It’s a special Friday.

My Toronto Blue Jays host game one of the World Series in Toronto tonight against Shohei Ohtani and the Los Angeles Dodgers. It’s the Jays' first appearance in the World Series in 32 years.

I can’t wait for the game to begin. It’s been a magical season for Major League Baseball’s only Canadian team. Go Jays. Make Canada proud!

Now on to the business at hand.

In Thursday’s options trading, the volume was 57.83 million, slightly higher than the average daily volume. The top 10 stocks accounted for 45% of the total, with calls accounting for 60% of the action.

As for unusual options activity, there were 1,291 calls and puts yesterday, with six exceeding a Vol/OI (volume-to-open-interest) ratio of 100.

I’ve searched through yesterday’s unusual options activity for options to watch for potential gains over the next four weeks.

Have an excellent weekend.

Oct. 31 - 8 Days to Expiration

Starting with the Oct. 31 expiration next Friday, I’m looking for near-term income while also having the potential to buy Upstart Holdings (UPST) stock at a better entry point.

The $15 in premium income from selling the Oct. 31 $43 put would generate an annualized total return of 16.0% [$0.15 bid price / $43 strike * 365 / 8].

While you’re not going to get rich from the $15 in premium income, if you do this 45 times over the next year, you would be more than happy with the 16% return.

However, I’m not suggesting you’ll be able to do this, because you won’t; it’s more about generating

passive income while you seek a better entry point for a stock with tremendous potential and risk.

So far in 2025, UPST stock is down over 15%, including a 14% slide in the past month, but up 17% in the past five days, indicative of a highly volatile stock. As recently as August, the AI lending platform’s share price was in the $80s.

Upstart is not a stock for risk-averse investors, but rather for aggressive investors who believe the fintech has what it takes to keep growing while delivering more consistent profitability.

Nov. 7 - 16 Days to Expiration

Among the unusually active options expiring on Nov. 7, the Netflix (NFLX) put with $1,090 had the highest Vol/OI ratio at 84.18.

If you own Netflix and have significant gains, buying long puts would be a smart protection play, especially if investors believe there is more to the Brazil tax-dispute story than just a one-time charge of $619 million.

But that’s not the opportunity I had in mind.

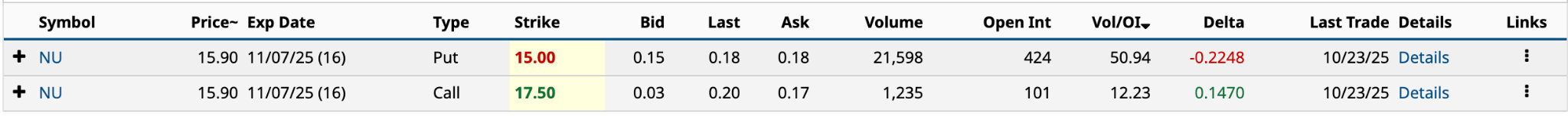

I’m looking at two options from Brazilian fintech Nu Holdings (NU). Two potential strategies: 1) Married Put and 2) Long Strangle.

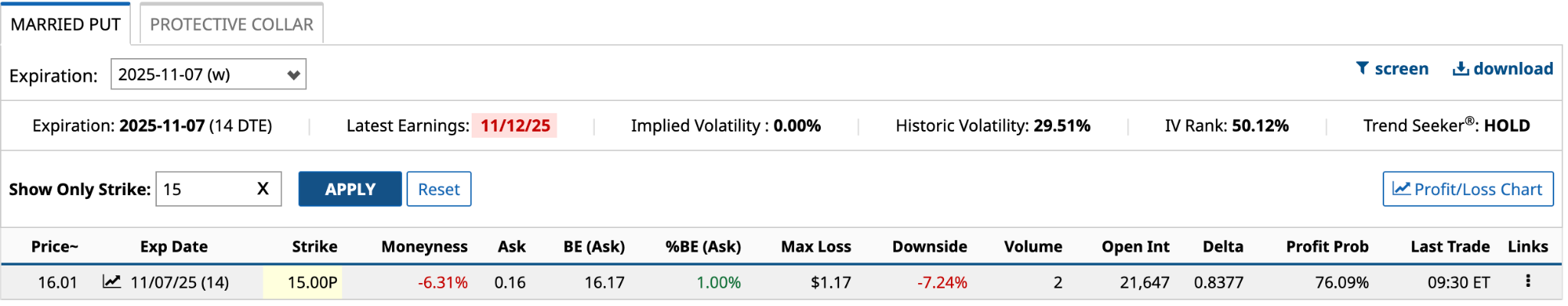

With the married put, you simultaneously buy shares of NU stock and an equivalent number of put options. In this example, I’ll use 100 shares and one put option. Early in Friday trading, two Nov. 7 $15 put contracts have traded. The shares cost $1,601, and the put $16, for a maximum loss of $117 over the next two weeks.

As shown below, there is a 76.09% chance the share price will trade above the $16.17 breakeven.

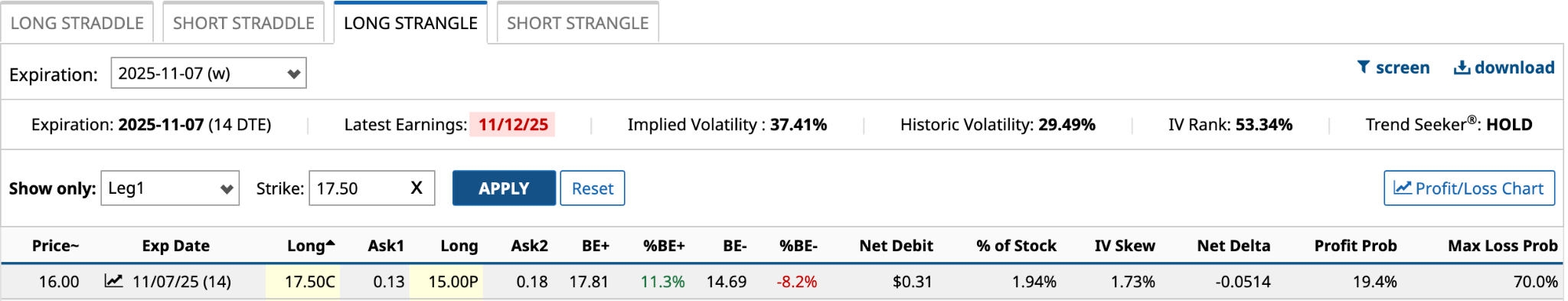

The long strangle involves both of Nu’s two unusually active options expiring on Nov. 7. In this options strategy, you’re expecting the stock’s volatility to rise, moving the share up or down in a big way.

For this long strangle, you buy the Nov. 7 $17.50 call and the $15 put. Your maximum loss is the cost of the two options — in this case, based on today's latest data, it is $31. You want Nu’s share price to be outside the breakeven range -- $17.81 on the upside and $14.69 on the downside -- for the long strangle to be successful.

Of the two strategies, the married put has a much better chance of success. I do, however, like NU stock for a long-term buy.

Nov. 14 - 23 Days to Expiration

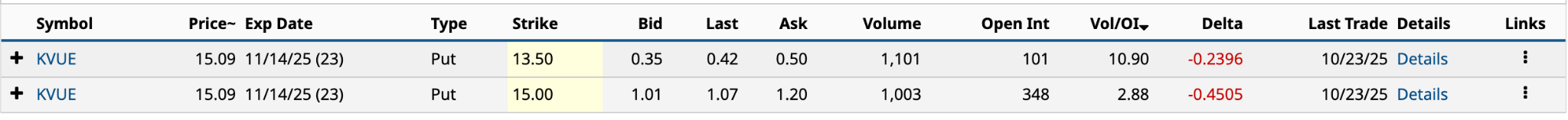

The maker of Tylenol’s two unusually active put options caught my eye. Kenvue (KVUE), the former consumer healthcare division of Johnson & Johnson (KVUE), was spun off as an independent company in August 2023. J&J shareholders who tendered their stock in the share exchange received 8.034 shares in Kenvue.

The recent claims by Donald Trump and the FDA that women taking Tylenol (acetaminophen) during pregnancy to cope with pain can cause an increased possibility of autism in the unborn child have hurt the share price. KVUE stock is down 30% year-to-date and 34% since the share exchange in August 2023.

With analysts on the fence about the company’s stock, there don’t appear to be many catalysts for a significant near- or long-term rebound. The two put options lend themselves to a Bear Put Spread.

Investors use the bear put spread when they feel the stock will decrease in value. You buy the Nov. 14 $15 put and sell the $13.50 put for a net debit of $85 [$15 put ask price of $1.20 - $13.50 put bid price of $0.35]. That’s also the most you can lose. The maximum profit is $65 [$15 strike - $13.50 - $0.85 net debit *100 shares].

Your profit probability is around 40% with a maximum profit percentage of 76.4% [maximum profit / maximum loss].

Nov. 21 - 30 Days to Expiration

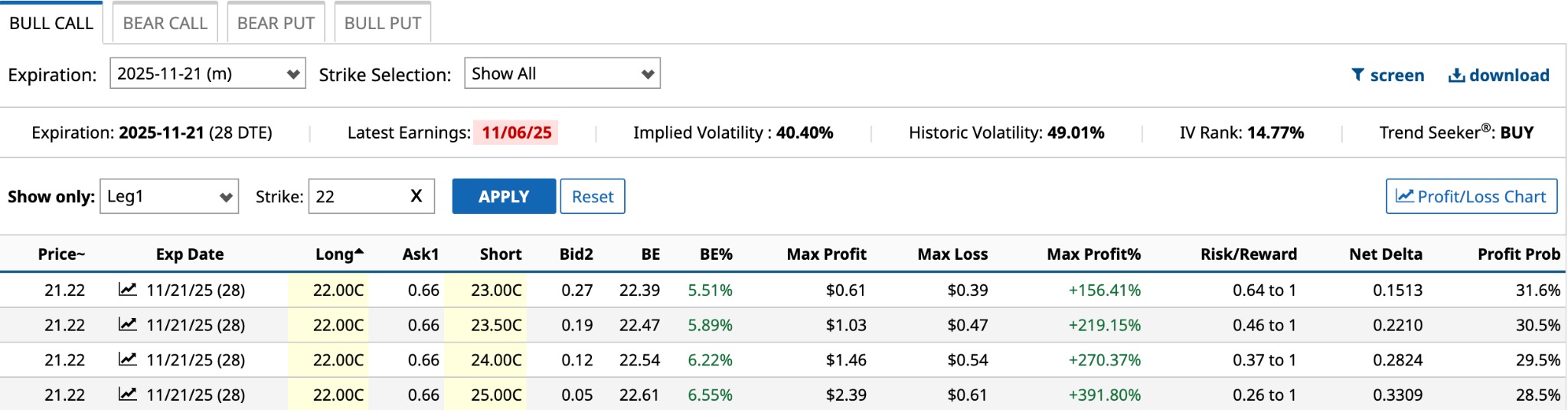

The final stock whose unusual options activity caught my attention from yesterday’s action was the two calls for Warner Bros Discovery (WBD).

I wrote about the media conglomerate’s unusual options activity yesterday. The company has put itself up for sale and is likely to be acquired in the next few months. The only questions are by whom and for how much?

WBD stock has increased by 180% over the past 12 months as investors sensed a deal was in the company’s future. How much higher its stock can go is anyone’s guess. I feel that CEO David Zaslav might be able to obtain a 20-30% premium from current prices. We’ll soon find out.

The two calls set up for a Bull Call Spread, which involves selling one put and buying another at a lower strike price, with the same expiration date. The bet is mildly bullish with no expectations of a significant move higher.

So, in this instance, using today’s prices, you would sell the $25 call and buy the $22 call for a net debit and maximum loss of $61. Your maximum profit would be $239 [$25 strike - $22 strike - $0.61 net debit].

Not only is your maximum profit percentage of 391.80% attractive, so too is your risk/reward ratio of 0.26 to 1. While your profit probability isn’t high at 28.5%, it’s a low-risk bet on making a few more dollars on a stock that’s run a long way in the past year.