Upstart Holdings (UPST) has had a rocky ride this year. After rallying earlier, the stock has lost most of its momentum and now sits roughly flat year-to-date, underperforming the S&P 500 Index ($SPX), which has gained more than 9% in the same period. The pullback highlights macroeconomic uncertainty and concerns around its valuations.

Upstart, known for its AI-driven lending marketplace, has not yet seen any material deterioration in its credit performance. Still, broader concerns about inflation, tariffs, and consumer credit demand have weighed heavily on investor confidence. These pressures have left the stock down more than 18% over the past month alone.

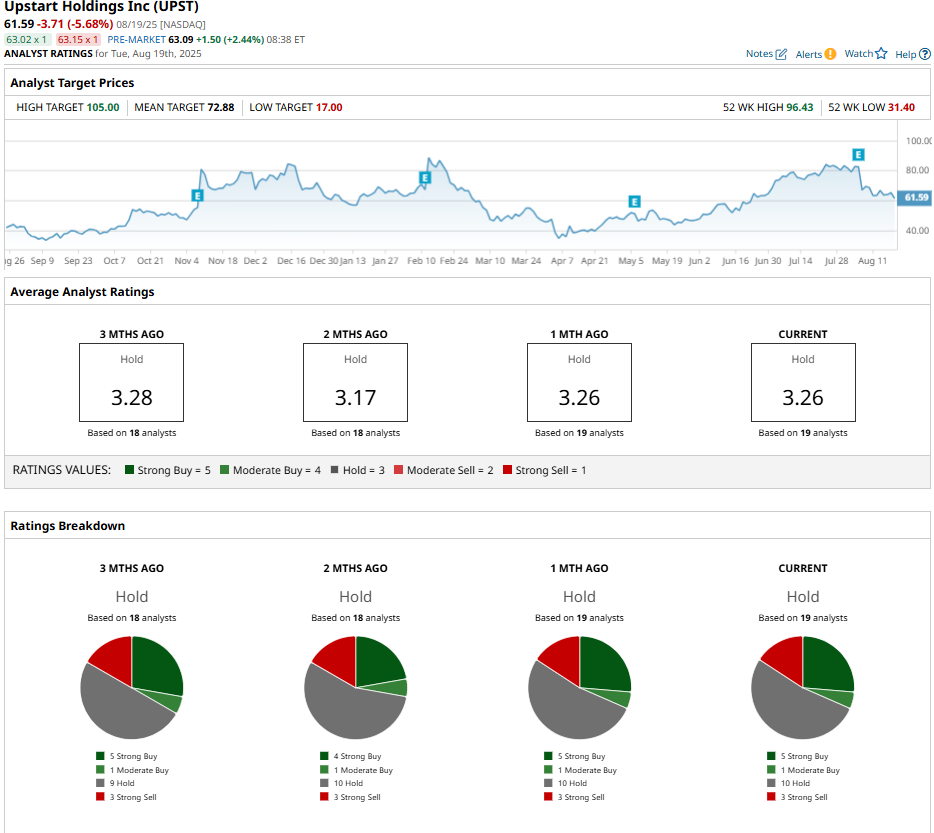

Despite the macro uncertainty, Upstart’s consistently solid quarterly performances are hard to ignore. Its operational strength and acceleration in fee-based revenue could lead to a solid recovery in its share price. Further, the highest price target for UPST stock is $105, implying nearly 70% upside potential from current levels.

UPST’s Q2 Shows Solid Momentum in Its Business

Upstart’s second-quarter results highlight that its platform is gaining traction, while its revenue mix is increasingly shifting toward more sustainable, fee-based income. Further, higher loan activity, improved underwriting efficiency, and continued momentum in its emerging product lines position it well to sustain the momentum in 2025 and beyond.

Loan originations on the Upstart platform reached $2.8 billion in Q2, the highest in three years. This surge reflects the appeal of Upstart’s platform and its growing funding partnerships. The company’s AI-driven underwriting model continues to improve, driving higher conversion rates and supporting triple-digit top-line growth. Notably, new product categories such as small-dollar loans and auto lending are meaningfully contributing to its growth, and accounting for more than 10% of total originations for the first time.

Upstart delivered revenue of $257 million in Q2, representing a 102% year-over-year increase. However, the key here was the growing shift toward fee-based income, which helps mitigate credit risk and positions the company for steady growth over the long term. Fee revenue was approximately $241 million, up 84% from a year ago. Within that, transactional revenue more than doubled, primarily reflecting improvements in Upstart’s underwriting models, while servicing fees climbed nearly 20% as the book of serviced loans expanded.

Net interest income contributed about $17 million, bolstered by growth in newer products, particularly auto loans, which continue to show improving returns.

The fintech’s reach is broadening as well. More than 250,000 new borrowers came onto the platform in the quarter, and it recorded a 159% increase in the volume of loan transactions. Small-dollar loans and auto lending each crossed the $100 million mark in quarterly originations, together contributing nearly one-fifth of new borrower activity. This diversification expands Upstart’s market opportunity and strengthens its long-term growth profile.

UPST’s margins are also moving in the right direction. Contribution margin rose to 58% in Q2, three percentage points higher than the previous quarter. This improvement was supported by stronger take rates, along with efficiency gains stemming from AI-driven cost optimization.

Upstart ended the quarter with about $1.02 billion of loans on its balance sheet, up from $815 million in Q1. This growth isn’t alarming as it is temporary and reflects rising demand in newer product categories. UPST is steadily focusing on external capital, which will reduce direct balance sheet exposure over time and support a low-risk, fee-centric business model.

Looking ahead, management projects continued momentum in fee-based revenue, with total revenues expected to reach about $280 million in the upcoming quarter. Of this, roughly $275 million is anticipated from fees.

Is UPST Stock a Buy, Sell, or Hold?

The macro uncertainty is keeping analysts sidelined, and they maintain a “Hold” consensus rating. However, with loan originations at multi-year highs, AI-driven underwriting improvements boosting conversions, and an expanding mix of fee-based income, Upstart appears to be positioning itself for more sustainable long-term growth.

Although macroeconomic uncertainty remains, Upstart is well-positioned to weather it and continue scaling profitably across multiple lending categories, making the stock an attractive buy on the dip.