President Donald Trump has threatened to impose a 50-percent import tax on anything brought into the U.S. from the European Union — and specifically warned that he will slap a 25-percent tariff on any Apple products unless the nation’s most valuable technology company begins manufacturing iPhones at home.

Trump took to Truth Social to repeat his oft-stated false claim that the European Union was formed “for the primary purpose of taking advantage of the United States on trade” and complained that the 27-member bloc “has been very difficult to deal with” because of what he called “powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more.”

He groused further about how the U.S. runs a more than $250,000,000 trade deficit with the E.U. — an accurate number for manufactured goods but grossly overstated when the amount of services purchased from the U.S. are taken into account — calling it “totally unacceptable” and stating that trade talks with the E.U. are “going nowhere.”

He added: “Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025. There is no Tariff if the product is built or manufactured in the United States. Thank you for your attention to this matter!”

Trump’s latest missive against America’s largest trading partner came just moments after he threatened to target America’s most valuable corporate citizen with a 25 percent tax on the the country’s most popular mobile phone unless it is fully manufactured within the U.S.

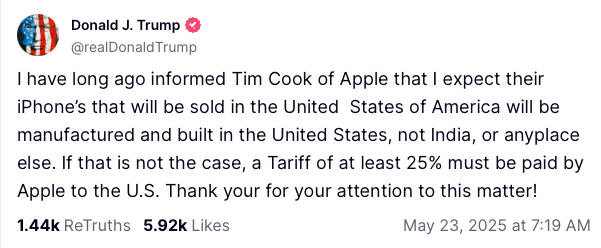

In a separate Truth Social post, he said he’d informed Apple CEO Tim Cook “long ago” that he “expect[s]” that the company iPhones destined for the U.S. market would be “manufactured and built in the United States, not India, or anyplace else.”

“If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S.,” he said.

Apple shares sank following Trump’s threat. The tech giant saw shares fall 3.5 percent in futures but it bounced back 2.8 percent in early trading following the president’s threat against the company in a Truth Social post Friday morning.

Trump’s post appeared to be a tacit admission that importers and consumers, rather than foreign countries, are responsible for paying the tariffs he has imposed and threatened to impose.

It’s unclear how the president could legally impose a tariff on a single product imported by a single company, as U.S. law requires tariffs imposed under the president’s emergency trade powers to be specific to countries and for a class of products or goods.

Speaking in the Oval Office on Friday, Trump appeared to acknowledge this fact when asked how he could impose tariffs on a single company. He replied that the import taxes in question would be imposed on “also Samsung and anybody that makes that product.”

“Otherwise it wouldn't be fair,” he said.

Trump added that the tariffs could be imposed “by the end of June.”

“When they build their plant here, there's no tariff, so they're going to be building plants here. But I had an understanding with him [Apple CEO Tim Cook] that he wouldn't be doing this. He said he's going to India to build plants. I said, that's okay to go to India, but you're not going to sell into here without tariffs. And that's the way it is,” he said.

But if such tariffs were by some mechanism placed on Apple’s mobile phone products, Americans could find themselves paying an additional $200 for the iPhone 16, which retails for $799 for the lowest-end model featuring 126 GB of storage space and an additional $224 for the iPhone 16 plus with the same memory.

The higher end model of the iPhone 16 that comes with 512 GB of storage could have $275 added to the $1,099 retail price.

The U.S. is Apple’s largest market for iPhones and according to Statista amounts to 44 percent of the company’s 2024 revenue. Of Apple’s total 2024 receipts, 52 percent were from iPhone sales worldwide, accounting for $201 billion in revenue.

Additionally, Trump’s proposed 50 percent tariff on imports from European Union could affect a wide swath of goods from any of the 27 countries that make up the E.U., ranging from pharmaceuticals used by Americans to treat any number of medical conditions, to precision optical, electrical, and medical equipment, to beverages, wine, spirts, and even automobiles.

Clothes, footwear, leather goods, cosmetics and fragrances, paper and stationary goods, tools, sporting equipment, cutlery and cookware, as well as coffee, tea and confectionery products could be hit with the import taxes as well, raising the cost by half and making it harder for Americans to afford needed products.

Because the United Kingdom is no longer part of the E.U., British products would not be subject to the threatened 50 percent tariff.

The pair of early morning threats roiled American futures and global stock markets, which promptly fell in the moments after the posts were published.

The president’s threats to impose yet more taxes on American consumers is the latest episode in a roller coaster saga that began on April 2, when he took to the White House Rose Garden to announce what he called “liberation day” and impose massive import taxes on all imports coming into the U.S.

Subsequent announcements and retaliatory actions raised taxes on imports from China — America’s third-largest trading partner — to a whopping 154 percent, causing fears of a recession to grow rapidly among investors and analysts.

Trump later backed down and agreed to drop many of the tariffs down a 10 percent level, which is still higher than any set of import taxes in nearly a century, and earlier this month he claimed that the U.S. and China had agreed to deescalate the trade war he started just weeks earlier.

Yet the uncertainty caused by his on-again, off-again use of tariffs as a blunt instrument meant to coerce other countries and American companies into obeying his diktats have led anxious investors to seek shelter in other countries and the E.U., threatening the American dollar’s longtime status as the world’s reserve currency.

The ongoing tariff drama, combined with years of shoddy budgeting by the U.S. Congress — largely driven by Republicans’ insistence on regressive tax cuts combined with spending increases funded by more and more debt — pushed Moody’s to slash America’s credit rating for the first time in nearly a century last week.

The agency said it was bringing it down a notch to Aa1 from the highest triple-A rating over the government’s massive budget deficit and high interest rates.

With the move, Moody’s catches up with the other two major credit rating agencies, which both downgraded the U.S. some time ago.

Moody’s said in a statement that it did not see a real effort by the government to cut spending, and that it expected the nation’s fiscal performance to deteriorate compared with other highly developed economies.

It also noted that President Donald Trump’s tariffs will significantly hurt the nation's long-term growth, and that it expects the federal debt burden to rise to about 134 percent of GDP by 2035.

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” Moody’s said in a statement.