/United%20Rentals%2C%20Inc_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Headquartered in Stamford, Connecticut, United Rentals, Inc. (URI) is a $61.1 billion market-cap equipment rental company that provides an extensive selection of construction and industrial equipment for rent, sale, and servicing. Its offerings include general and specialized machinery, tools, safety gear, storage solutions, power and climate control systems, as well as repair and maintenance services.

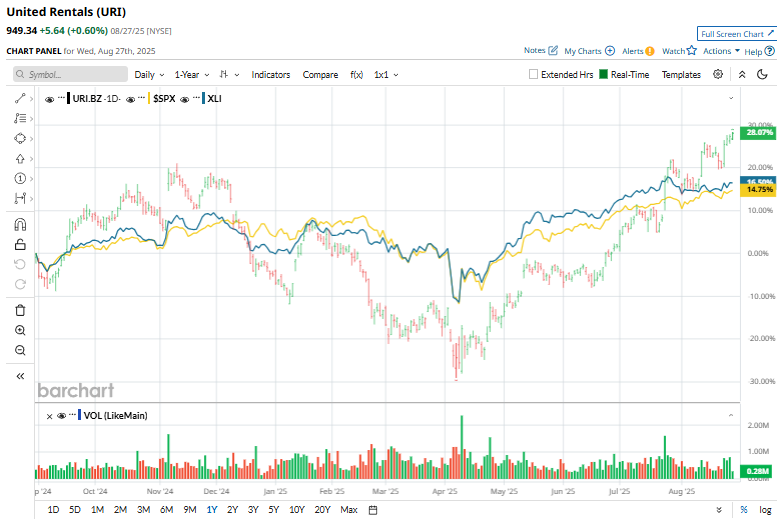

Shares of this rental giant have outperformed the broader market over the past year. URI has gained 28.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.2%. Additionally, in 2025, URI stock is up 34.8%, surpassing the SPX’s 10.2% rise on a YTD basis.

Narrowing the focus, URI has also surpassed the Industrial Select Sector SPDR Fund (XLI). The exchange-traded fund has gained about 18.5% over the past year and 16.2% in 2025.

On July 23, United Rentals delivered solid Q2 2025 results, reporting revenue of $4.04 billion, up 5.8% year-over-year, driven by growth across general rentals and specialty segments. Net income rose to $789 million, while EPS increased 13% to $12.12. The company generated $1.8 billion in adjusted EBITDA and continued strong cash generation, repurchasing $553 million in shares during the quarter. Management reaffirmed its FY2025 guidance, and the results impressed investors, triggering a 9% rally in the next trading session.

For the current fiscal year, ending in December, analysts expect URI’s EPS to grow 1.7% to $43.92 on a diluted basis. However, the company’s earnings surprise history is grim. It missed the consensus estimates in three of the last four quarters while beating the forecast on another occasion.

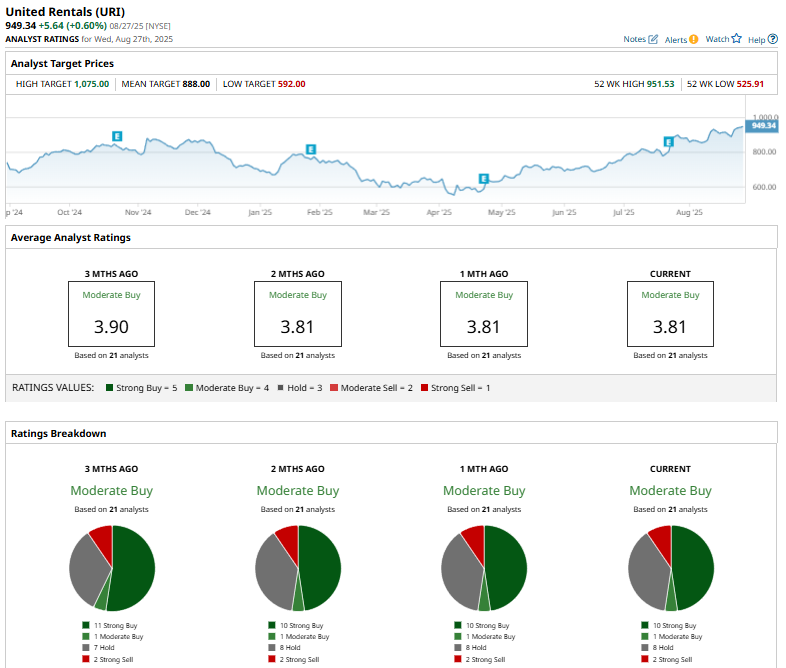

Among the 21 analysts covering URI stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” eight “Holds,” and two “Strong Sells.”

This configuration is bearish than three months ago, with 11 analysts suggesting a “Strong Buy” rating.

On July 28, Morgan Stanley analyst Angel Castillo raised the price target for United Rentals from $702 to $955, a 36% increase, while maintaining an “Overweight” rating, signaling strong confidence in the company’s growth prospects.

The stock currently trades above the mean price target of $888 and the Street-high price target of $1,075 suggests an upside potential of 13.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.