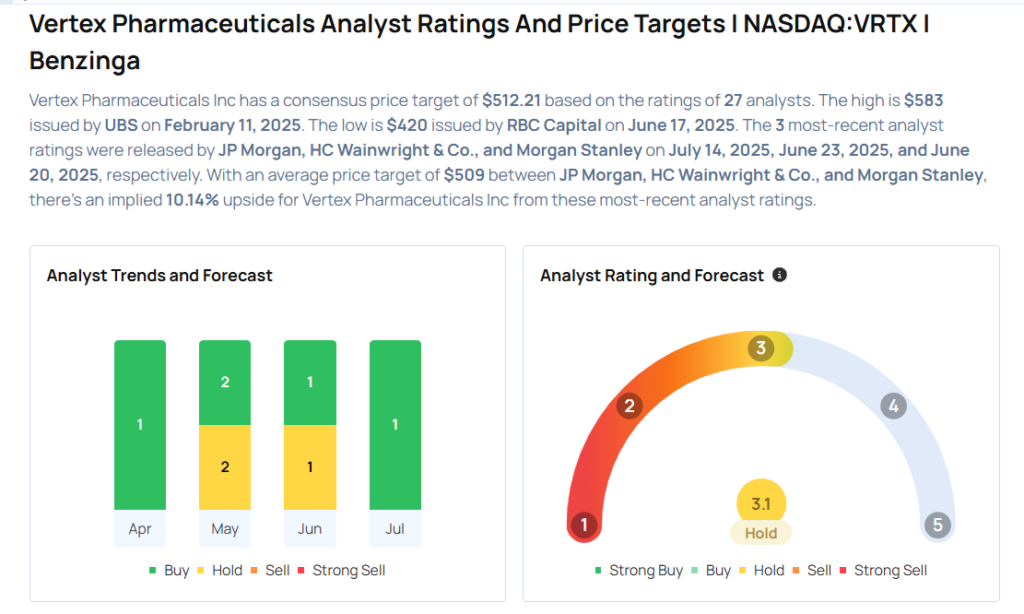

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Jessica Fye maintained an Overweight rating and raised the price target from $515 to $517 on July 14, 2025. This analyst has an accuracy rate of 66%.

- HC Wainwright & Co. analyst Andrew Fein reiterated a Buy rating with a price target of $550 on June 23, 2025. This analyst has an accuracy rate of 63%.

- Morgan Stanley analyst Matthew Harrison maintained an Equal-Weight rating and cut the price target from $464 to $460 on June 20, 2025. This analyst has an accuracy rate of 61%.

- Needham analyst Joseph Stringer reiterated a Hold rating on May 6, 2025. This analyst has an accuracy rate of 65%.

- Leerink Partners analyst David Risinger downgraded the stock from Outperform to Market Perform and cut the price target from $550 to $503 on May 6, 2025. This analyst has an accuracy rate of 71%.

Considering buying VRTX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock