Happy Thursday to Barchart readers everywhere.

It’s a glorious day to be alive if you are a Toronto Blue Jays fan. Last night, my favorite baseball team punched their ticket to the ALCS, beating its archrival, the New York Yankees, three games to one. Toronto hosts either the Mariners or the Tigers on Sunday. I can’t wait.

Enough about me. It’s time to discuss yesterday’s unusual options activity. That I can do.

There were 1,311 unusually active options yesterday--Vol/OI (volume-to-open-interest) ratios of 1.24 or greater expiring in seven days or longer--with calls outdoing the puts, 881 to 430, more than two to one.

Of the 1,311, Block (XYZ) had six, including two in the top 100. Among the six, bullish investors will find at least two options strategies to consider to bet on the fintech growth company.

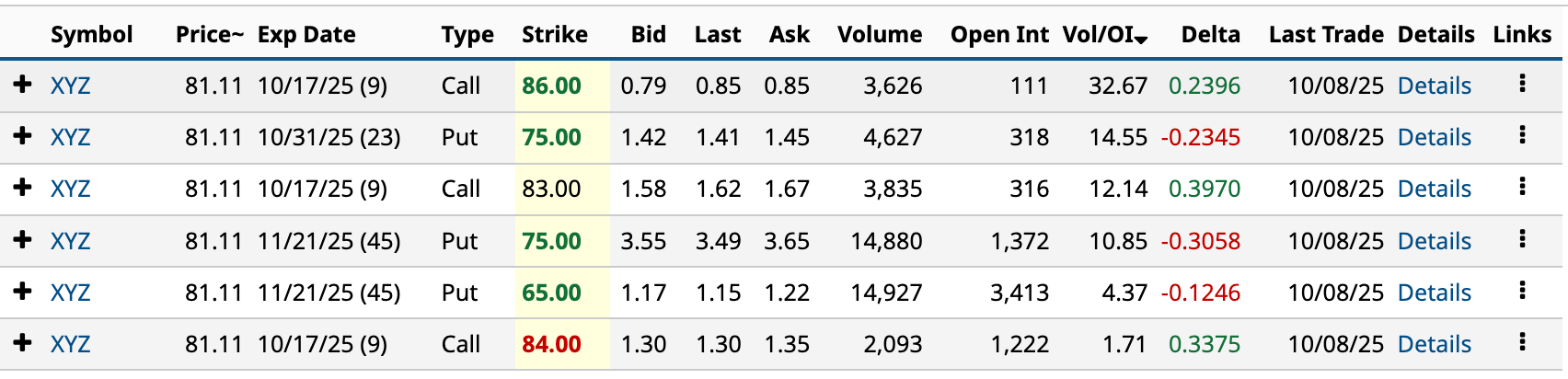

Block’s 6 Unusually Active Options

As I said in the introduction, Block had six yesterday, with Vol/OI ratios ranging from a high of 32.67 to a low of 1.71. The six were evenly split between puts and calls.

Of the six, the Nov. 21 $75 put and the Nov. 21 $65 put had the highest volumes, with 14,880 and 14,927, respectively. These two puts form part of two possible scenarios for utilizing a Covered Strangle or Covered Combination options strategy.

Of the six, the Nov. 21 $75 put and the Nov. 21 $65 put had the highest volumes, with 14,880 and 14,927, respectively. These two puts form part of two possible scenarios for utilizing a Covered Strangle or Covered Combination options strategy.

The three Oct. 17 calls (with strike prices of $83, $84, and $86) had volumes of 3,835, 2,093, and 3,626, respectively. These three calls form the basis of a Long Ratio Call Spread.

Before I get into each strategy, I’ll revisit what’s happening with Block and XYZ stock.

Block’s Been Dead Money for the Past 3 Years

Between May 2022 and October 2025, Block’s share price traded between $50 and $100. It hit its 52-week high of $99.26 on Dec. 5, 2024. It’s down 19% since then.

As for the company, it’s been a while since I’ve taken a closer look at how the business is faring. The lack of price movement hints at what I’m to find.

But first, let’s consider Wall Street’s take. Of the 41 analysts covering its stock, 27 have a Buy rating (3.98 out of 5), with a target price of $84.58, which is approximately 5% higher than its current share price. That’s lukewarm support--at best.

Block reported Q2 2025 results in early August. While the results were weaker than expected, the guidance left investors optimistic. Its shares gained on the news. They’ve continued to move higher in the two months since, albeit a modest move.

Its guidance for 2025 calls for a $10.17 billion gross profit and an adjusted operating profit of $2.03 billion, a 20% margin. That’s considerably higher than in 2024, when its gross profit was $8.89 billion, its operating profit was $892 million, and its margin was 10%.

That sounds alright to me.

On the Square side of the business, Block continues to focus its attention on restaurants and hospitality. On Oct. 8, at the company’s biannual Square Releases event, it announced several new products, including voice ordering, that will make it easier for restaurant owners to thrive.

In its Q2 2025 shareholder letter, Block stated that it was focused on winning the quick-service restaurant (QSR) market. Yesterday’s event highlighted this focus.

On the Cash App side of the business, it continues to work toward its long-term goal of merging Cash App and Square into one single, integrated financial ecosystem.

“There will be a significant reason to use Cash App and not have to go to the App Store for 10 different apps,” CNBC reported CEO Jack Dorsey’s comments from the Q2 2025 conference call. “Everything is in one app, and that will be the Cash App.”

With Cash App’s gross profit up 16% year-over-year, a 500 basis-point sequential increase from Q1 2025, the moves it continues to make to someday merge its offerings to personal and business customers are paying dividends, even if that’s not been reflected in its share price.

This should change in 2026.

Block’s Covered Strangles

As I said in the introduction, the Nov. 21 $75 put and the Nov. 21 $65 put form one part of two covered strangles.

For those unfamiliar, a covered strangle involves owning 100 shares of a company’s stock, while selling both an OTM (out of the money) put and call, both with the same expiration date. The covered strangle is also known as a covered combination, as it combines a Covered Call (selling a call for income while being long the stock) with a cash-secured put (selling the put for income).

So, in this example, based on today’s price of $8,050, the 100 shares of XYZ stock would cost you $8,050. Selling one Nov. 21 $75 put generates $355 in premium income for an annualized return of 42.5% [($3.55 bid price / $75 strike price - $3.55 bid price) * 365 / 43], while the $65 put generates $117 in premium income for an annualized return of 15.3% [($1.17 bid price / $65 strike price - $1.17 bid price) * 365 / 43].

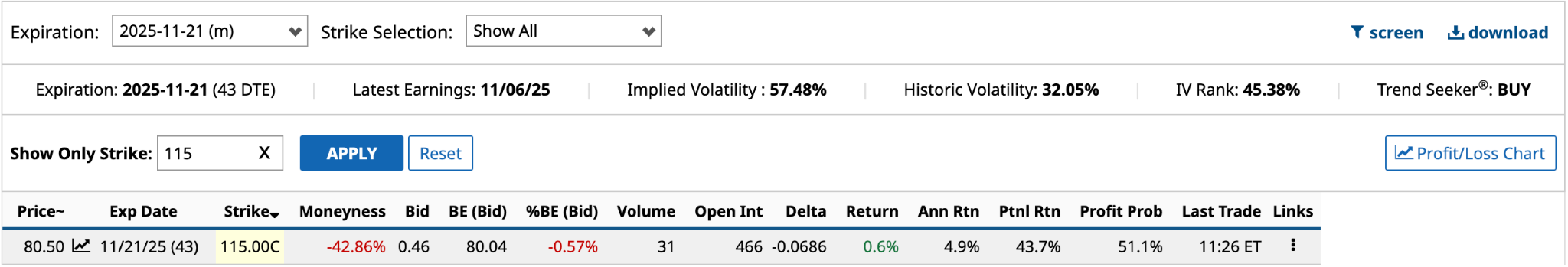

To complete the covered strangle, you would sell one call for premium income. For illustration purposes, I’ll select the Nov. 21 call furthest OTM. That would be $115.

For the purposes of this exercise, I based all calculations on $80.50 (today’s price) rather than yesterday’s closing price of $81.11, while using the bid prices for the puts from yesterday’s close.

For the purposes of this exercise, I based all calculations on $80.50 (today’s price) rather than yesterday’s closing price of $81.11, while using the bid prices for the puts from yesterday’s close.

As you can see from the data above from today’s trading, the $115 call is nearly 43% out of the money. The premium income generated is $46 for an annualized return of 4.9% [$0.46 bid price / ($80.50 share price - $0.46 bid price) * 365 / 43]. The maximum potential return on the covered call would be 43.7% [($115 strike price + $0.46 bid price - $80.50 share price) / $80.50 stock price - $0.46 bid price].

The second part of the covered strangle is the cash-secured put. Remember that you will also set aside the cash necessary to buy 100 shares should they be assigned to you by the put buyer.

The total gains for the two scenarios.

1) The share price is $115 at expiration, and you’re required to sell your 100 Block shares. Your premium income based on the $115 call and $75 put is $401. Your capital gain is $3,450 [$115 strike - $80.50 share price]. Your return is 47.8% [$3,851 total gains / $8,050 cost of shares]. Your annualized return is 405.7%.

2) The share price is $115 at expiration, and you’re required to sell your 100 Block shares. Your premium income based on the $115 call and $65 put is $163. Your capital gain is $3,450 [$115 strike - $80.50 share price]. Your return is 44.9% [$3,613 total gains / $8,050 cost of shares]. Your annualized return is 381.7%.

Note: the actual return, taking into account the opportunity cost of keeping $6,500 to $7,500 in cash or short-term Treasury bills, rather than investing it, would alter the result slightly, in either direction.

Block’s Long Ratio Call Spread

The long ratio call spread strategy involves combining one short call and two long calls of the same expiration but with a higher strike. It effectively combines a Bear Call Spread and a long call. You’re betting on a big move by XYZ stock.

Based on the three Oct. 17 calls (with strike prices of $83, $84, and $86), you’ve got three scenarios. I’ll go with the $84 and $86 strike prices.

The maximum gain is unlimited based on how high Block’s share price can appreciate over the next 43 days. The maximum loss is calculated as the high strike price - the low strike price + the net debit paid or - the net credit received.

Using the bid and ask prices from yesterday’s close, the maximum loss is $240 [$86 strike - $84 strike + net debit $0.40 ($1.30 bid price for $84 strike - 2 * $0.85 ask price)].