President Donald Trump told McDonald's Corp. (NYSE:MCD) franchisees and suppliers on Monday that they were "lucky" he won the 2024 presidential race, claiming the U.S. economy would have been pushed towards bankruptcy under former Vice President Kamala Harris.

Trump Warns Of ‘Catastrophe' Under Kamala Harris

Speaking at the McDonald's Impact Summit in Washington, Trump argued that welfare rolls and government jobs would have surged while "real jobs were going down" if he had lost, The Hill reported.

He warned that without his tariffs and investment agenda, "you would have had a catastrophe. You probably would have had a bankrupt country," and added, "You are so… lucky that I won that election, I'm telling you," drawing laughter and applause.

Inflation, Job Losses Fuel Economic Backlash

The remarks come as Trump and Republicans face rising anger over persistent inflation and a weakening labor market. Annual inflation climbed to 3% in September, the same rate as when Trump took office for his second term, according to the latest consumer price index report. Private payrolls have flatlined, with the most recent ADP report showing a net loss of 32,000 jobs in September, the worst reading in more than two years.

Fast-food prices highlight the strain on consumers. The Economist's Big Mac index shows the average U.S. Big Mac cost $6.01 in July, up from $5.69 a year earlier, while Federal Reserve data put the average price of ground beef at about $6.32 a pound in September, up from roughly $5.67 a year before.

Tariff Rollbacks And McDonald's Anecdotes Frame Message

Under pressure from food inflation and fresh Democratic gains in cost–of–living–focused races, the Trump administration last week rolled back tariffs on dozens of food imports, including beef, coffee, bananas, and other tropical products, in an effort to ease prices.

Trump, who has long highlighted his fondness for McDonald's, reminded the crowd of a 2024 campaign stop where he worked the fry station at a Pennsylvania franchise.

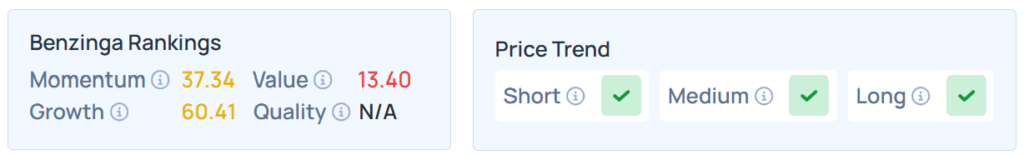

Price Action: McDonald’s Corp shares closed 0.69% lower on Monday at $304.90, and are up 0.11% overnight. The stock has an average score on Growth in Benzinga's Edge Stock Rankings, but has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers, competitors, and more.

Read Next:

Photo: Joshua Sukoff from Shutterstock