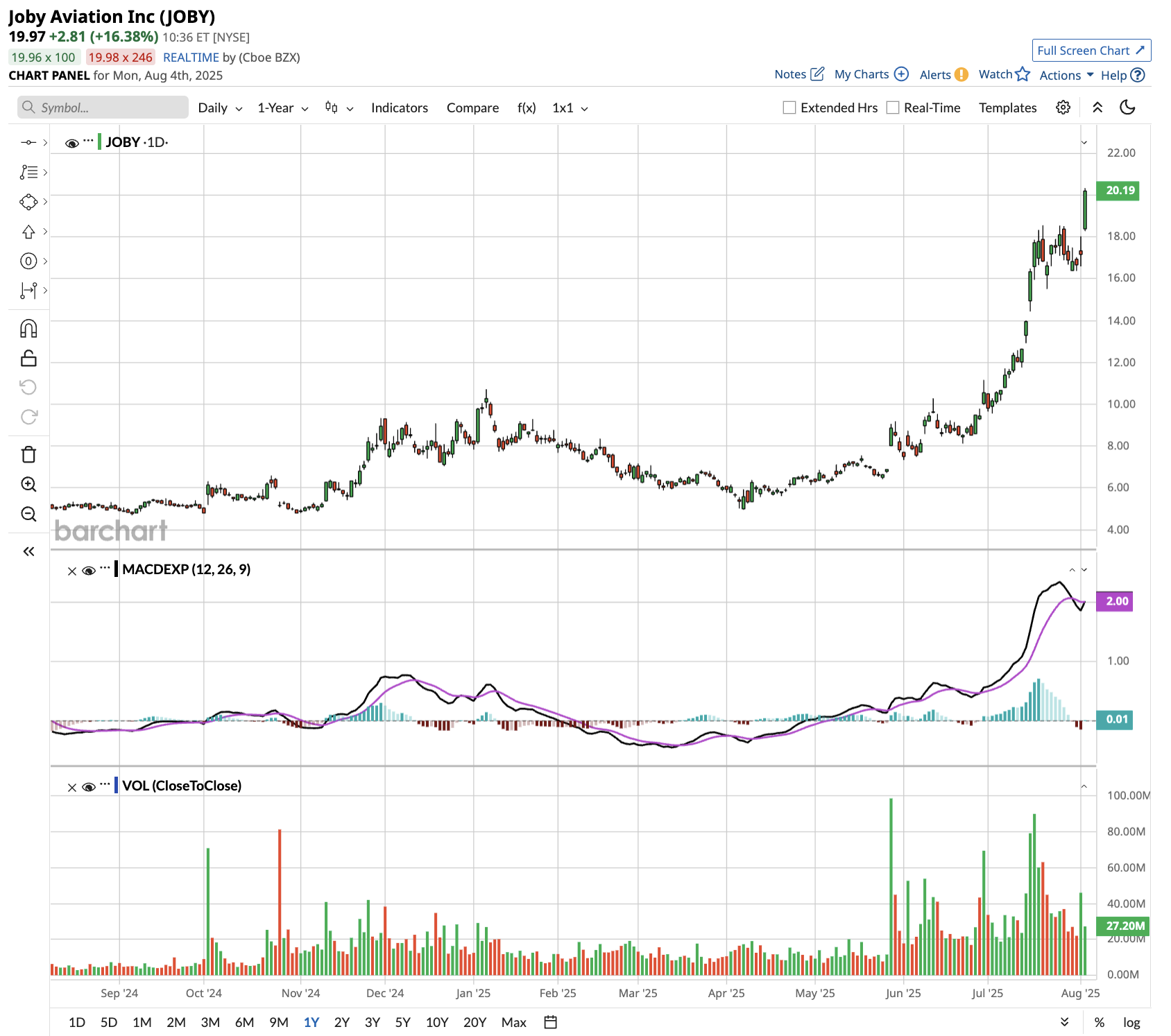

Joby Aviation (JOBY) has soared 153% year-to-date, drawing comparisons to Palantir’s (PLTR) explosive growth trajectory. The electric air taxi developer’s latest partnership with defense giant L3Harris (LHX) to develop hybrid military aircraft has investors betting on its dual-market potential.

A recent announcement revealed that Joby and L3Harris will develop a next-generation military craft capable of piloted or autonomous flight. The partnership combines Joby’s vertical takeoff and landing (VTOL) technology with L3’s military systems expertise, targeting applications like surveillance, reconnaissance, and contested logistics. The companies plan to test this fall, followed by operational demonstrations in 2026.

Beyond defense applications, Joby is pursuing aggressive commercial growth. The company delivered its first electric aircraft to the UAE in June, targeting a 2026 launch. Reports suggest Joby is also weighing an acquisition of helicopter service provider Blade Air Mobility (BLDE), which would provide immediate access to existing commercial aviation markets.

JOBY Stock Performance Depends on Commercial Operations

Joby Aviation’s first quarter 2025 results showcase the company’s accelerating progress toward commercial air taxi operations. Several critical achievements have positioned it as the industry leader in electric vertical takeoff and landing (eVTOL) aircraft development.

The company made record-breaking progress on FAA certification, advancing 12 percentage points in Stage 4 of the certification process during the quarter. With Joby’s internal certification now 62% complete, each signed-off test plan brings the company closer to Type Inspection Authorization (TIA) flights with the FAA, a crucial step toward commercial operations.

CEO JoeBen Bevirt emphasized the significance of this progress, noting that “each plan we sign off with the FAA is a step towards unlocking TIA flights.” It remains on track to begin TIA flights within 12 months, as previously outlined.

Joby achieved a major industry milestone by completing routine pilot-onboard transition flights between vertical and horizontal flight modes. This achievement, described as “one of the most challenging technological feats in aerospace,” was built on hundreds of unmanned transition flights and thousands of ground and air tests.

It also conducted unprecedented failure injection testing at Edwards Air Force Base, demonstrating its aircraft’s redundancy and fault tolerance by safely flying with disabled tilt mechanisms, battery packs, and propulsion stations.

Joby’s pilot production line delivered its fifth aircraft during the quarter, with each build providing valuable manufacturing insights. The company’s expanded Marina facility is nearing completion and will double manufacturing capacity while housing a certified full-motion flight simulator arriving later this year.

The company ended Q1 with $813 million in cash, not including Toyota’s (TM) expected $500 million investment. Joby outlined three distinct revenue paths: direct sales for defense applications, partnerships for international markets, and direct-to-consumer operations in key markets.

With Dubai flight testing planned for mid-2025 and commercial service targeted for early 2026, Joby continues executing on its ambitious timeline while maintaining its industry-leading position in the rapidly evolving eVTOL sector.

What Is the Target Price for JOBY Stock?

Wall Street estimates Joby Aviation to increase sales from $1.4 million in 2025 to $519 million in 2028. Its adjusted losses are forecast to narrow from $0.70 per share to $0.37 per share in this period.

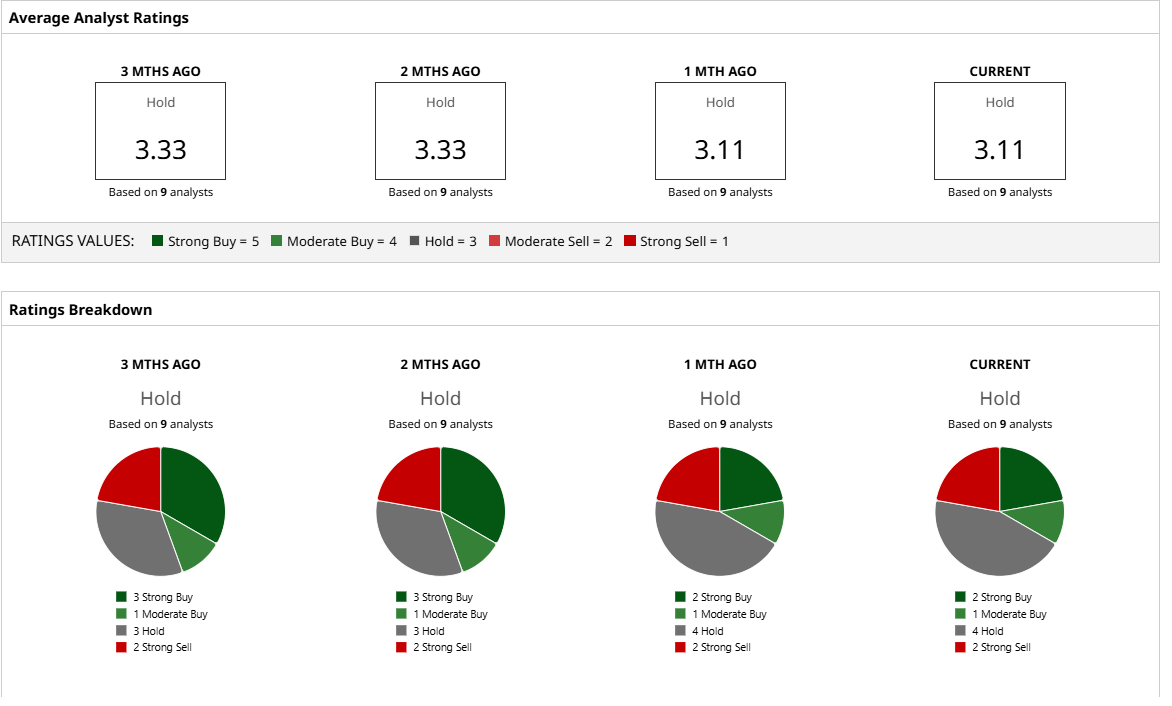

Of the nine analysts covering JOBY stock, two recommend “Strong Buy,” one recommends “Moderate Buy,” four recommend “Hold,” and two recommend “Strong Sell.” The average target price for JOBY stock is $8.75, significantly below the current price. Like Palantir, Joby trades well above analyst price targets despite consensus “Hold” ratings, suggesting strong investor enthusiasm outpacing Wall Street’s conservative outlook.

Both companies leverage cutting-edge technology to serve dual commercial and government markets, creating multiple revenue streams and reducing dependency on single sectors.

With a $16.1 billion market cap and expanding manufacturing capabilities, Joby appears positioned to capitalize on the growing demand for autonomous aviation solutions across military and civilian applications.