Several biotech stocks are showing renewed strength over the past week, with their Momentum scores soaring in Benzinga’s Edge Stock Rankings.

Top 4 Biotech Stocks With A Surge In Momentum

In Benzinga’s Edge Rankings, Momentum is assessed based on the relative strength of the stock, and it takes into account the price movements and volatility across multiple time frames, before ranking them individually as a percentile against all other stocks.

See Also: 2 Steel Stocks Just Saw A Big Growth Spike

Over the past week, these four biotech stocks have seen significant improvements in their respective momentum scores, and here’s why?

1. Tenaya Therapeutics

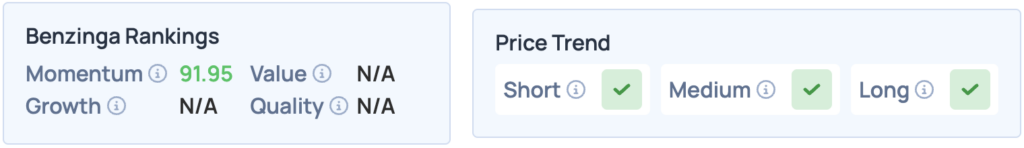

A clinical-stage biotech company focused on developing therapies for heart disease, Tenaya Therapeutics Inc. (NASDAQ:TNYA) witnessed a significant 75.63 point surge in its Momentum score, rising from 13.31 to 88.94 within the span of a week.

This can be attributed to its stronger-than-expected second-quarter performance, alongside its TN‑201 gene therapy for treating hypertrophic cardiomyopathy, clearing a key safety review.

According to Benzinga’s Edge Stock Rankings, the stock scores high on Momentum, and has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

2. InflaRx NV

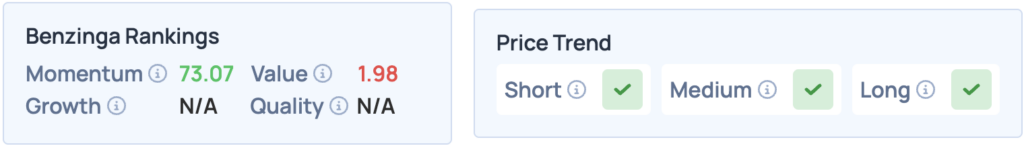

German clinical-stage biopharmaceuticals company, InflaRx N.V. (NASDAQ:IFRX), that primarily focuses on anti-inflammatory therapeutics, saw a spike in its Momentum scores, rising 67.89 points from 10.27 to 78.16 last week.

This comes despite there being no news or catalyst from the company itself, but a potential FDA policy shift, favoring noninvasive trial endpoints, particularly in liver disease, which sent a number of small-cap biotech names surging.

The stock scores high on Momentum, but does poorly in Value, and has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

3. RenovoRx

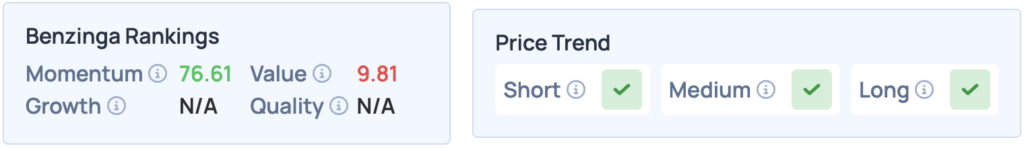

RenovoRx Inc. (NASDAQ:RNXT) is a California-based biotech company that offers targeted oncology therapies, which saw a spurt in Momentum over the past week, with its Edge scores soaring 56.86 points, from 23.34 to 80.2.

This can be attributed to its recent second-quarter revenues, which beat estimates, alongside the robust uptake of its RenovoCath device, which expanded from five cancer centers to 13 during the quarter.

HC Wainwright analyst Swayampakula Ramakanth maintained a “Buy” rating and $3 price target, citing accelerating sales and a growing commercialization strategy, representing an upside of 141%.

The stock does well on Momentum in Benzinga’s Edge Rankings, but fares poorly in-terms of Value. It has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

4. Alector Inc.

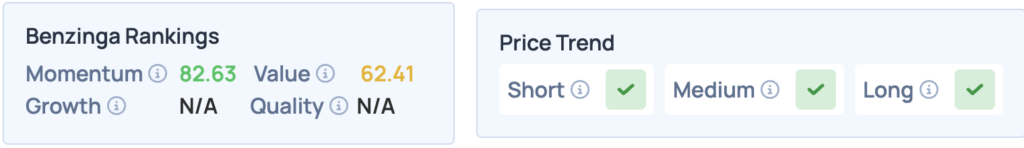

Another California-based startup, Alector Inc. (NASDAQ:ALEC), develops therapies for neurodegenerative diseases, and last week, saw its Momentum score jump from 26.84 to 74.1, an increase of 47.26 points within a span of a week.

The recent spike follows an upgrade from Mizuho to “Outperform,” with the firm raising its price target from $2.50 to $3.50. The upgrade was based on increased confidence in Alector's INFRONT‑3 Phase 3 trial, partnered with GSK, which now carries an estimated 60% chance of success and remains on track for topline data in mid-Q4 2025.

According to Benzinga’s Edge Stock Rankings, the stock scores well on Momentum, and does reasonably well on Value, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Read More:

Photo courtesy: Shutterstock