What if the best trades of the year were already marked on the calendar?

In a Barchart webinar, contributor Gavin McMaster demonstrated how traders can uncover repeating patterns in commodities and tech stocks using Barchart’s Seasonal Returns tool — and how to build trading strategies around them.

“It’s not about guessing,” Gavin explained. “Seasonality helps identify recurring market behavior — and when combined with technicals or options data, it can add an extra edge.”

Example 1: Gold’s Seasonal Strength

Gavin started by pulling up the popular SPDR Gold Shares (GLD) exchange-traded fund (ETF).

Under Technicals → Seasonal Returns, traders can view 15 years of monthly returns, showing how gold tends to perform in each month.

“January consistently stands out as one of the strongest months,” Gavin noted. “That could be linked to the Chinese New Year or broader market cycles.”

GLD Seasonal Takeaways:

- Strongest Months: January, August, April

- Weakest Month: November

- Strategy Idea: Combine seasonality with technical confirmation — for example, trendline breaks or RSI recoveries in early January — to time gold entries.

- Try it yourself: Check Gold Seasonality for futures (GC*1) on Barchart →

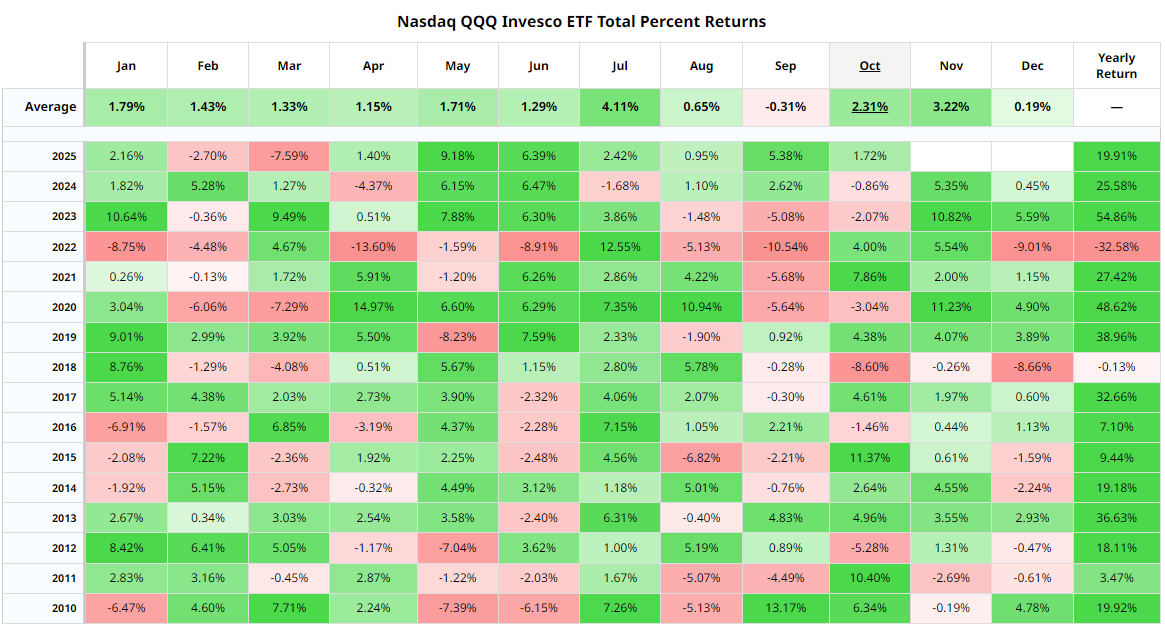

Example 2: Nasdaq’s Seasonal Patterns

Next, Gavin looked at the Invesco QQQ Trust (QQQ). The seasonality chart revealed a powerful pattern that most traders overlook.

“September historically is the weakest month for QQQ,” Gavin explained. “But from November through March, tech stocks show some of the strongest returns on record.”

This “winter tech rally” has appeared consistently over the last 15 years — often aligning with holiday sales, fiscal spending cycles, and earnings optimism.

QQQ Seasonal Takeaways:

- Strongest Stretch: November through March

- Weakest Month: September

- Strategy Idea: Consider bullish setups — like long calls or call spreads — from early November into late February to align with the historical uptrend.

- Try it yourself: Explore Nasdaq Seasonality →

How to Trade Seasonality (According to Gavin)

Once you’ve identified the patterns, the next step is execution. Gavin outlined three approaches for traders to capitalize on seasonal data:

- Trend Following: Ride established seasonal trends. For example, trade S&P 500 (SPY) strength in Q4 or gold’s typical early-year rally.

- Sector Rotation: Move capital between market sectors based on historical seasonal performance — like energy in the summer or retail in December.

- Options Strategies: Use calls, call spreads, or bull put spreads to profit from expected moves during seasonal strength.

Examples:

- Spot setups for calls on GLD ahead of January.

- Screen bullish call spreads on QQQ in November with February or March expirations.

- Hedging - Protect against seasonal underperformance in months like September with protective puts or reduced exposure.

“You’re putting probability on your side,” Gavin said. “You can’t predict the market, but you can trade in alignment with what history shows tends to happen.”

Tools to Try on Barchart

Use these Barchart features to start building your own seasonality-based strategy:

- Seasonal Returns Tool – Identify month-by-month trends for ETFs, futures, and commodities.

- Options Screeners – Find long call or vertical spread opportunities during strong seasonal periods.

- Sector Performance – Track which market sectors align with seasonal strength cycles.

The Bottom Line

Seasonal data doesn’t guarantee profits, but it gives you context. By knowing when assets tend to outperform or struggle, you can stack the odds in your favor and refine your entry timing.

“Seasonality won’t replace your strategy,” as Gavin said. “But it can strengthen it — like trading with the wind at your back.”

Watch the clip for a quick breakdown →

- Watch the Full Webinar: The Power of Trading Seasonality

- Explore Seasonality Tools for your favorite assets on Barchart.