When President Donald Trump began his second term with the battle cry “drill, baby, drill,” he vowed a new era of American energy supremacy, promising cheaper prices, more rigs, and more jobs. But nine months in, the boom is looking more like a bust.

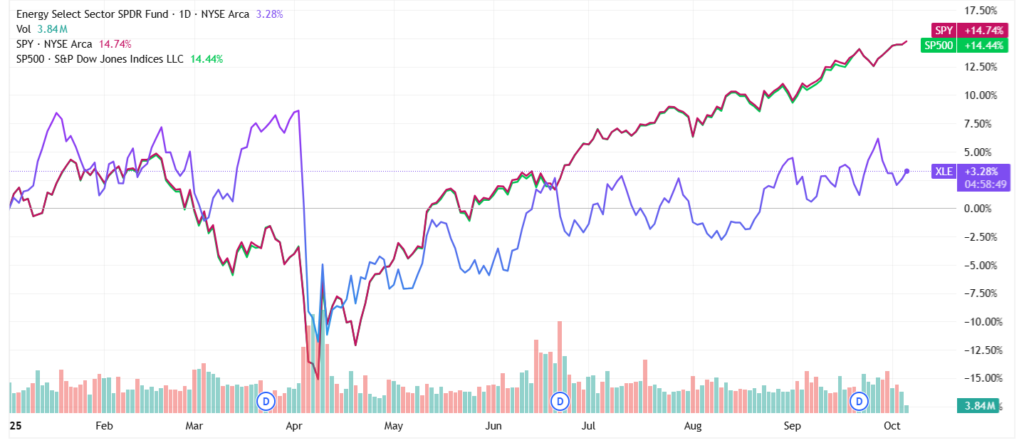

- XLE has lost more than 4% over the past year. Check its prices, live.

Production of oil and gas has declined for two consecutive quarters, the Federal Reserve Bank of Dallas reported. Brent crude futures have dropped over 15% year-to-date, and West Texas Intermediate (WTI) is down almost 17%. The Energy Information Administration (EIA) anticipates Brent oil averaging a mere $50 a barrel in early 2026, with global inventories increasing by more than 2 million barrels per day over the coming months.

That slide deflated energy ETFs that previously rode high on Trump rhetoric. The Energy Select Sector SPDR Fund (NYSE:XLE) — the home of such companies as Exxon Mobil Corp (NYSE:XOM) and Chevron Corp (NYSE:CVX) — has underperformed this year, lagging the S&P 500.

Vanguard Energy Index Fund ETF (NYSE:VDE) and iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO), which have more exposure to upstream producers, have declined sharply as the rig counts drop and capital expenditure plans are halted. The funds have lost 3% and 5% in the past year, respectively.

In fact, demand appears tenuous. Gasoline consumption in the U.S. will barely climb at all in 2026, while solar energy is taking a record portion of new electricity demand, according to EIA. Abroad, consumption has weakened in Europe, China and Latin America, all long-time sources of growth for oil. At the same time, the OPEC agreement to increase output by 137,000 barrels per day until November puts more pressure on the market, eroding the market share of American producers.

For ETF investors, that translates into a rethink. As pure-play oil and gas funds falter, midstream ETFs like the ALPS Alerian Energy Infrastructure ETF (NYSE:ENFR), which generate returns on pipeline volumes rather than oil prices, may offer more stable income potential.

Trump’s “One Big Beautiful Bill,” which increases federal leasing and reduces royalty rates, may soothe some expenses, but here, too, hope is thin on the ground; only 6% of oil chief executives polled by the Dallas Fed said it would make a significant impact, as reported by Yahoo Finance.

In brief, the White House’s energy revolution is running into a crude reality check. For the time being, investors taking a bet on a “drill, baby, drill” renaissance might discover that the only thing gushing is oversupply.

Read Next:

Photo: Shutterstock