The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Novocure Ltd (NASDAQ:NVCR)

- On July 24, NovoCure posted better-than-expected quarterly results. “With the first half of 2025 complete, I am pleased to report continued progress towards our clinical, regulatory and commercial milestones. In Q2, we grew our glioblastoma and non-small cell lung cancer businesses and advanced our efforts to bring Tumor Treating Fields therapy to new patient populations,” said Ashley Cordova, CEO, Novocure. “With one launch ongoing and two more on the horizon, we are well-positioned in both the near and long term. This is a pivotal period for Novocure.” The company's stock fell around 32% over the past month and has a 52-week low of $11.57.

- RSI Value: 21.8

- NVCR Price Action: Shares of Novocure fell 4% to close at $12.04 on Friday.

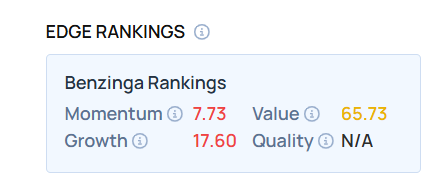

- Edge Stock Ratings: 7.73 Momentum score with Value at 65.73.

HCA Healthcare Inc (NYSE:HCA)

- On July 25, HCA reported quarterly total revenues of $18.61 billion, representing a 6.4% increase from the same period last year and marginally surpassing the consensus estimate of $18.49 billion. HCA Healthcare raised fiscal 2025 GAAP earnings per share guidance from $24.05-$25.85 to $25.50-$27.00 compared to the consensus of $25.37. The company's stock fell around 13% over the past month and has a 52-week low of $289.98.

- RSI Value: 22.6

- HCA Price Action: Shares of HCA fell 2.1% to close at $334.32 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in HCA stock.

Molina Healthcare Inc (NYSE:MOH)

- On July 23, Molina Healthcare posted mixed second-quarter results and issued soft guidance. “Our second quarter results and revised full year outlook reflect a challenging medical cost trend environment,” said Joseph Zubretsky, President and Chief Executive Officer. The company's stock fell around 45% over the past month and has a 52-week low of $156.36.

- RSI Value: 27.7

- MOH Ltd Price Action: Shares of Molina Healthcare rose 4.3% to close at $165.02 on Friday.

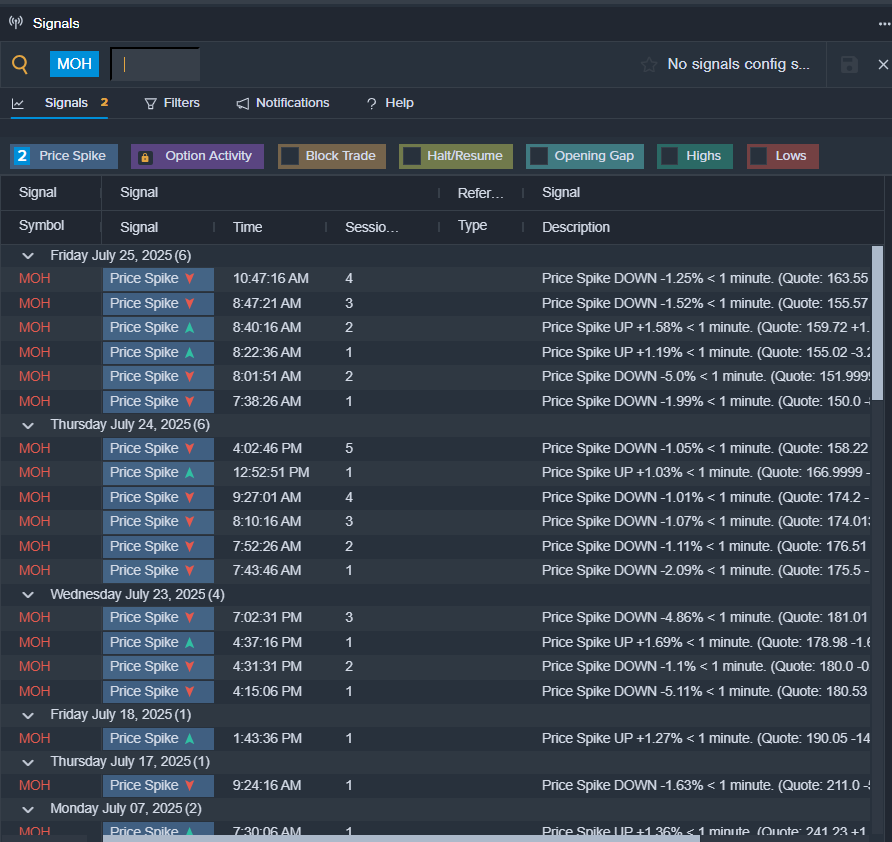

- Benzinga Pro’s signals feature notified of a potential breakout in MOH shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock