Shares of space systems solutions company Rocket Lab (RKLB) are up almost 70% so far this year, thanks to solid launch operations that are picking up pace. However, RKLB stock also pulled back more than 11% on Sept. 3. Should you consider buying shares of the company now? Let's take a closer look.

About Rocket Lab Stock

Based in Long Beach, California, Rocket Lab is an aerospace firm that focuses on launching and building satellites, particularly for small- to mid-size payloads. The company handles everything from satellite production to deployment, offering complete space services. Its flagship launch vehicle, the Electron rocket, is engineered for rapid, affordable missions to low Earth orbit.

Rocket Lab also delivers customizable spacecraft through its Photon platform, catering to the needs of commercial, defense, and research customers. Operating launch facilities in both the U.S. and New Zealand, the company plays a significant role in the expanding small satellite sector. The company has a market capitalization of $20.8 billion.

Over the past year, Rocket Lab’s share price has surged largely due to the expansion of its launch operations, increased interest from government clients, and a positive outlook tied to its upcoming rocket technology. Over the past 52 weeks, RKLB stock has gained 578%. Shares are also up 69% year-to-date (YTD). RKLB stock had reached a 52-week high of $53.44 in July, but it is now down 19% from this high.

Rocket Lab recently surged on the news of the launch of its Launch Complex 3. However, in the Sept. 3 session, shares dropped 11.7% intraday as investors reassessed the company’s valuation.

RKLB stock currently has an eye-watering valuation. Its price-to-sales (P/S) ratio sits at 54.2 times, which is significantly stretched compared to the industry average.

Rocket Lab Highlighted Operational Progress

On Aug. 7, Rocket Labs reported solid topline growth in its second-quarter results for fiscal 2025. Total revenues increased 36% year-over-year (YOY) to $144.5 million. Non-GAAP gross margin grew from 30.7% in Q2 2024 to 36.9% in Q2 2025, based on significant operational strides. On the other hand, Rocket Lab’s bottom-line losses are still climbing. Net loss per share climbed from $0.08 in the prior-year period to $0.13 in Q2 2025.

Rocket Lab launched five Electron missions during Q2. This included “two launches two days apart from the same launch site,” which was a new record for the company’s Launch Complex 1.

The company also highlighted its new Payloads business unit, which is expected to significantly bolster its position in securing defense satellite contracts. This is also tied to the acquisition of Geost, a developer of electro-optical and infrared (EO/IR) sensor systems.

Late last month, Rocket Lab officially opened Launch Complex 3 at Virginia’s Mid-Atlantic Regional Spaceport (MARS), the company’s dedicated test, launch, and landing facility for its reusable Neutron rocket. This is a big step towards Neutron’s first launch.

The company is also expanding its presence in the semiconductor industry to meet the demand for space-grade chip technologies. Based on conducive government investments, the company expects to double its production from 20,000 wafers to nearly 35,000 wafers per month and “supply U.S. spacecraft manufacturers with domestically produced semiconductors.”

For Q3 2025, Rocket Lab expects revenue in the range of $145 million to $155 million, while its non-GAAP gross margin is projected to be in the range of 39% to 41%.

Wall Street analysts have a mixed outlook about Rocket Lab’s future earnings. Although loss per share is projected to increase 8% annually to $0.41 for the current fiscal year, analysts foresee a 34% YOY improvement to a $0.27 loss per share in the next fiscal year. For Q3, loss per share is expected to remain unchanged YOY at $0.10.

What Do Analysts Think About Rocket Lab Stock?

Wall Street analysts are still soundly optimistic about RKLB stock. Recently, Needham analyst Ryan Koontz reiterated a “Buy” rating on the stock and maintained a price target of $55, reflecting continued positive sentiment.

Last month, Cantor Fitzgerald also maintained an “Overweight” rating on the stock, while raising the price target from $35 to $54, based on the solid Q2 results. Citing the same reason, analysts at Keybanc Capital Markets maintained an “Overweight” rating as well, raising their target from $40 to $50.

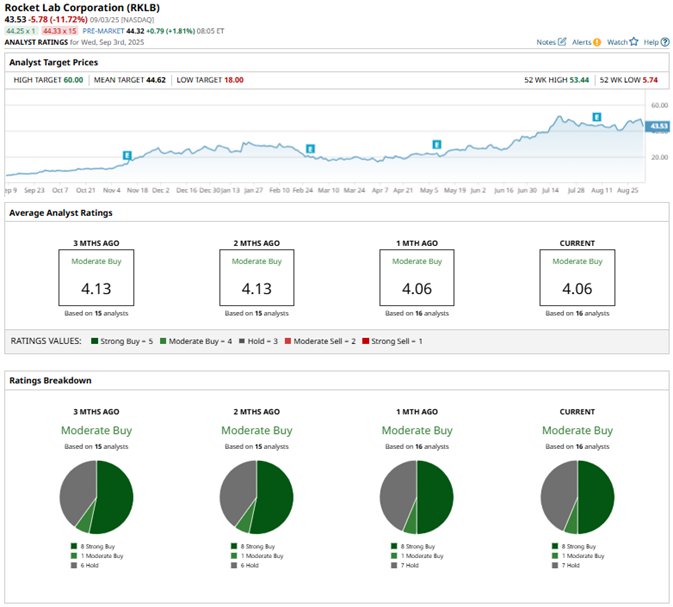

Rocket Lab stock is popular on Wall Street, with analysts awarding RKLB a consensus “Moderate Buy” rating overall. Of the 16 analysts rating the stock, eight analysts rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” and seven analysts play it safe with a “Hold” rating.

The consensus price target of $44.62 represents 4% potential upside from current levels. However, the Street-high price target of $60 suggests a potential 40% rally from here.

Key Takeaways

While Rocket Lab's valuation remains elevated — which is seemingly the reason RKLB stock is down from its recent highs — its performance this year has been nothing short of phenomenal. Moreover, the company’s expansion plans are robustly in place, and the launch of its new launch complex is expected to bolster its market position. Therefore, investors might consider investing in RKLB stock now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.