The first five months of Donald Trump‘s presidency have coincided with one of the steepest collapses in the U.S. dollar in over three decades, as economic contraction, surging deficits and political friction with the Federal Reserve hammered investor confidence in the greenback.

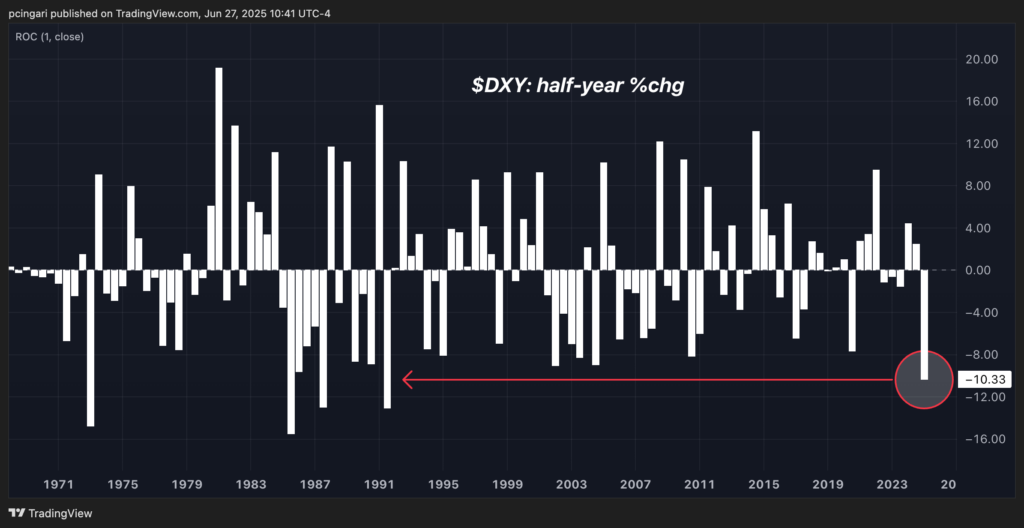

The Dollar’s Biggest Slump Since 1991

The U.S. Dollar Index, a benchmark that measures the greenback's strength against a basket of major currencies, has dropped over 10% year-to-date, marking its worst half-year performance since the second half of 1991.

After staging a powerful rally between late 2024 and January 2025 — gaining in 13 of 14 weeks on optimism over Trump's return and expected tax and tariff policies — the dollar turned sharply lower after Inauguration Day on Jan. 20.

What Triggered The Dollar Collapse?

Initial market expectations had priced in a stronger dollar under Trump, given his promises of tax cuts and protectionist trade policies. Yet, these measures backfired.

The tide began turning in March, when the euro surged after Germany's coalition government launched a major fiscal expansion, abandoning the country's long-held debt brake. Berlin approved a defense spending boost, while the European Union announced an €800 billion "ReArm Europe" program, sending capital flows into the eurozone.

April delivered a double blow to the greenback. On April 2, Trump introduced sweeping tariffs — dubbed "Liberation Day" — against several trading partners. Markets recoiled as the move triggered retaliatory threats and rising uncertainty.

A 90-day pause, announced on April 9, failed to restore confidence in the greenback.

Economic data deepened the dollar's woes. The U.S. economy contracted by 0.5% in the first quarter, marking the first decline since 2022. At the same time, concerns mounted over deteriorating fiscal conditions.

Deficit Explosion And Debt Downgrade

Moody's downgraded U.S. sovereign debt, stripping Washington of its last AAA credit rating. The rating agency highlighted a sustained increase in government debt and interest payments over more than a decade as key reasons for the downgrade.

Meanwhile, the bipartisan Congressional Budget Office projected that Trump's flagship "One Big Beautiful Bill" would balloon the federal deficit by $2.8 trillion over the next decade.

This comes as the federal deficit-to-GDP ratio already hovers near 7%, and total government debt surpasses 100% of GDP.

Fed Tensions Escalate, Rate Cut Bets Rise

Further damaging the dollar was Trump's escalating feud with Federal Reserve Chair Jerome Powell. After criticizing Powell throughout spring, Trump openly signaled he wouldn't reappoint him when his term expires in May 2026.

The Fed held interest rates steady for a fourth consecutive meeting in June, citing inflation risks tied to tariffs. Powell said the current rate level was "appropriate" given the economic conditions, pushing back against political pressure.

In response, Trump lashed out at Powell, accusing him of political bias. Later in June, he floated possible replacements, reinforcing market expectations of a looser monetary policy.

Markets now anticipate two rate cuts before the end of 2025 and four more in 2026 — a dovish shift that has further weakened the dollar.

Where Is the Dollar Now?

On June 27, the U.S. Dollar Index – as tracked by the Invesco DB USD Index Bullish Fund ETF (NYSE:UUP) – slipped to 97, its lowest level since February 2022, before Russia's invasion of Ukraine. The index is heading for its seventh straight session of declines.

What began as a bullish outlook under Trump has quickly unraveled, turning the first half of 2025 into the dollar's worst chapter in nearly 40 years.

Read Next:

Photo created using images from Shutterstock and Midjourney.