To paraphrase a popular line from the old TV series Seinfeld, they’re rare, and they’re spectacular! Having more than doubled since April, can the Vaneck Rare Earth Strategic Metals ETF (REMX) keep delivering those “rare” returns for shareholders?

First, let’s take a step back and address the elephant in the room. No, not China, which is currently using its massive reserves of rare earth metals to try to negotiate with the United States. It is simpler than that.

What Are Rare Earth Metals?

What makes them “rare” has little to do with abundance. Many of the 17 minerals classified as such are not so difficult to find. However, their population tends to be diffuse. That is, you won’t find a lot in one central location.

Mining rare earth metals is therefore a very involved process,

And they are worth finding, as they are critical for smartphones, computers and televisions, as well as powering electric vehicles and even wind turbines. Heard of a catalytic converter in a car? To build one takes cerium and lanthanum, two rare earth metals.

Speaking of catalysts, this year’s political wrangling over rare earth metals has created a classic supply-demand issue, or at least a fear of one. The U.S. has great demand for rare earths, and China has the supply.

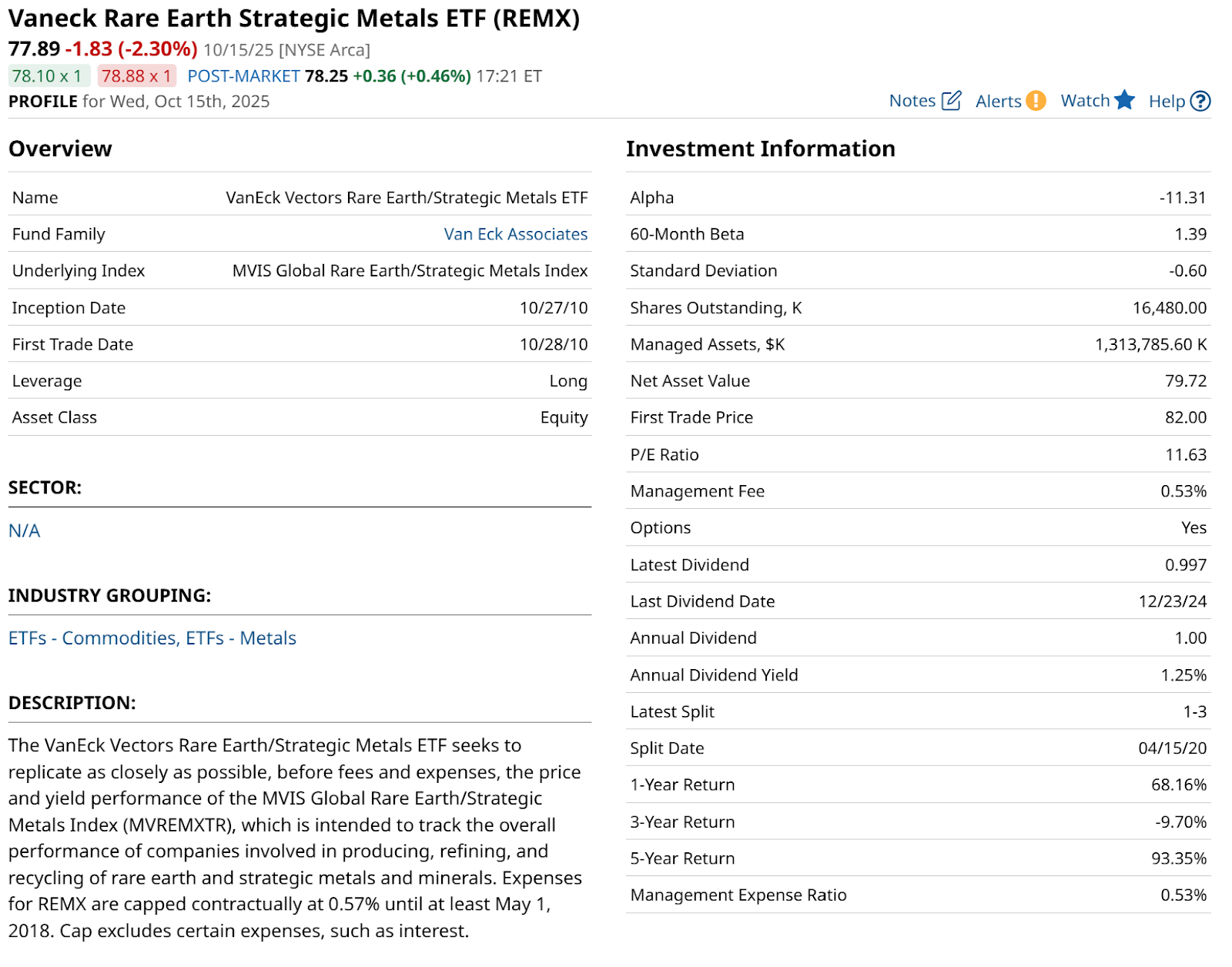

The result has been a surge in the value of related stocks. That’s what REMX is dedicated to holding. And perhaps the most surprising thing about this nearly 15-year-old ETF is that it is still sitting at just $1.3 billion in assets.

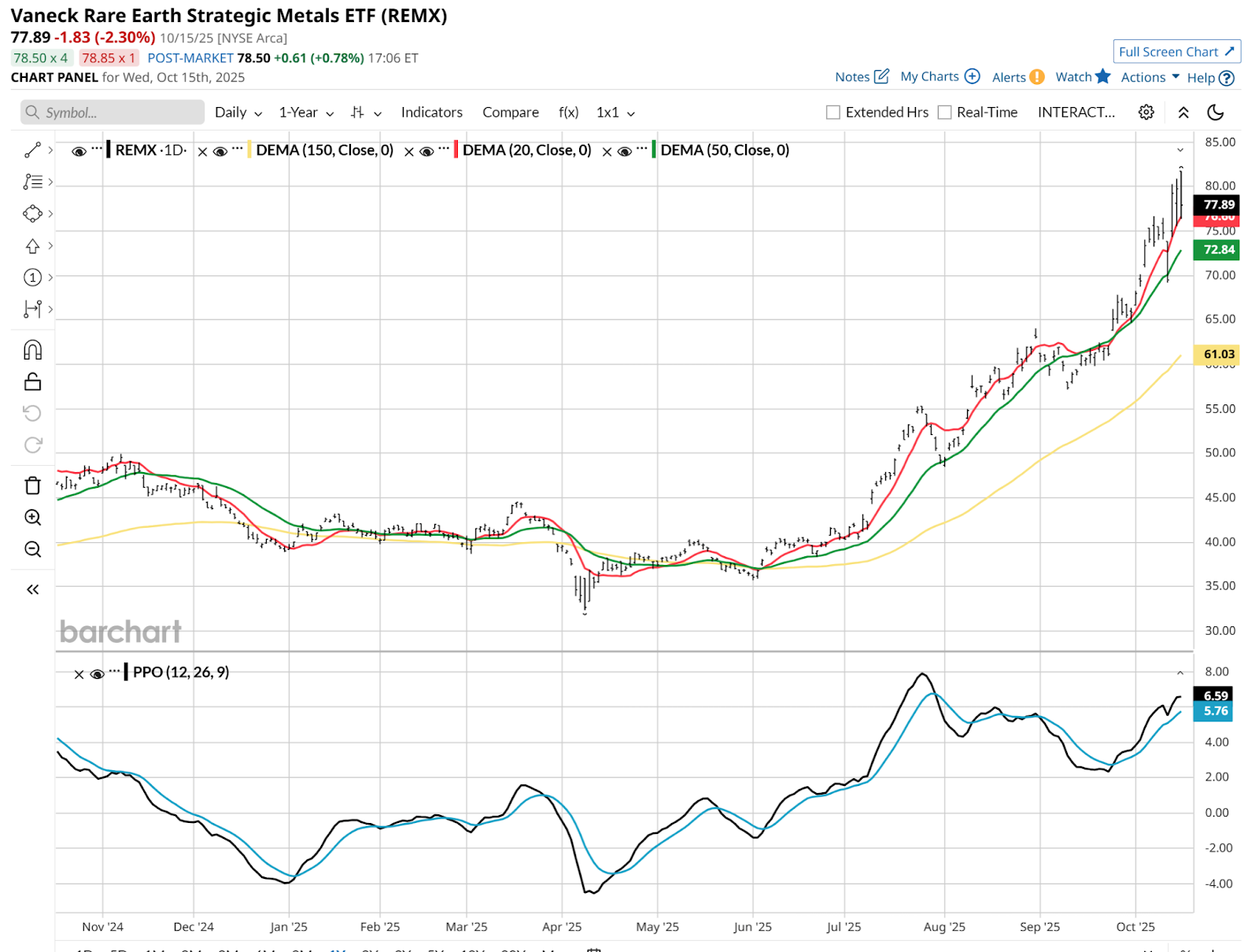

While that daily price chart above shows a very stretched technical picture, similar to that of gold and silver, when we pan back to a weekly view, REMX gets more interesting.

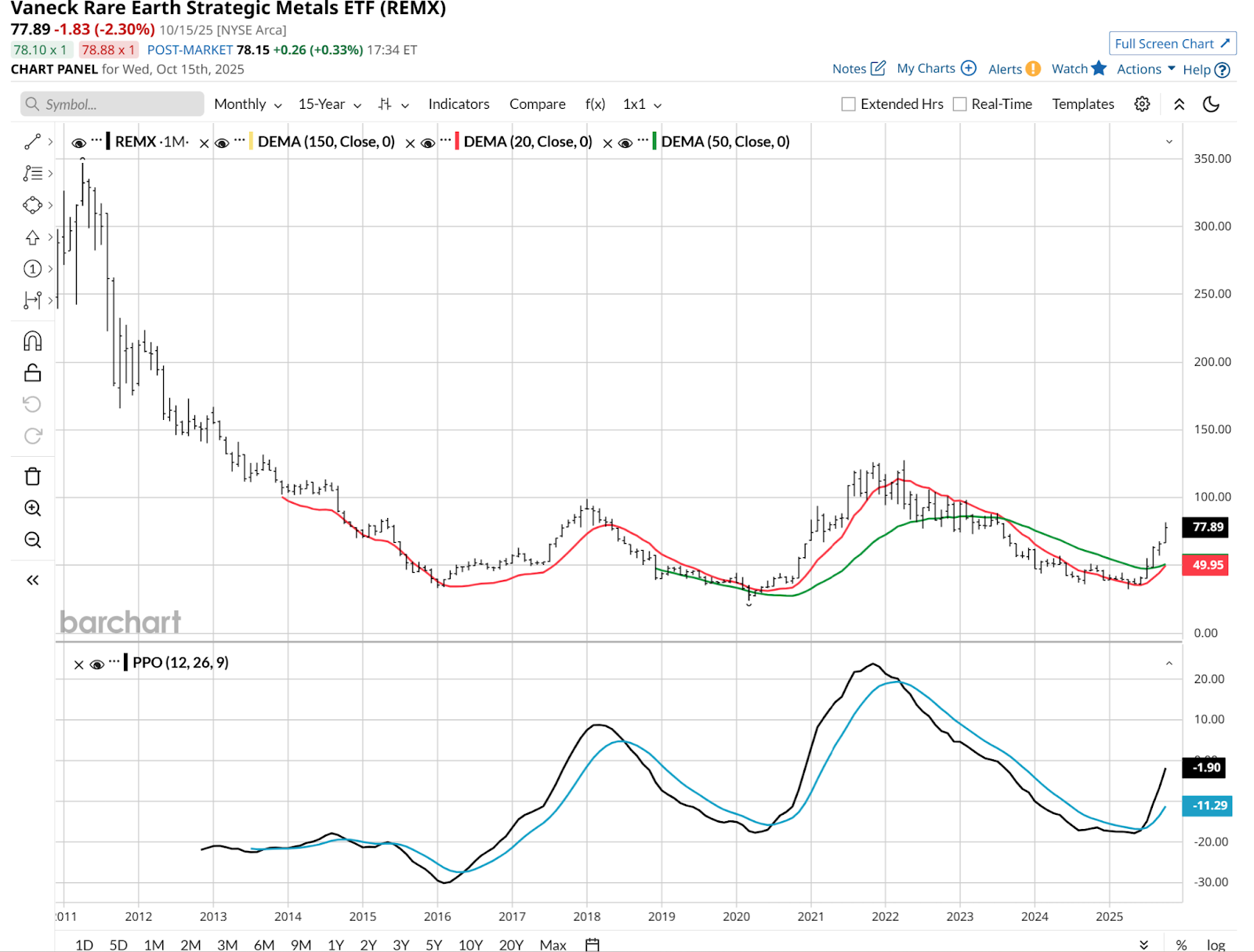

Below, we see that while this ETF has certainly run up a long way, it could rally another 50% from here and still not reach its high water mark of the past 5 years, which was around $130 a share.

And as this monthly view below indicates, REMX hit an all-time high way back near its inception, in 2011. Its price per share is only now recovering to where it was about 10 years ago. So on a price basis, there could be more room to go here. But not likely without some tremendous volatility along the way. REMX produced a beta nearly 40% higher than the S&P 500 Index ($SPX) over the past 5 years, as shown in the table above.

How Can Traders Buy Rare Earth Metals Stocks?

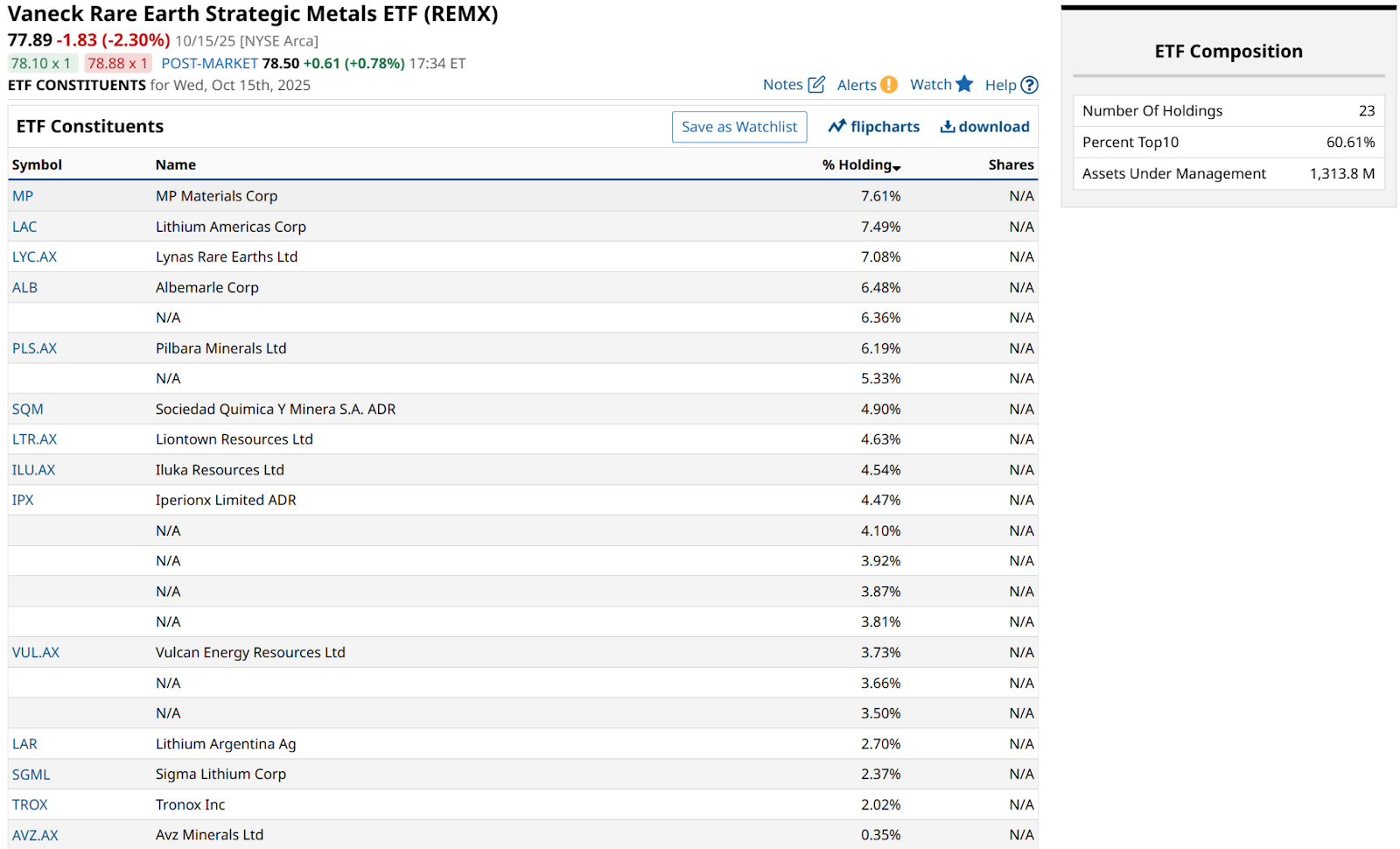

The other way traders can consider playing this trend, apart from keeping track of the trade discussions between the U.S. and China, is to start scouting some of the roughly 20 stock holdings within REMX. Here’s the list, though note several “N/A” holdings, which indicates that they are very small, thinly traded stocks.

For U.S.-focused investors, there are a handful of names that are liquid and recognizable, including some Latin American companies. This is part of the present political banter, given that Brazil, Argentina, and Chile all represent potential alternatives to China for U.S. acquisition of rare earth metals.

Maybe you didn’t have REMX on your bingo card back in January. Now that this sub-sector of the commodities business is very much in play and in the headlines, it is more likely that it will be one to watch into next year and beyond.