Grocery giant Kroger Co. (NYSE:KR) is making an aggressive push to win over cost-conscious shoppers, revealing it has lowered prices on more than 3,500 products since the beginning of the year.

The move comes as the company reported mixed second-quarter earnings and raised its full-year sales forecast, signaling confidence in its “back to basics” strategy.

Check out Kroger’s stock price here.

Kroger Aims To Simplify Value Proposition

The strategic price investments are at the core of Kroger's plan to simplify its value proposition for customers who are feeling the strain of the economy.

“Our customers are telling us they like lower prices and simpler promotions,” said Chairman and CEO Ron Sargent on the earnings call. “They care about quality and value, and they appreciate better store conditions and better service.”

Vows To Remain ‘Margin Neutral’

To fund the deep discounts without sacrificing profitability, Kroger is focused on cutting costs and improving productivity.

The company is vowing to keep its profit margins stable, with CFO David Kennerley stating the goal is for the full-year gross margin rate to be “relatively flat.”

This disciplined approach allows Kroger to invest in price without alarming investors and achieving its “expectations to remain margin neutral.”

See Also: Spotlight on Kroger: Analyzing the Surge In Options Activity

No ‘Material Impact’ From Tariffs

While managing internal costs, Kroger is also navigating the external economic climate. Addressing concerns about inflation from trade policy, Kennerley assured investors that the company is well-positioned.

“Tariffs have not had a material impact on our business thus far,” he said, adding that Kroger's approach is to “raise prices as a last resort to ensure that we keep prices as low as possible for our customers.”

Kroger Q2 Earnings Snapshot

The company reported second-quarter adjusted earnings per share of $1.04, beating the analyst consensus estimate of 99 cents. Quarterly sales of $33.94 billion, marginally missing the consensus view of $34.102 billion.

Kroger lifted its full year adjusted EPS outlook to $4.70–$4.80, up from $4.60–$4.80, compared with the $4.77 analyst consensus.

Adjusted identical sales without fuel are expected to rise in the range of 2.7% – 3.4% as compared to the prior view of 2.25% – 3.25%.

Price Action

The stock rose 0.30% on Thursday and 0.032% after-hours. The stock has advanced 8.54% on a year-to-date basis, and 21.79% over the year.

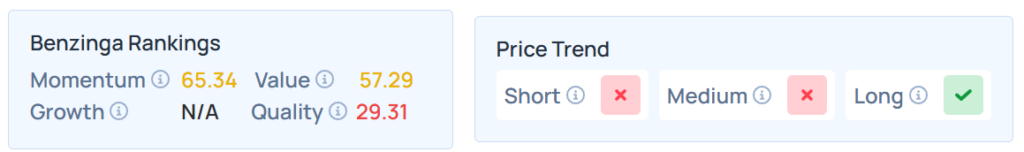

Benzinga’s Edge Stock Rankings indicate that KR maintains a weaker price trend in the short and medium terms but a strong trend in the long term. However, the stock’s quality ranking is relatively weak. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Thursday. The SPY was up 0.83% at $657.63, while the QQQ advanced 0.58% to $584.08, according to Benzinga Pro data.

On Friday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock