/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

UnitedHealth Group (UNH) is set to launch Optum Real, an artificial intelligence (AI) system that could revolutionize medical claims processing, potentially lowering costs and improving patient care.

The technology translates complicated insurance rules into straightforward guidance, enabling doctors and billing teams to immediately determine whether a claim is likely to be approved. Early results from testing at Allina Health, a Minneapolis hospital network with 12 facilities, show meaningful improvements since the March rollout. The system has reduced claim denials across more than 5,000 outpatient visits in cardiology and radiology departments while speeding up prior authorizations.

The AI-powered technology flags incomplete claims before submission, which reduces paperwork for providers and insurers. UnitedHealth developed Optum Real through its Optum Insight division, which provides software for healthcare organizations. Currently, only UnitedHealthcare uses the system, but the company plans to expand access to other insurers and providers to build scale and reduce administrative costs across the industry.

UnitedHealth is not charging fees for core functions but will generate revenue through digitization support and premium analytics tools. Down more than 40% from its all-time high, UNH stock has grossly underperformed the broader markets in the past year due to rising healthcare costs and regulatory pressures.

However, Optum Real could become a catalyst for improved margins and new revenue streams. The technology addresses operational pain points while positioning UnitedHealth as a healthcare technology leader.

Is UNH Stock a Good Buy Right Now?

During its Q2 earnings call, UnitedHealth slashed its outlook for 2025 as medical costs were estimated to increase by $6.5 billion compared to earlier projections. CEO Stephen Hemsley pledged a cultural overhaul focused on transparency and stakeholder engagement. The company is undertaking what Hemsley described as fundamental reforms across multiple business lines, with independent experts reviewing critical processes, including risk assessment and care management.

Medicare Advantage accounts for more than half the cost overruns at $3.6 billion, driven by a medical trend that reached 7.5% compared to the 5% rate UnitedHealth anticipated when pricing 2025 plans.

The commercial business faces $2.3 billion in additional costs split between exchange plans and employer coverage, while Medicaid pressures stem primarily from elevated behavioral health spending.

The revised outlook also removes $1 billion from previously planned portfolio actions the company will no longer pursue, plus $850 million in unfavorable prior period adjustments and settlements.

UnitedHealthcare president Timothy Noel admitted the insurance heavyweight underestimated accelerating medical trends and failed to adjust benefits or plan designs adequately.

- Physician and outpatient care account for 70% of Medicare pressures, while inpatient utilization accelerated through the second quarter.

- Emergency room visits and observation stays are increasing, with providers bundling more services into each clinical encounter.

- Medicare Supplement trend jumped to over 11% from the typical 8% to 9% range, which indicates a significant increase in care activity and billing patterns.

Management emphasized commitments to value-based care despite the challenges, with the pending Amedisys acquisition still moving forward.

Is UNH Stock Undervalued?

UNH plans to leverage AI across operations to improve forecasting, drive efficiency, and accelerate decision-making. Leadership changes continue as UnitedHealth works to restore performance levels consistent with stakeholder expectations.

Analysts tracking UNH stock forecast adjusted earnings to grow from $16.21 per share in 2025 to $31.77 per share in 2029. If UNH stock is priced at 15x forward earnings, which is reasonable, it could surge over 30% within the next four years. If we adjust for dividend reinvestments, cumulative returns could be closer to 40%.

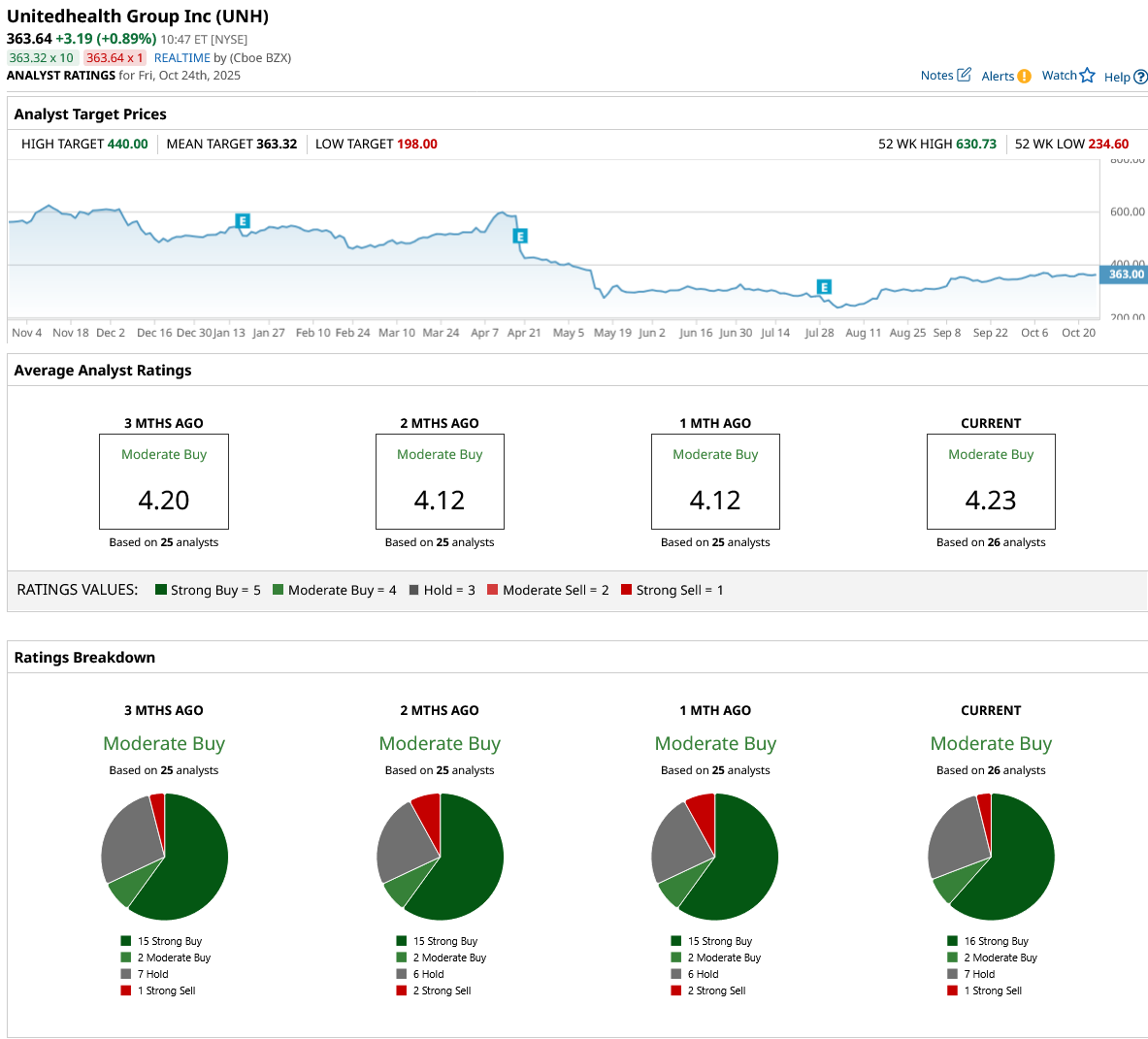

Out of the 26 analysts covering UNH stock, 16 recommend “Strong Buy,” two recommend “Moderate Buy,” seven recommend “Hold,” and one recommends “Strong Sell.” The average UNH stock price target is $363.32, which is almost exactly the same as the current price of $363.64.