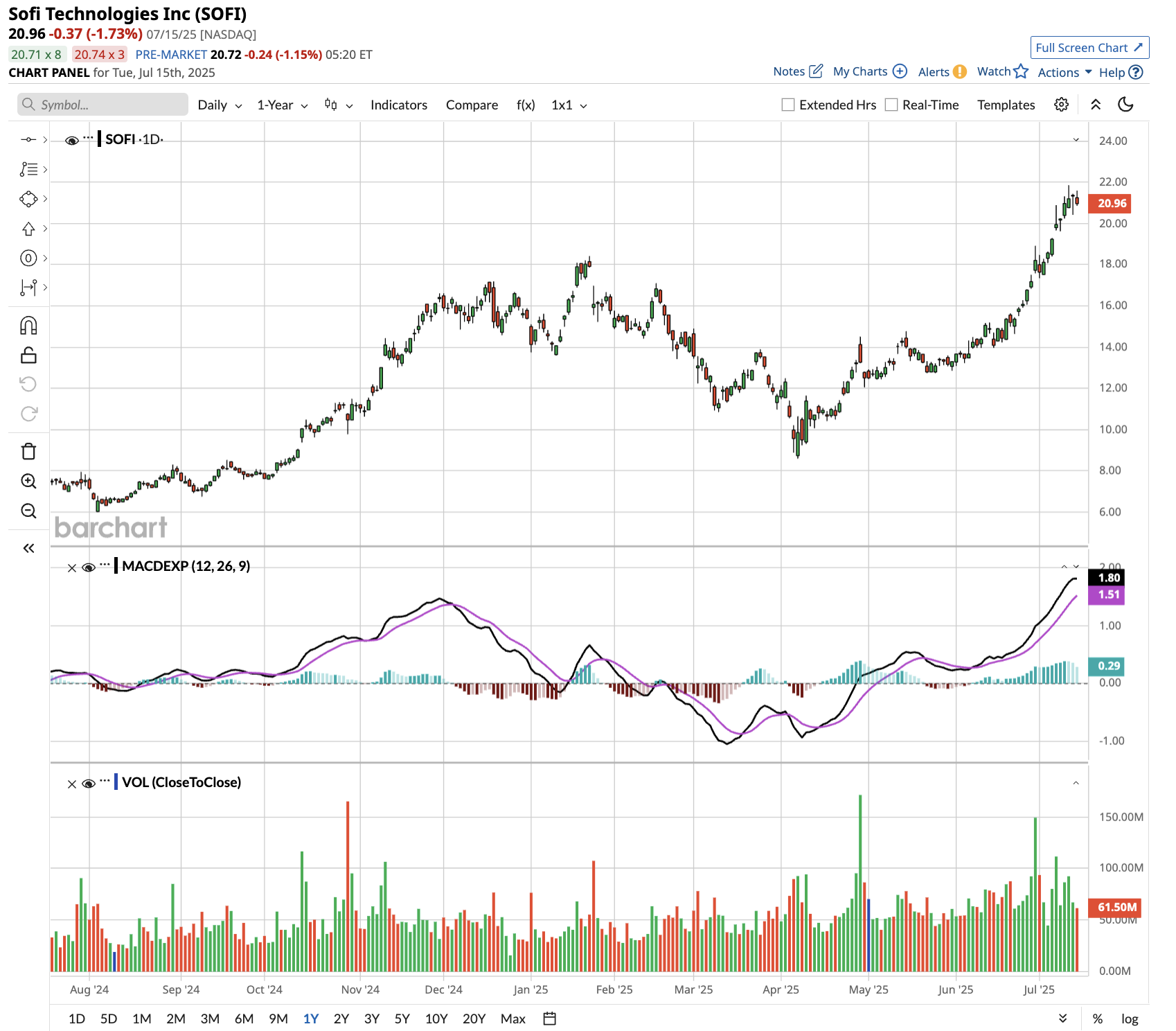

SoFi Technologies (SOFI) has been on an impressive tear, gaining roughly 53% in the last month and 180% in the past 12 months. The rally extended last week after SoFi announced strategic partnerships with asset managers, including Cashmere, Fundrise, and Liberty Street Advisors. SoFi disclosed plans to expand retail investor access to alternative investments in artificial intelligence, machine learning, and space technology. This move democratizes private market investments with minimum capital requirements starting at just $10.

The company’s expansion into private markets, combined with its growing 10.9 million member base, positions SoFi to capitalize on increasing demand for alternative investments. CEO Anthony Noto emphasized the platform’s role in building “truly diversified portfolios” for a new generation of investors.

While the stock’s momentum appears strong, investors should monitor whether SoFi can sustain growth as competition intensifies in the fintech space.

Is SoFi Stock a Good Buy Right Now?

SoFi Technologies presents a compelling investment opportunity as a vertically integrated digital bank targeting younger, affluent consumers dissatisfied with traditional banking. Its mission to help people “get their money right” drives a comprehensive one-stop financial services platform spanning lending, banking, investing, and payments.

SoFi delivered exceptional Q1 results with record member growth of 800,000 new additions (34% year-over-year) and 1.2 million new products (35% growth). It now serves approximately 11 million members, offering over 15 million products, which demonstrates the effectiveness of its cross-selling strategy.

Revenue growth has accelerated to over $3 billion annually, with adjusted EBITDA margins reaching 26%. The company has successfully diversified beyond its lending origins, with fee-based revenue now comprising 41% of total revenue, up from 26% in 2021.

Key growth drivers include the $27 billion deposit base, which generates funding cost savings; the rapidly expanding Loan Platform Business, which generates $380 million in annualized revenue; and strong momentum in Financial Services products.

SoFi's Financial Services Productivity Loop generates sustainable competitive advantages by achieving high customer lifetime value and low acquisition costs. Approximately 30% of new products come from existing members, eliminating duplicate acquisition expenses. The company's technology-first approach enables rapid innovation and scalability compared to traditional banks, which are often burdened by legacy systems.

Management raised 2025 guidance, expecting $3.3 billion in revenue (24%-27% growth) and maintaining medium-term revenue growth above 25% annually. It targets a 20%-30% return on equity in the long term, while investing in crypto re-entry, SoFi Plus subscription services, and enhanced AI capabilities.

SoFi capitalizes on structural shifts in consumer finance, particularly among digitally native demographics. With strong unit economics and an expanding product portfolio, SoFi appears well-positioned for sustained growth in the evolving financial services landscape.

Is SOFI Stock Still Undervalued?

Analysts tracking the fintech stock estimate revenue to increase from $2.61 billion in 2024 to $5.06 billion in 2029. In this period, adjusted earnings are forecast to expand from $0.15 per share to $0.91 per share.

Today, SoFi stock trades at a forward price-to-earnings of 75x, which might seem elevated. However, its lofty valuation is supported by stellar earnings growth. If SOFI stock is priced at 40x forward earnings, it will trade around $36 per share in early 2029, indicating upside potential of 60% from current levels.

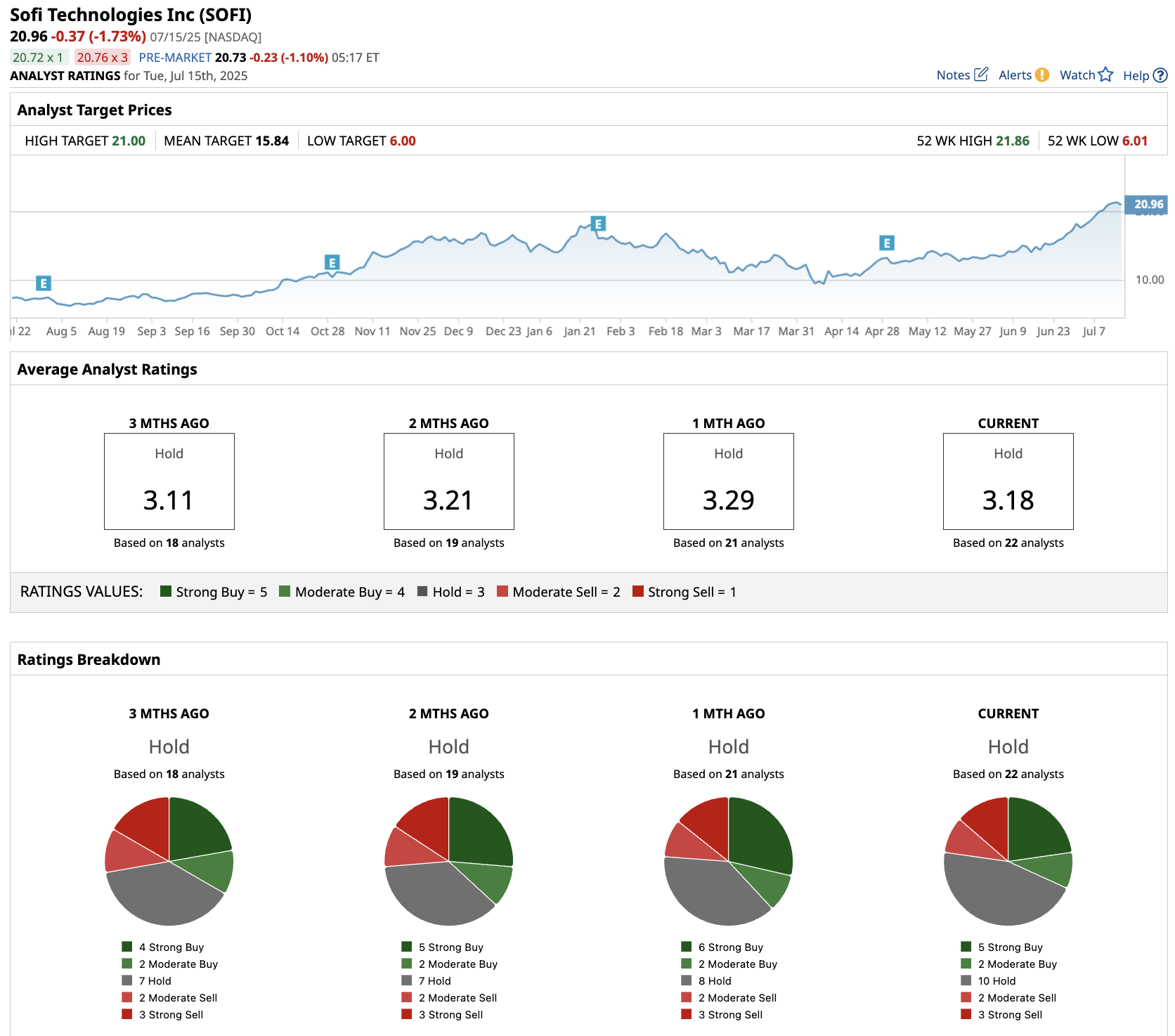

Out of the 22 analysts covering SOFI stock, five recommend “Strong Buy,” two recommend “Moderate Buy,” 10 recommend “Hold,” two recommend “Moderate Sell,” and three recommend “Strong Sell.” The average SOFI stock price target is $15.84, nearly 30% below the current trading price.