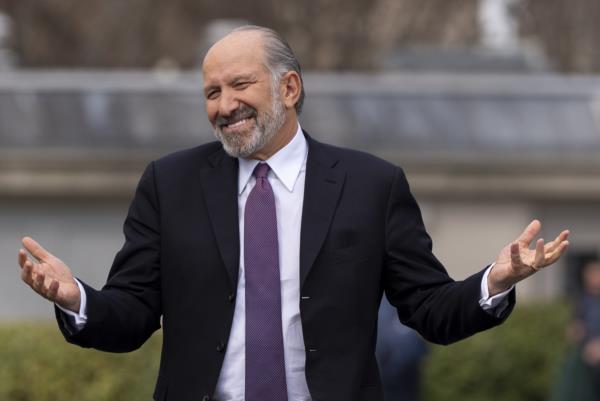

The United States government is considering taking equity stakes in private-sector businesses, following its recent move to acquire a 10% stake in chipmaker Intel. Commerce Secretary Howard Lutnick revealed that discussions are underway within the Trump administration to potentially enter into similar agreements with other companies, particularly long-time defense contractors.

Lutnick emphasized the importance of assessing where the government can add significant value to a business before considering such investments. He highlighted the need to prioritize the interests of the American people, especially when the government plays a crucial role in a company's operations.

One of the key areas under consideration is the defense sector, with a focus on companies like Lockheed Martin, which heavily relies on government contracts for its revenue. Lutnick pointed out that Lockheed Martin's close ties to the US government raise questions about the economic implications of such relationships. He mentioned ongoing discussions within the Department of Defense to evaluate the potential benefits of government equity stakes in defense contractors.

While defense contractors are a primary focus, Lutnick also mentioned other scenarios where the government might consider taking ownership stakes. These include situations such as acquiring rare earth minerals and providing funding for research at universities, where strategic investments could benefit national interests.

As the Trump administration explores the possibility of expanding its ownership in private businesses, the implications of such moves on the economy and national security remain subjects of intense debate. Companies like Lockheed Martin and others in sectors critical to national interests may face increased scrutiny as the government evaluates its role in supporting and influencing private enterprises.