/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

IREN Limited (IREN), once known primarily as a Bitcoin (BTCUSD) miner, has pivoted aggressively toward artificial intelligence (AI), repositioning itself as a rising force in AI infrastructure. The company’s shift isn’t just a rebrand—it's backed by bold investments. Most recently, IREN announced a more than $670 million purchase of 12,400 new GPUs, effectively doubling its capacity and solidifying its ambitions to become an AI cloud infrastructure provider. The pivot has sparked enormous interest on Wall Street, sending IREN stock soaring more than 300% this year.

The stock’s meteoric rise, however, raises a pressing question for investors: with IREN already up threefold in 2025, is there still room to run—or has the easy money already been made? Let’s take a closer look at the company’s pivot its fundamentals and assess whether this red-hot AI data center stock is worth chasing at today’s levels.

About IREN Limited Stock

IREN Limited is a crypto mining company transitioning into an AI cloud infrastructure provider. The company is expanding its AI cloud GPU capacity in part by using revenue from its Bitcoin mining operations. In fact, it is among the many companies that have transformed their business models to align with current trends and to capitalize on the expanding opportunity in AI infrastructure. IREN’s market cap currently stands at $11.4 billion.

Shares of the Bitcoin miner and data center operator have more than tripled this year, driven by its transition from pure crypto mining to an AI cloud services business. IREN stock rallied yesterday after receiving a new bull rating.

IREN Doubles Down on Its AI Cloud Ambitions

On Monday, IREN stock jumped more than 8% after the company reinforced its ambitions to become an AI infrastructure hub by acquiring an additional 12,400 GPUs for about $674 million. The purchase includes 7,100 Nvidia B300s, 4,200 Nvidia B200s, and 1,100 AMD MI350Xs. With this move, IREN’s total GPU capacity now stands at roughly 23,000, more than double its year-end target of 10,900 GPUs announced by management last month.

IREN’s newly acquired GPUs are scheduled for delivery in the coming months and will be deployed at the Prince George campus in British Columbia. Another key point is that IREN is diversifying its portfolio by adding AMD’s (AMD) top-end generation. The company stated that combining AMD’s hardware with Nvidia (NVDA) GPUs enhances its AI infrastructure capabilities and expands its addressable market.

Iren added that its British Columbia campus has the capacity to support over 60,000 Blackwell GPUs. The company noted that financing workstreams are in progress to enable additional GPU purchases to meet rising demand and that it plans to redeploy ASICs to other sites to minimize any disruption to its Bitcoin mining operations.

With the latest expansion, IREN is now targeting an AI cloud annualized run rate of over $500 million by the end of Q1 2026. That’s twice management’s previous target of $200–$250 million in annualized revenue (provided last month) by December 2025. The company pointed to strong demand for AI cloud capacity, highlighting a “growing appetite among customers to contract capacity ahead of commissioning,” and emphasized that it is “well positioned” to meet this demand. That said, IREN’s GPU-as-a-service rental model is set to become the primary driver of the company’s next phase of growth.

IREN’s Financials

Last month, IREN reported its fourth-quarter and full-year fiscal 2025 results, delivering numerous record figures. Its full-year revenue surged 168% year-over-year (YoY) to a record $501 million. It’s worth noting once again that the majority of its revenue still comes from Bitcoin mining, as the company’s transition is not yet complete. That said, Bitcoin mining revenue stood at $484.6 million in FY25, up 163% YoY, fueled by higher average Bitcoin prices and an increase in average operating hashrate. AI Cloud Service revenue skyrocketed 429% YoY to $16.4 million as the company began scaling up its capacity. Meanwhile, adjusted EBITDA reached a record $270 million, up 395% YoY, while net income also set a record at $87 million.

IREN is not merely renting GPUs; it is building essential AI infrastructure. The company’s operating data center capacity more than tripled to 810 megawatts in FY25, while contracted grid-connected power climbed to 2,910 megawatts. With that, its vertical integration gives it a unique position to deliver across the full AI infrastructure stack—from powered shells to turnkey colocation to fully managed cloud services.

In Q4, the company generated $187.3 million in total revenue, a 228% YoY increase. This growth was primarily fueled by a 233% surge in Bitcoin mining revenue, which rose to $180.3 million. The company also swung to profitability in the quarter, reporting net income of $176.9 million and adjusted EBITDA of $121.9 million.

Management projected over $1 billion in annualized revenue from Bitcoin mining based on current mining economics. With its new AI Cloud annualized revenue target, the company is nearing $1.5 billion in total annualized revenue, with room for further growth ahead.

IREN’s dual revenue model provides a balance between stability and growth. Of course, this assumes Bitcoin prices remain at their current high levels, as the segment still plays a crucial role while the company scales its AI Cloud business. Essentially, Bitcoin mining delivers a steady cash flow at $41,000 per Bitcoin, while the AI cloud business is poised to drive future growth.

IREN Valuation and Analysts’ Estimates

According to Wall Street projections, IREN is expected to post a dramatic 108.99% YoY revenue growth to $1.07 billion in fiscal 2026, while earnings are estimated to surge 184.62% YoY to $1.11 per share.

From a valuation standpoint, IREN stock looks expensive. The forward price-to-sales ratio stands at 22.67, well over the sector median of 3.56. The forward P/E, EV/Sales, and Price/Book ratios all point to the same conclusion. Of course, the premium is inevitable when an AI narrative is involved. However, the current valuation offers little margin of safety if GPU deployment or utilization encounters any setbacks.

What Do Analysts Expect for IREN Stock?

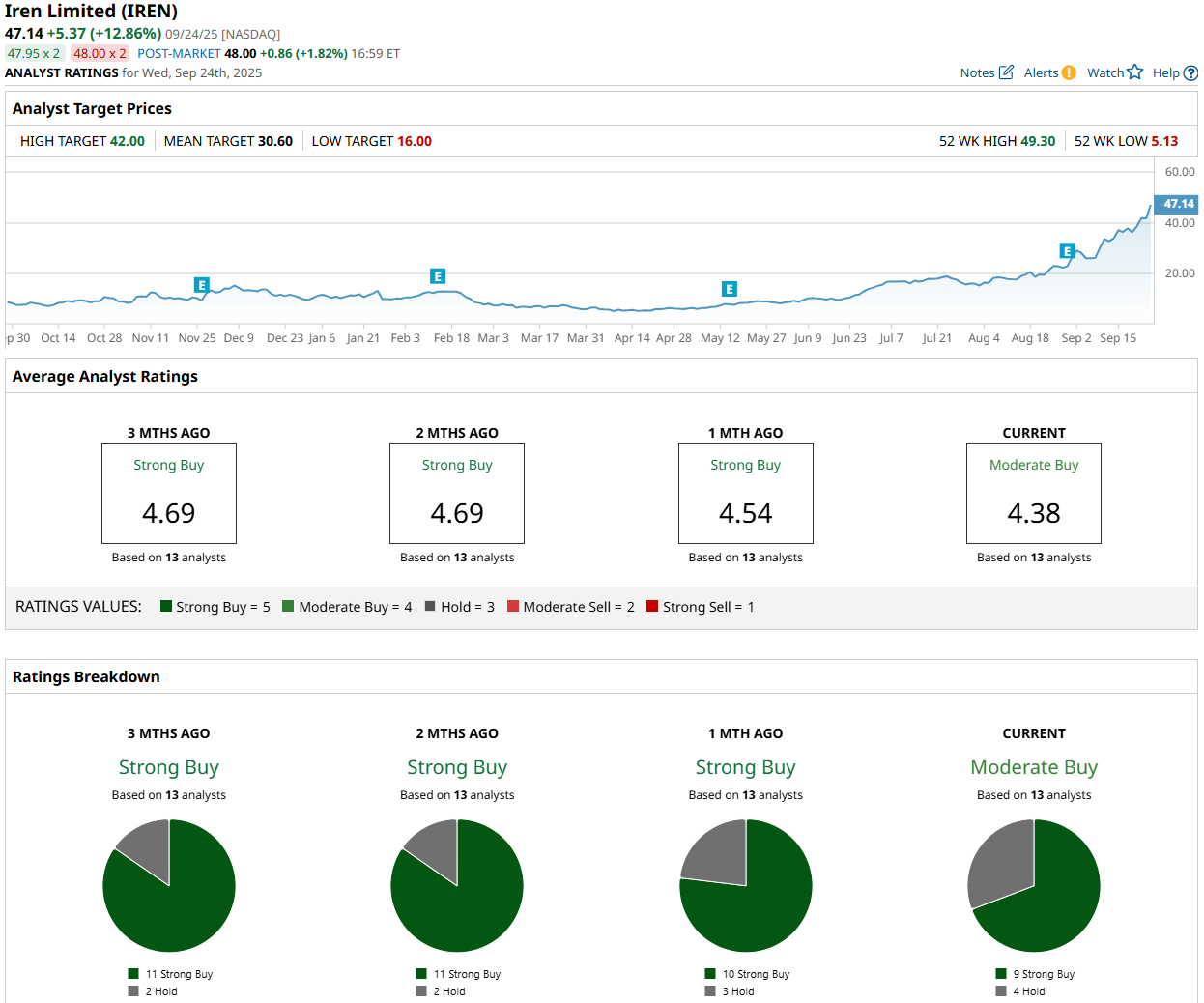

Wall Street analysts have a consensus rating of “Moderate Buy” on IREN stock. Out of the 13 analysts covering the stock, nine recommend a “Strong Buy” and four advise holding.

On Wednesday, Arete initiated coverage of IREN stock with a "Buy" rating and set a Street-high price target of $78.

While analysts keep assigning IREN bullish ratings and high price targets, I don’t believe it’s wise to chase the rally and buy at current levels. Of course, the company’s future looks highly promising, but much of the optimism already appears priced into the stock at current levels. With that, I would recommend investors wait for a pullback before buying, though given the stock’s parabolic chart, pinpointing a realistic entry zone is difficult. I view the $30 level as an attractive entry point with a favorable risk-to-reward profile, though the problem is that such deep pullbacks are rare during strong uptrends.