/The%20Shopify%20logo%20on%20a%20smartphone%20screen%20by%20IB%20Photography%20%20via%20Shutterstock.jpg)

As artificial intelligence (AI) continues to shape the digital commerce landscape, Shopify (SHOP) is working to ensure it remains not only relevant, but essential.

The company’s first-quarter results were more than reassuring. Shopify President Harley Finkelstein indicated in the Q1 earnings call that Shopify’s agility remains a powerful asset.

Shopify stock has surged 9.8% year-to-date, compared to the broader market gain of 6.3%. Let’s find out if Shopify can reignite sustained growth in the AI-powered era of e-commerce.

About Shopify Stock

Valued at $145 billion, Shopify is a commerce platform that helps individuals and businesses create and manage online stores. It offers tools for selling products online, in-person, and on social media, as well as managing payments, shipping, inventory, and marketing, all in one place.

After years of rapid growth and pandemic-driven tailwinds, the Canadian company now faces a more uncertain macroeconomic environment. However, the company displayed resilience during a quarter marked by rising global trade tensions and shifting economic policy. Total revenue increased 27% year on year in Q1, marking the eighth consecutive quarter of revenue growth above 25%. Gross merchandise volume (GMV), or the total value of merchandise sold on the platform, rose 23% to $74.8 billion. This was the seventh consecutive quarter of GMV growth above 20%. Offline GMV increased 23%, indicating Shopify’s growing popularity among brick-and-mortar retailers and mid-market brands.

Despite ongoing geopolitical uncertainty, cross-border trade remained stable, accounting for 15% of total GMV. Additionally, international GMV increased 31%, indicating that Shopify’s global expansion strategy is yielding long-term revenue and transaction scale.

Shopify’s merchant cohort dynamics have been a strategic growth driver for the company. Its ability to consistently outperform the broader e-commerce market, with 38 of its last 39 merchant cohorts doing so since 2015. This demonstrates the strength of its platform, execution, and merchant-first approach. Shopify Payments also achieved 64% GMV penetration as a result of its expansion into 16 new countries. Shop Pay, Shopify’s accelerated checkout solution, saw 57% annual GMV growth, processing more than $22 billion in Q1 alone.

AI Is Disrupting Commerce, and Shopify Needs to Respond

However, growth alone will not be sufficient.

With AI transforming everything from logistics to customer service, the next phase of e-commerce will necessitate tools that are smarter, faster, and more localized. Shopify appears to understand this and is moving quickly to meet the demand.

Perhaps the most exciting recent launch is tariffguide.ai, an AI-powered tool that instantly identifies duty rates based on product description and country of origin, which can mean the difference between 0% and 15% import fees, resulting in a direct margin impact. The company is also incorporating AI into its daily workflows.

The Shop app has been updated to allow buyers to filter products by country, promoting local businesses and improving discovery. The Sidekick AI assistant has been redesigned for improved logic processing, multilingual support, and scalability with larger merchant datasets. Monthly active users of Sidekick more than doubled in 2025 alone. Shopify’s “AI-first” mandate is now operational too.

Shopify maintained a strong 15% free cash flow margin. As of the end of the quarter, the company had $5.5 billion in cash, equivalents, and marketable securities. Heading into the second quarter, Shopify expects mid-20% revenue growth, high-teens gross profit growth, and free cash flow margins that remain in the mid-teens. Management emphasized continued investments in AI, enterprise functionality, offline retail, and global expansion. This indicates that Shopify is not backing off in the face of macroeconomic uncertainty.

Analysts predict that the company will report 10.6% earnings growth and a 22.6% revenue increase in 2025.

Despite Shopify’s strong performance, many investors are still unsure about its valuation. To justify its premium valuation of 80x forward earnings and 13x forward sales, Shopify must continue to deliver both top-line growth and expanding profitability.

What Does Wall Street Say About Shopify Stock?

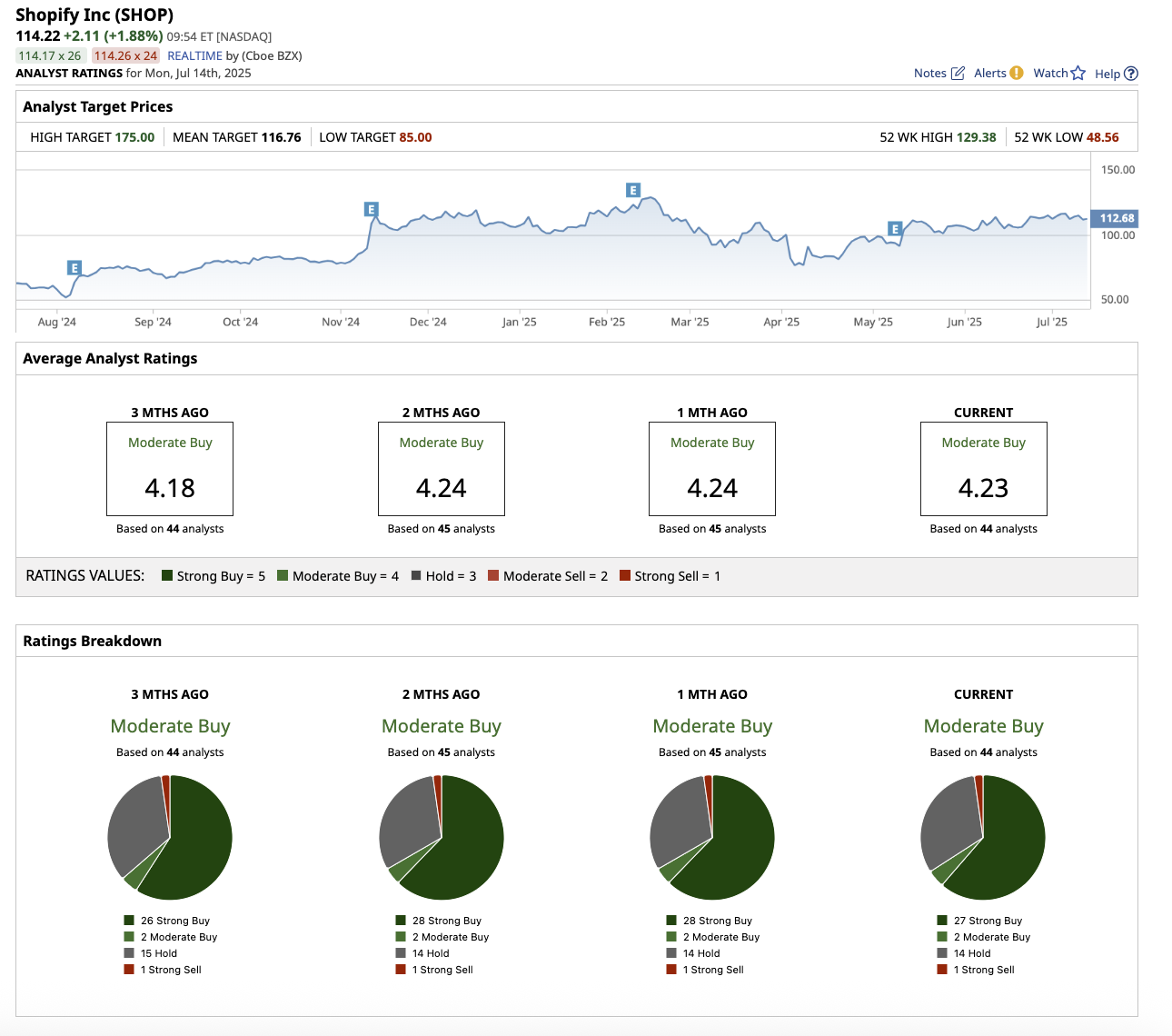

Overall, Wall Street rates SHOP stock a “Moderate Buy.” Of the 44 analysts covering SHOP, 27 rate the stock a “Strong Buy,” two have a “Moderate Buy” recommendation, 14 suggest a "Hold,” and one rates it a “Strong Sell.” The stock is trading close to its mean price target of $116.76. However, its high target price of $175 suggests the stock could go as high as 53.2% over the next 12 months.

The Key Takeaway

Shopify’s long-term goal is to evolve from a commerce enabler into a fully integrated commerce ecosystem. That means managing the checkout experience, owning shipping and fulfillment tools, and incorporating AI-powered decision-making throughout the merchant journey. However, this journey will take time. Patient investors who believe in the rise of AI-driven commerce may find Shopify poised for a new era of growth.