/United%20Rentals%2C%20Inc_%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

United Rentals, Inc. (URI), with a market capitalization of $63.1 billion, is a leading equipment rental company, offering a broad portfolio of construction, industrial, aerial, power, and fluid-handling equipment and services to customers across construction, utilities, municipalities, and industrial sectors. Headquartered in Stamford, Connecticut, the company operates an extensive integrated network of locations across North America and beyond. The company is expected to report Q3 earnings soon.

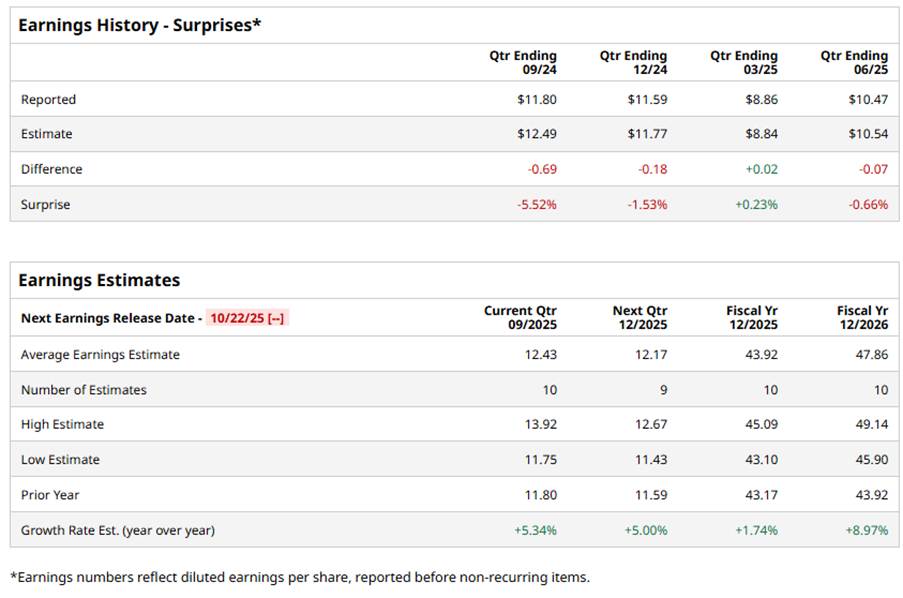

Ahead of the event, analysts expect United Rentals to report a profit of $12.43 per share, up 5.3% from $11.80 per share in the year-ago quarter. The company has surpassed Wall Street’s EPS estimates in just one of its last four quarters, while missing on the other three occasions.

For fiscal 2025, analysts expect the company to report EPS of $43.92, up 1.7% from $43.17 in fiscal 2024. Looking ahead, its EPS is expected to grow 9% annually to $47.86 in fiscal 2026.

URI stock has surged 24.3% over the past 52 weeks, surpassing the broader S&P 500 Index’s ($SPX) 17.8% rise and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% increase over the same time frame.

United Rentals’ shares have been rising due to stable topline performance and positive market sentiment amid strong demand in data center construction. In its Q2 earnings report (released on July 23), the company reported revenue of $3.9 billion, a 4.5% year-over-year (YoY) rise, surpassing analyst expectations. Its adjusted EPS came in at $10.47, compared to $10.70 in the prior-year quarter and slightly missing expectations.

However, the company uplifted its full-year guidance and announced a $400 million boost to its 2025 share repurchase program, totaling $1.9 billion. The company also raised its revenue outlook to $15.8 billion to $16.1 billion range, up from the prior $15.6 billion to $16.1 billion range.

The consensus opinion on URI stock is moderately upbeat, with an overall “Moderate Buy” rating. Of 20 analysts covering the stock, 11 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” seven suggest a “Hold,” and one suggests a “Strong Sell.” URI currently trades above its average analyst price target of $947.65.