President Donald Trump renewed threats on Monday to impose substantial tariffs on India over its continued purchases of Russian oil, accusing the nation of profiting from the Ukraine conflict while disregarding casualties.

Trump Calls Out India’s Oil Resale Operations

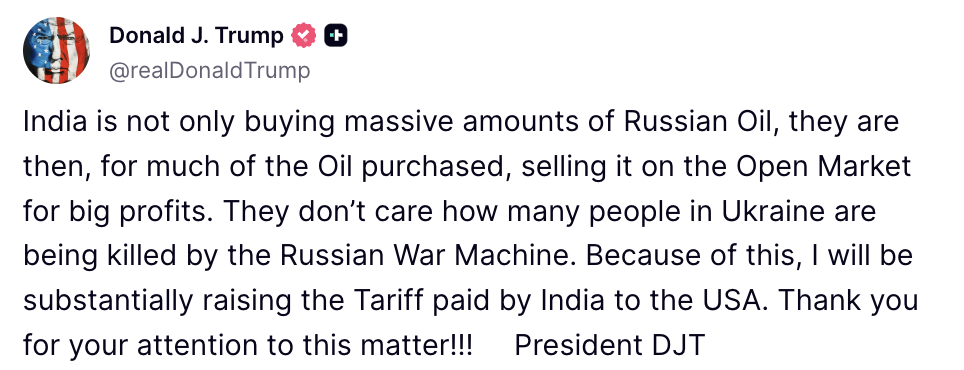

Writing on Truth Social, Trump stated: “India is not only buying massive amounts of Russian Oil, they are then, for much of the Oil purchased, selling it on the Open Market for big profits. They don’t care how many people in Ukraine are being killed by the Russian War Machine.”

The president added he would be “substantially raising the Tariff paid by India to the USA” as a result.

India Maintains Russian Energy Imports Despite Pressure

India has purchased over one-third of its oil imports from Russia since the Ukraine war began, making it the second-largest importer of Russian crude after China. Two senior Indian officials told The New York Times that the government has not directed oil companies to reduce their imports from Russia, despite U.S. pressure.

The energy relationship has become a central focus of ongoing U.S.-India trade negotiations. Total bilateral goods trade reached approximately $129 billion in 2024, with India maintaining a nearly $46 billion surplus.

See Also: Trump Is Playing With Inflation Data, People Say—Here’s What We Know

Broader BRICS Nations Face Similar Threats

Sen. Lindsey Graham (R-S.C.) previously indicated that Trump plans 100% tariffs on China, India, and Brazil for purchasing Russian oil. “Those three countries buy about 80% of cheap Russian oil. That’s what keeps Putin’s war machine going,” Graham stated on Fox News in July.

The tariff strategy targets nations over Russian energy purchases and de-dollarization efforts, creating additional pressure on emerging market economies.

Market Impact On The Energy Sector

Energy markets showed mixed responses to escalating geopolitical tensions on Monday. The iShares U.S. Oil & Gas Exploration & Production ETF (NYSE:IEO) closed up 0.45% at $87.90, while the United States Oil Fund (NYSE:USO) lost 1.74% to $76.11. WTI crude hovered above $66.01 per barrel, with Brent around $68.49.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock