Home Depot Inc. (NYSE:HD) expressed during its second-quarter earnings call that it is navigating a complex economic landscape where new President Donald Trump‘s tariffs and stubbornly high interest rates are fueling customer hesitation on large-scale projects.

Check out Home Depot’s stock price over here.

Consumers Stall Big-Ticket Projects

In its second-quarter earnings call on Tuesday, executives painted a picture of a resilient consumer still engaging in smaller home improvement jobs, but holding back on major renovations due to broad economic concerns.

The primary headwind, according to leadership, is a pervasive sense of caution among consumers. While transactions for items over $1,000 grew 2.6%, the company noted softer engagement in discretionary projects that typically require financing.

CEO Ted Decker stated that when customers are asked why they postpone major work, the chief reason isn’t cost or labor, but something more fundamental. “By a wide margin, economic uncertainty is number one,” Decker told analysts.

Tariffs, High Interest Rates Fuel Uncertainty

Executives confirmed that on some imported goods, “tariff rates are significantly higher today than they were when we spoke in May,” which will lead to “modest price movement in some categories”.

Adding to this environment are new government tariffs and the interest rate climate. Decker also pointed to a “frozen housing market,” suggesting that relief on interest rates would help spur activity.

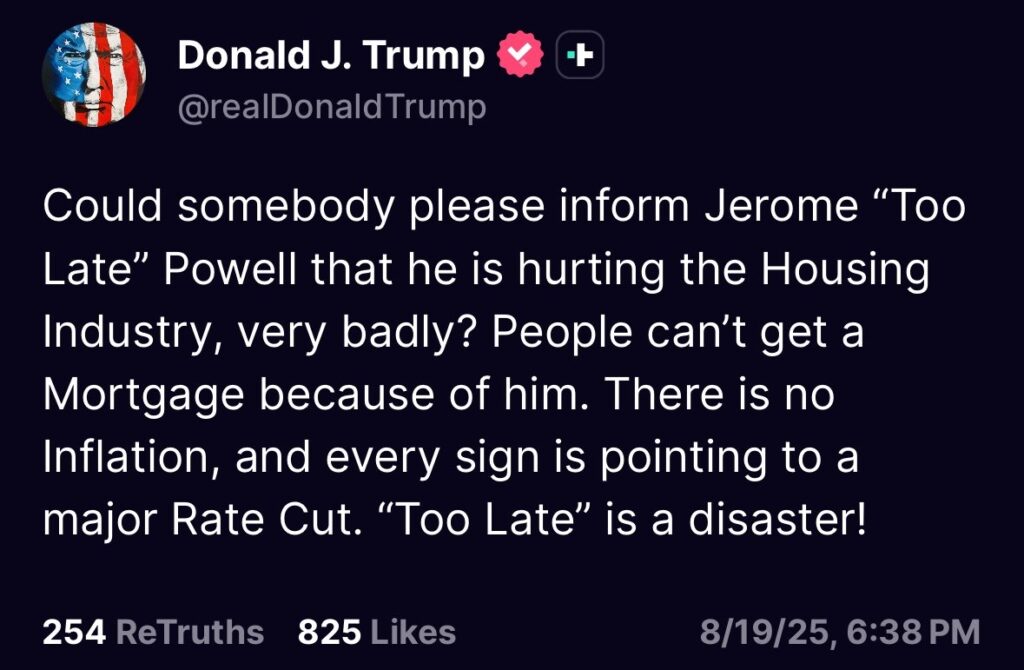

Meanwhile, on the same day, President Trump targeted Federal Reserve Chair Jerome Powell again, stating that higher interest rates were hurting the housing market.

See Also: Short Seller Andrew Left Says ‘OpenAI At $500 Billion Puts Palantir At $40’ — And That’s Generous

Home Depot Q2 Earnings Snapshot And Outlook

Sales for the second quarter reached $45.277 billion, an increase of 4.9% from the previous year, but slightly below Wall Street's estimate of $45.356 billion. Adjusted diluted earnings per share were $4.68, just above last year's $4.67 but short of the $4.71 consensus estimate.

Buoyed by this performance, the company reaffirmed its fiscal 2025 guidance, signaling confidence in its ability to manage the uncertain outlook. Full-year sales are expected to reach $163.980 billion, short of the $164.303 billion consensus, with capital expenditures at roughly 2.5% of sales.

The company expects a gross margin of 33.4%, an operating margin of 13.0%, and an adjusted operating margin of 13.4% for the full year. Meanwhile, adjusted diluted EPS is forecast at $14.94, down 2% from last year and below the $15.00 estimate.

Price Action

Home Depot rose 3.17% to $407.20 on Tuesday and advanced 0.12% in after-hours trading. It has gained 4.82% on a year-to-date basis and 10.87% over the past year.

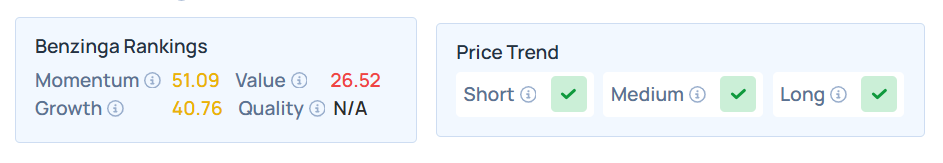

Benzinga's Edge Stock Rankings indicate that HD maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended lower in premarket on Tuesday. The SPY was down 0.54% at $639.81, while the QQQ declined 1.36% to $569.28, according to Benzinga Pro data.

On Wednesday, the futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading lower.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock