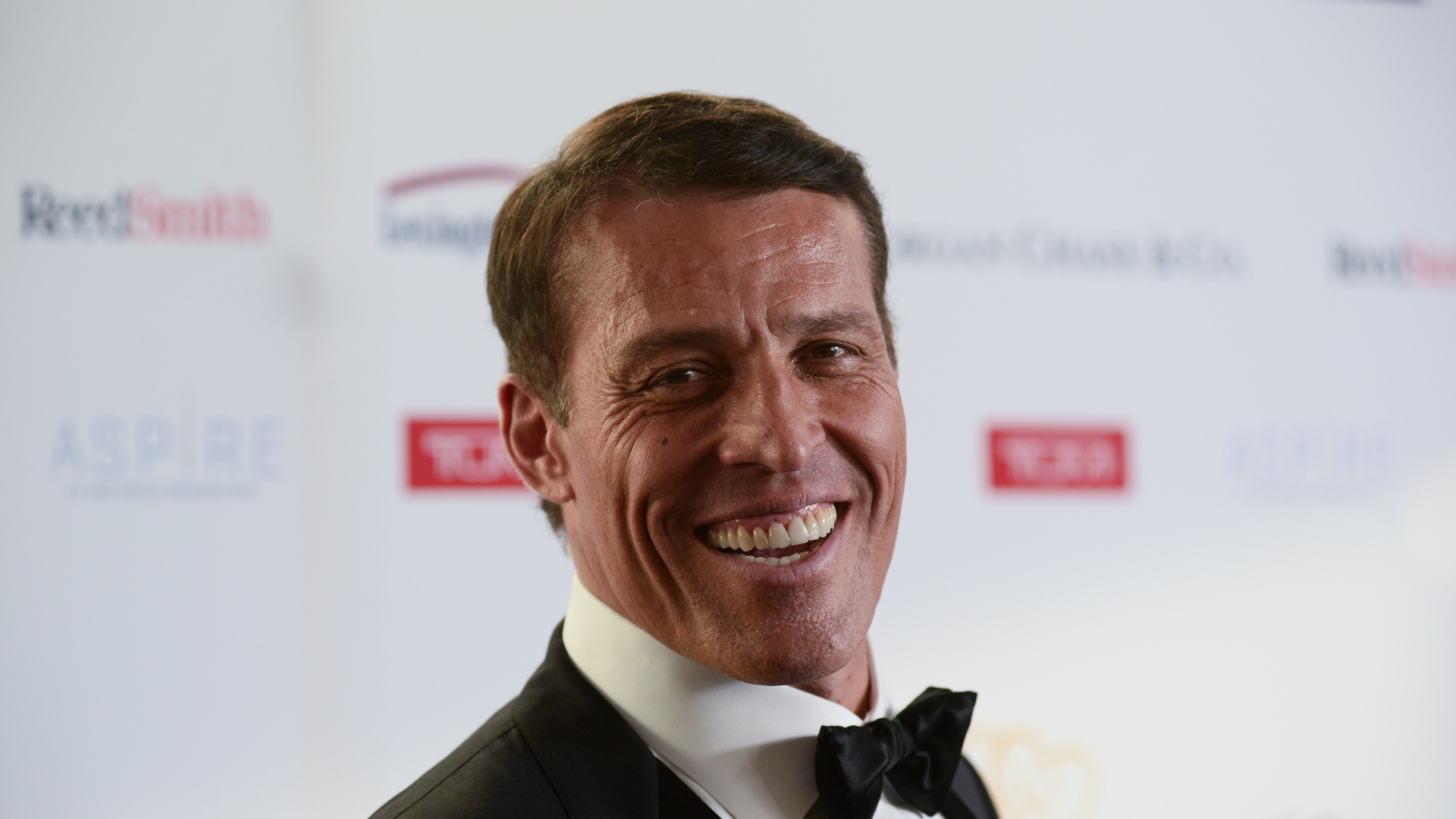

Tony Robbins, famed author, entrepreneur and self-made millionaire, has plenty of advice for investors at any level. Whether you’re just starting out or looking to grow your wealth, Robbins contends that investing isn’t all that complicated. By sticking to the basics, Robbins believes you can achieve your financial goals and even become a millionaire.

Read Next: I’m a Financial Advisor: 4 Investing Rules My Millionaire Clients Never Break

Find Out: 7 Tax Loopholes the Rich Use To Pay Less and Build More Wealth

As opposed to developing a complicated strategy aimed at beating the stock market, Robbins says, “The most important thing is to get started with whatever you have.” Based on his personal experiences and wealth of money expertise, here are Robbins three best investment tips to help you build your fortune.

Capitalize on Compound Interest

To Robbins — and pretty much all financial planners — compound interest is the key to long-term investment success. The earlier you start investing, the more time your money has to grow exponentially.

Robbins got into investing at 18, buying a triplex in California. Although this specific investment didn’t work out too well for the future millionaire, it fueled his interest and encouraged him to pursue other investments. “It got me in the game,” said Robbins. “If you don’t invest early on, you lose.”

To further demonstrate this point, Robbins gave the example of two investors who take different paths to build their wealth. The first one begins investing at age 19 and continues socking away $300 per month until age 27. At that point, the money is simply left in the account to compound, with no further contributions made. If the market returns 10% per year, which is in line with its long-term average, the $28,800 this person invested would be worth nearly $2 million by age 65. The second one, on the other hand, doesn’t start investing until age 28 but keeps putting away $300 per month until age 65, for a total contribution of $133,200.

So, which investor do you think will end up with more money? Perhaps surprisingly, it’s investor No. 1, as investor No. 2, even with an additional $104,400 in contributions, would only amass a nest egg of about $1.4 million, around 30% less of a rate of return than the first investor.

Robbins urges young investors to contribute to investment accounts as much as their income allows and to get in the habit of increasing their contributions regularly. A tax-advantaged, retirement account like a 401(k) plan is the simplest way to start.

Diversify Your Portfolio

Another popular investment principle that Robbins finds critical is diversification. According to him, “You have to diversify. You can’t put all of [your money] in one place.”

Owning a mix of stocks, bonds, real estate investment trusts (REITs) and non-correlated asset classes like precious metals can help cut down the volatility of your portfolio. This is because varying investments like these don’t always move up or down in tandem like the S&P 500 can. As a result, diversification smooths out the ups, downs and potential losses in your portfolio.

One good place to start is a simple index fund. With one purchase, your money could be spread out among tens or even hundreds of companies. You should also consider working with a fiduciary financial advisor who understands your risk tolerance and your needs and is required to work in your best interest.

Automate Everything

Robbins’ third investment tip is to automate everything. This is primarily a psychological tactic, but it’s also practical and comes with fewer management fees.

According to Robbins, if you set up your accounts to automatically transfer money into savings and investments, you won’t have the opportunity to spend it. Saving and investing then become habits you don’t even have to think about — you’ll just be automatically building your wealth without even lifting a finger.

Robbins acknowledges that this is a difficult first step for many. “It’s hard to do, but if you start to automate it and you do it regularly… you will have financial freedom that most people never have,” he said. “More importantly… [you’ll have] peace of mind, you’ll have inner strength. You’ll know that you’ve mastered this area of your life. And it’s not complex.”

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- New Law Could Make Electricity Bills Skyrocket in These 4 States

- I'm a Self-Made Millionaire: 6 Ways I Use ChatGPT To Make a Lot of Money

- 5 Strategies High-Net-Worth Families Use To Build Generational Wealth

- 10 Used Cars That Will Last Longer Than the Average New Vehicle

This article originally appeared on GOBankingRates.com: Tony Robbins’ 3 Best Investment Tips for Becoming a Millionaire