/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

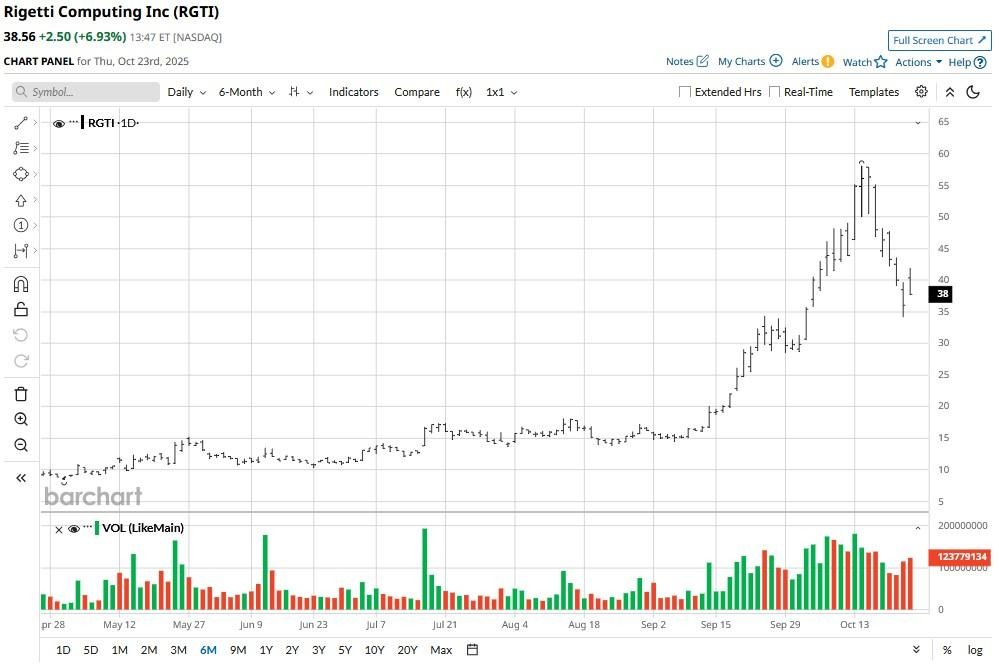

Rigetti Computing (RGTI) shares soared more than 15% at one point in Thursday trading following reports President Donald Trump’s administration wants to take equity stakes in the quantum technology companies. However, investors should note that the Trump admin has since said it is not negotiating equity stakes with any quantum-tech companies.

Despite a sharp increase on Thursday, RGTI stock remains down over 30% versus its recent high.

Is Government Interest Bullish for Rigetti Stock?

While the prospect of government funding sure is attractive, the Wall Street Journal report is bullish for Rigetti stock primarily because it signals Washington’s recognition of quantum computing as a strategically vital technology.

By aligning it with national security priorities, similar to semiconductors and rare earths, the U.S. government is effectively elevating quantum technology to a protected class of innovation.

This validation could attract more institutional interest, accelerate public-private partnerships, and position RGTI as a key player in a field with long-term geopolitical and economic significance.

RGTI Shares Are Worth Owning, With or Without Federal Grants

Rigetti remains attractive as a long-term holding, even without government funding, as it already has over $500 million in cash, which means it’s not dependent on federal grants anyway.

The company is also gaining enterprise traction as evidenced in its partnerships with AWS, NASA, and Deloitte, validating its commercial relevance.

RGTI has recently achieved quantum volume milestones as well and advanced its 84-qubit Ankaa system demonstrating real-world scalability. Its hybrid quantum-classical architecture is attracting interest from several industries, including finance, pharma, and logistics.

While the Nasdaq-listed firm remains pre-profit, its continued losses can actually be interpreted as the cost of innovation.

In short, with quantum computing now recognized as a strategic sector, Rigetti’s mature tech, solid balance sheet, and expanding customer base position RGTI shares as a high-conviction play in a market poised for exponential disruption.

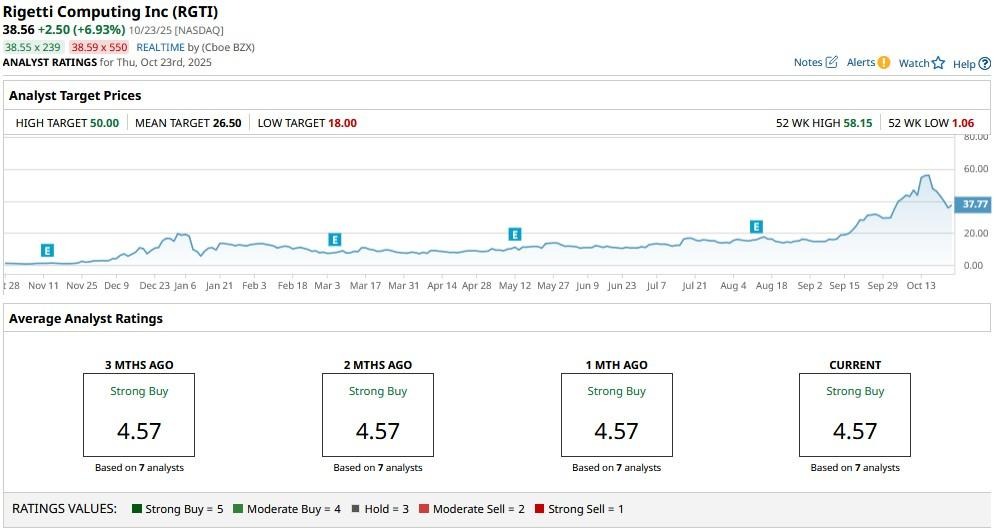

Wall Street Sees Significant Upside in Rigetti Computing

Wall Street analysts also forecast a big future for Rigetti shares over the long term.

The consensus rating on RGTI stock currently sits at “Strong Buy” with price targets going as high as $50, indicating potential upside of about 25% from here.