Closing post

Time to recap…

Donald Trump is preparing to send letters to trading partners, setting out tariff rates that countries will have to pay from the beginning of next month.

The US president has said he will send out about “10 or 12” letters on Friday, with further letters over the next few days, as the 90-day pause on his “reciprocal tariffs” comes to an end.

Trade tensions are bubbling at the second biggest economy in the world too. China announced new tariffs of up to 35% on brandy from the European Union, condemned as ‘unfair’ by an EU spokesperson.

The Chinese tariffs will range from 27.7% to 34.9% and will be effective from Saturday, lasting five years. The Chinese commerce ministry said the decision follows a probe launched last year, which linked European cognac imports to threats against its domestic brandy industry.

However, the duties include exemptions for some major cognac makers, including Remy Cointreau, Pernod Ricard and LVMH’s Hennessy. The EU imposed tariffs on Chinese electric vehicles last year, and Beijing has launched similar anti-dumping probes into European dairy and pork.

The new tariffs could set a difficult tone for a China-EU summit that is scheduled to be held later this month in Beijing.

Meanwhile in the UK, a former Bank of England deputy has said Rachel Reeves has to ‘neurotically fine tune taxes’ because of her decision to opt for fiscal rules that give her little wiggle room.

Charlie Bean, who is also a former member of the OBR’s budget responsibility committee, told Radio 4’s Today programme:

About £10 billion - that’s a very small number in the context of overall public spending. Government spending is about about one and a quarter trillion so £10 billion is a small number … and it is a small number in the context of typical forecasting errors.

…She should aim to operate with a larger margin of headroom, so previous chancellors have typically operated with headroom of the order of £30 billion.

Because she has chosen about a third of that … it is very easy for numbers to go in the wrong direction and she finds she has to neurotically fine tune taxes to control the OBR forecast that is several years ahead.

The original sin is that she should not have chosen to operate with such a tight margin of error.

Tesla sales in the UK rebounded in June, according to the latest figures for monthly new car registrations, following the launch of its new Model Y.

The company, which is led by the billionaire Elon Musk, sold 7,719 cars in the UK last month, up 14% compared with June last year. However registrations still remain 1.3% lower in the year to date.

Tesla has been struggling with weak sales in some of its international markets, as it has faced a consumer backlash against Musk’s politics, as well as stiff competition from Chinese rivals such as BYD. Overall the company delivered 384,122 vehicles in the second quarter, down 13.5% from 443,956 units a year ago.

Updated

The end of a 90-day pause on Trump’s “reciprocal tariffs” looms next week on 9th July, with many countries racing to hammer out a deal before they are hit with the president’s levies.

Indonesia has offered to cut duties on key imports from the US to “near zero” and to buy $500m worth of American wheat, as part of its trade talks with Washington, its lead negotiator has said. Jakarta is facing a tariff rate of 32% in the US market if it does not reach an agreement.

Chief economics minister Airlangga Hartarto said the Indonesian government has offered to cut tariffs on key American exports, including agricultural products, to near zero, compared with current rates that vary between 0% and 5%. He said:

It will be near zero … but it will depend as well on how much the tariffs we get from the US.

Airlangga also said that the state carrier Garuda Indonesia would buy more Boeing planes as part of a $34 billion deal with business partners to boost purchases from the US.

Updated

Chinese tariffs on European brandy are 'unfair', says EU spokesperson

Elsewhere in the world of trade, tensions are simmering between the EU and China, after Beijing announced it would place new tariffs of up to 35% on brandy from the bloc.

Olof Gill, a spokesperson for the EU, said:

We believe that China’s measures are unfair. We believe they are unjustified. We believe they are inconsistent with the applicable international rules and are thus unfounded.

The Chinese tariffs will range from 27.7% to 34.9% and will be effective from Saturday, lasting five years. The Chinese commerce ministry said the decision follows a probe launched last year, which linked European cognac imports to threats against its domestic brandy industry.

However, the duties include exemptions for some major cognac makers, including Remy Cointreau, Pernod Ricard and LVMH’s Hennessy.

The EU imposed tariffs on Chinese electric vehicles last year, and Beijing has launched similar anti-dumping probes into European dairy and pork.

The announcement comes as the Chinese foreign minister Wang Yi tours Europe to discuss trade. Wang is set to meet his French counterpart, Jean-Noël Barrot, later today in Paris. A China-EU summit is planned to be held later this month in Beijing.

Updated

Ryanair boss hopeful that commercial aircraft will be exempt from US-EU tariffs

The boss of Ryanair has said that he is hopeful that trade tariffs between the US and the European Union would not apply to commercial aircrafts, as it would disrupt complex supply chains.

Ryanair chief executive Michael O’Leary told Ireland’s RTE radio:

Commercial aircraft have always been exempt under previous tariffs ... We think that’s likely to be restored even if there are tariffs applied.

The comments come as investors await the EU to finalise a trade deal with the US ahead of Trump’s deadline on 9 July. The Stoxx Europe 600 index, which tracks the performance of some of the biggest companies on the continent, is down by 0.65%.

The EU and the US are closing in on a high-levle “framework” trade deal that would mean that the bloc could avert 50% tariffs on all its exports next Wednesday.

Updated

UK construction downturn starts to ease

The downturn in UK construction is starting to ease, according to new data released this morning.

The S&P Global UK Construction Purchasing Managers’ Index rose to 48.8 from 47.9 in May, reaching a six-month high. It is still below the 50 threshold which represents growth in the market.

The survey painted a mixed picture across the industry, with housing activity expanding for the first time since September, but the commercial sector contracting at the fastest rate since mid 2020.

Gareth Belsham, of Bloom Building Consultancy, said:

Yes the overall contraction in industry workloads continues to ease, and housebuilders even saw output rise in June. That’s the good news.

But on the other side of the ledger, commercial sector workloads fell sharply, declining at their fastest level since May 2020 - a month when Britain was in the teeth of the Covid pandemic. Infrastructure and civil engineering work contracted even more rapidly.

But the real cause for alarm is the continued decline in new orders - as they are the key to where the industry goes from here. Builders’ order books have got progressively thinner every single month in 2025 so far, and this is taking a severe toll on construction industry sentiment.

Welfare U-turn shows UK faces 'formidable' challenges, says credit rating agency S&P Global

The inability of Britain’s government to make cuts to its welfare sending has underscored the “formidable” challenge it faces in shoring up its finances, analysts at the credit rating agency S&P Global have said.

This week Sir Keir Starmer was forced to gut his controversial welfare bill following strong opposition from Labour MPs, abandoning approximately £5bn in potential savings for the government.

Analysts at S&P wrote:

We consider the inability to make modest cuts to welfare spending, which has ballooned in the UK since the 2020 pandemic, underscores the UK government’s very limited budgetary room for manoeuvre.

Turning back to the UK, house builders are among the worst performers across the FTSE this morning. MJ Gleeson, which has been struggling with high costs and planning delays, said it now expects its pre-tax profit to be at or around £24.5m, at the lower end of what the market had been expecting. The update has sent its shares down 5.4%.

Rival Vistry has followed it down 3.1%, while in the FTSE 100 Berkeley and Barratt Redrow are both down by 2% and 1.7% respectively.

Trump’s flagship tax bill steals from the sick, elgerly and hungry, and gives to billionaires and jackboots, writes Moira Donegan.

The budget reconciliation bill that passed the US House of Representatives on Thursday and was promptly to be signed into law by Donald Trump represents the particular perversity of national politics in America: seemingly no one wants it, everyone hates it, and it is widely agreed to be devastating for staggering numbers of Americans. And yet, the bill felt inevitable: it was a foregone conclusion that this massive, malignant measure was something that everyone dreaded and no one had the capacity to stop.

They didn’t really even try. In the Senate, a few conservative Republicans made noise about the bill’s dramatic costs: the congressional budget office estimates that the bill will add $3.3 tn to the deficit over the coming decade, and the senator Rand Paul, a budget hawk from Kentucky, declined to vote for it for this reason. But other Republicans, who used to style themselves as fiscally responsible guardians against excessive government spending, engaged in a bit of freelance creative accounting in order to produce an estimate that falsely claimed the cost of the bill would be lower. Most of them quickly found themselves on board.

Updated

Elsewhere, the government has set out a roadmap for reviving the onshore wind industry in England, after Labour lifted the de facto ban last year which was put in place by the Conservatives.

The Onshore Wind Industry Taskforce has set out more than 40 steps to help development in the sector, including planning reforms, re-powering old turbines and exploring plans to expand the clean industry bonus for onshore wind.

Energy secretary Ed Miliband said in a report:

As one of the cheapest and fastest-to-build sources of power we have, onshore wind will play a critical role in boosting our energy independence with clean power by 2030.

The reality is that every turbine we build helps protect families, businesses and the public finances from future fossil fuel shocks.

The government is planning to almost double onshore wind across England by 2030, taking its capacity from 14.8GW to 27 to 29GW. It has claimed the strategy will support the creation of up to 45,000 skilled jobs by the end of the decade.

Updated

It is a rather weak open for stock markets in Europe this morning. In the UK, the blue chip FTSE 100 index has slipped 0.3% in early trading.

The German Dax index slipped 0.5%, while the French Cac 40 index dropped by 0.8%, as the European Union tries to finalise a new trade deal with the US.

Susannah Streeter, head of money and markets at the investment broker Hargreaves Lansdown, said that optimism is starting to evaporate at the end of the week as the US tariff deadline looms on 9 July.

There’s a distinct lack of Friday fizz for the FTSE 100, as investors mull repercussions for the global economy. Investors are also assessing the implications of the passing of Trump’s big tax cut bill which will add to the mountain of US debt.

Streeter added the US stock market has been riding high on signals that so far Trump’s trade policies have not weakened the economy.

The closely watched US jobs report for June signalled much more strength in the labour market than expected. Although it’s wiped out hopes of an interest rate cut this month, it didn’t hit sentiment, which appears more focused on the resilience of the world’s largest economy. Markets are closed for the July 4th holiday but more caution is set to creep into sentiment and show up when trading resumes on Monday.

Updated

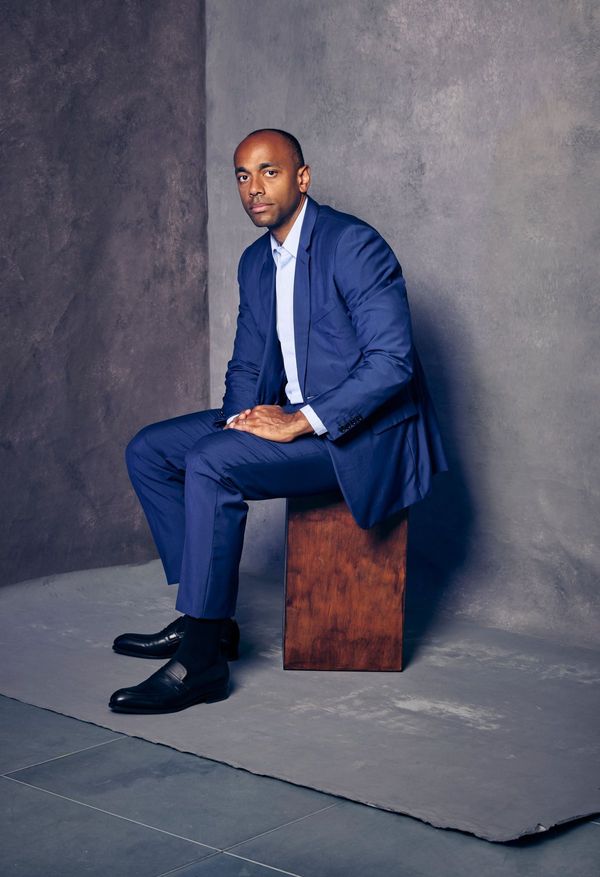

Reeves has to ‘neurotically fine tune taxes’ because of narrow fiscal headroom, says former Bank of England deputy

Rachel Reeves has not given herself enough fiscal headroom to manage public finances, Charlie Bean, the former deputy of the Bank of England has said, and has to “neurotically fine tune taxes”.

Bean, who is also a former member of the OBR’s budget responsibility committee, told Radio 4’s Today programme the chancellor had chosen fiscal rules that give her a “very small margin” of headroom.

About £10 billion - that’s a very small number in the context of overall public spending. Government spending is about about one and a quarter trillion so £10 billion is a small number … and it is a small number in the context of typical forecasting errors.

You can’t forecast the future perfectly both because you can’t forecast the economy and you can’t forecast all the elements of public finances …. the forecasts are imprecise and there is no way you can avoid that. That is a fact of life.

She should aim to operate with a larger margin of headroom, so previous chancellors have typically operated with headroom of the order of £30 billion.

Because she has chosen about a third of that … it is very easy for numbers to go in the wrong direction and she finds she has to neurotically fine tune taxes to control the OBR forecast that is several years ahead.

The original sin is that she should not have chosen to operate with such a tight margin of error.

Reeves has been under intense public pressure, after the government’s concessions to Labour MPs over plans to change welfare payments have wiped out plans for £5bn savings a year.

Updated

Oil futures fall as Iran reiterates commitment to nuclear non-proliferation

Oil futures have slipped after the Iranian foreign minister Abbas Araqchi said Tehran remains committed to the nuclear Non-Proliferation Treaty.

Brent crude futures dropped by 0.51% to $68.45 a barrel, while US West Texas Intermediate crude dropped 0.37% to $66.75.

Vandana Hari, founder of oil market analysis provider Vanda Insights, said:

Thursday’s news that the U.S. is preparing to resume nuclear talks with Iran, and Araqchi’s clarification that cooperation with the U.N. atomic agency has not been halted considerably eases the threat of a fresh outbreak of hostilities.

This week Tehran enacted a law suspending cooperation with the UN nuclear watchdog, the International Atomic Energy Agency. However Hari added that the oil price correction “may have to wait till Monday”, when the US returns from a long weekend and reacts to an Opec+ decision on Sunday.

Opec+, the world’s biggest group of oil producers, is expected to announce an increase of 411,000 barrels per day in production for August.

UK electric car sales up by a third in first half

Meanwhile in the UK, British electric car sales rose by a third in the first half of 2025 after the strongest June for overall car sales since before the Covid pandemic.

The number of battery electric car sales rose 34.6% to 224,838 units in the first six months of the year, according to preliminary data from the Society of Motor Manufacturers and Traders (SMMT), a lobby group.

New car sales rose 6.8% year-on-year in June to 191,200 units, the best sales figures for the month since 2019. A quarter of all June sales, or nearly 47,400, were electric.

The figures come amid a difficult period for the the UK car industry, which has struggled to increase sales to pre-pandemic levels as potential buyers have been hit by the cost of living crisis after Russia’s full-scale invasion of Ukraine.

British car factories have also had to contend with a major slowdown in response to extra US tariffs of 25% announced by Donald Trump in March. Last month UK car production fell to its lowest level for May since 1949 as manufacturers cut back shipments.

You can read the full story from my colleague Jasper Jolly here.

Introduction: Trump celebrates spending and tax bill on US Independence Day

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

President Donald Trump has secured passage of his controversial flagship tax and spending bill, after the House of Representatives approved the bill late on Thursday.

The 218-to-214 vote sends the legislation to Trump, who has said he plans to sign the bill on Friday as the US celebrates Independence Day.

Speaking to supporters at the Iowa State Fairground, he said “there could be no better birthday present for America”.

There could be no better birthday present for America than the phenomenal victory we achieved just hours ago, when Congress passed the “One Big Beautiful Bill” to make America great again…one-hundred-and-sixty-five days into the Trump administration, America is on a winning streak like, frankly, nobody has ever seen before in the history of the presidency.”

Meanwhile, the president’s trade war rattles on. Trump told reporters late on Thursday that his administration will start sending out letters on Friday setting unilateral tariff rates, which countries would have to begin paying on 1 August.

Trump said “10 or 12” letters would go out on Friday, with additional letters coming “over the next few days”. The higher import duties will range in value from “maybe 60 or 70% tariffs to 10 and 20% tariffs”, he said.

The top tier of that range would be higher than any of the levies the president first outlined during his Liberation Day rollout in April. He did not provide any detail on which countries might receive such high tariffs.

The UK is one of a few countries that has reached a trade agreement with Trump, including Vietnam. Many trading partners such as the European Union, Japan and South Korea are still trying to finalise trade deals. Trump has threatened that if countries fail to reach deals by 9 July, he could simply impose tariff rates on them.

The agenda

9:00am BST: UK SMMT car market figures for the first half of the year

9:30am BST: UK PMI construction data

US market closed for Independence Day

Updated