Prominent analysts are divided on enterprise AI giant Palantir Technologies Inc.’s (NASDAQ:PLTR) prospects, ahead of the company’s third-quarter results on Monday.

PLTR stock is at important technical levels. See what is happening here.

400x PE Is ‘Totally Justified’

Long-time Palantir bull, Tom Nash, said that the company's recent partnership with NVIDIA Corp. (NASDAQ:NVDA) has “changed the whole story” on his YouTube channel last week.

According to Nash, the partnership gives Palantir “superpowers” by effectively combining “the raw computing power of Nvidia” with the latter’s ability to “organize massive amounts of data and AI into one logical platform,” unlocking significant value in the process.

See Also: Palantir Co-Founder Says AI Giants Face Endless Capital Hunt But ‘Afraid To Scare Their Investor’

Regarding the company’s valuations, Nash said that its price-to-earnings ratio of 400 times forward earnings is “totally justified” for those investors who believe the company is set to take over the world.

Nash, however, acknowledged that the stock “will have wild swings” and “massive sensitivity to sentiment changes,” given such high valuations.

The Stock Is ‘Three Times’ Overvalued

Another prominent independent investor on YouTube, Parkev Tatevosian, CFA, struck a more cautious note during his analysis of the stock last week.

He warned investors that Palantir’s “market price is more than three times the value,” which he would consider to be its fair price, indicating that it was now significantly overvalued.

Tatevosian said his intrinsic value per share estimate was $50, compared to a market price of $200.47. Tatevosian also noted that Palantir's forward price-to-earnings ratio of 256 is “about 10 times the value of the average stock in the S&P 500.”

“Palantir's success is no secret to anyone,” he said, adding that in his view, “investors are overestimating the company's value.”

Bears Continue To ‘Underestimate’ This Company

According to Wedbush Securities analyst Dan Ives, bears continue to underestimate Palantir. “The haters hate. I mean, the reality is the bears were yelling when it was $15, screaming from the mountaintops at $50, yelling fire in a crowded theater at $100,” he said, noting that they continue to underestimate its potential.

Ives praised Palantir as a key force reshaping the technology industry, saying no other company is transforming the landscape as profoundly as CEO Alex Karp and his team have done, while speaking with the Schwab Network last week.

Shares of Palantir were up 3.04% on Friday, closing at $200.47, and are up 0.88% overnight, ahead of the company’s much-anticipated third-quarter results, after markets close on Monday.

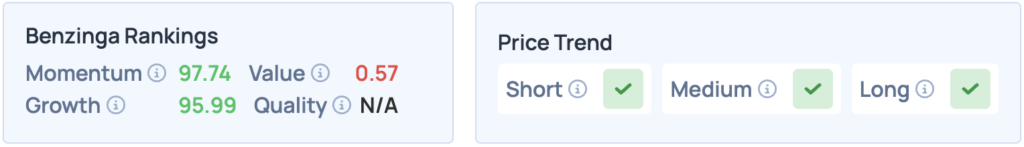

The stock scores high on Momentum and Growth in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Image via Shutterstock