Economist Justin Wolfers is pushing back against the narrative surrounding President Donald Trump’s new trade agreement with Japan, arguing that the deal essentially results in a tax increase for American consumers.

What Happened: On Thursday, in a post on X, Wolfers addressed what he refers to as a “confusion in the reporting” of Trump’s latest trade deal with Japan. “So let me clarify,” he says, accompanied by a video of his recent appearance on MSNBC.

In the clip, Wolfers says, “the most important thing for viewers to think about is the framing. So if you began by saying that [the] tariff on Japan has gone from 25% to 15%, it would feel like he'd negotiated a great deal. That's not what happened here.”

Wolfers notes that the tariffs on Japanese imports were previously just 2%, “so the biggest thing Trump has done is he's raised taxes on Americans who import goods from Japan from 2% to 15%.”

The deal's potential impact on U.S. automakers is also in question, as Wolfers pushed back against claims that the deal could open up the Japanese market to American manufacturers. “I am not remotely optimistic,” he says, adding that the reason why the Japanese don’t buy American cars is that they prefer smaller cars.

Why It Matters: Fund manager Spencer Hakimian noted early this week that the announcement of the trade deal sent Japanese automaker Toyota Motor Corp. (NYSE:TM) soaring, despite the 15% tariffs being announced on all imports from Japan.

He attributes this to the fact that while American automakers have to 50% more for steel and copper, on account of the tariffs, alongside similar tariffs on their production in China, Mexico and Canada, Toyota only pays 15%, and “they’re done with all the shenanigans.”

Japanese auto stocks have been rallying since the trade deal was announced, in sharp contrast to their American counterparts.

| Stocks | Year-To-Date Performance | Gains Since Trade Deal |

| Toyota Motor Corp. (NYSE:TM) | -0.76% | +12.84% |

| Subaru Corp. (OTC:FUJHY) | +12.37% | +18.58% |

| Nissan Motor Co. Ltd (OTC:NSANY) | -24.13% | +9.61% |

| Mazda Motor Corp. (OTC:MZDAY) | Flat | +19.57% |

| Honda Motor Co. Ltd (NYSE:HMC) | +18.15% | +10.93% |

| Mitsubishi Corp. (OTC:MSBHF) | +26.42% | +6.20% |

On Wednesday, Tesla Inc. (NASDAQ:TSLA) warned that it could face “a few rough quarters” as a result of the tariffs imposed by President Donald Trump. The company further noted that it faced $300 million in additional costs during its second quarter, due to the same.

Early this week, General Motors Co. (NYSE:GM) announced that it faced a $1.1 billion tariff-related headwind during its second quarter.

Price Action: Shares of Toyota were down 0.79% on Thursday, trading at $191.66, and another 1.13% after hours.

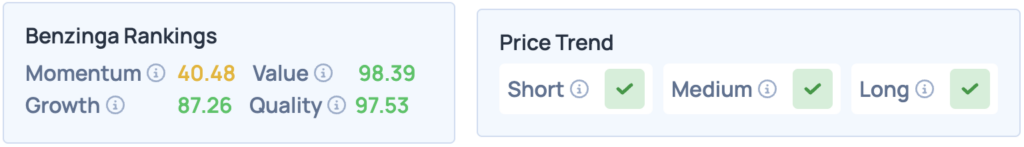

According to Benzinga’s Edge Stock Rankings, Toyota shares score high on Growth, Value and Quality, with a favorable price trend in the short, medium and long term. Click here for deeper insights into the stock, and to see how it compares with its U.S.-based competitors.

Photo Courtesy: Alec Issigonis on Shutterstock.com

Read More: