/TJX%20Companies%2C%20Inc_%20shopping%20cart%20by-Jhanggo%20via%20iStock.jpg)

Valued at a market cap of $164.1 billion, The TJX Companies, Inc. (TJX) is the leading off-price apparel and home fashions retailer in the U.S. and worldwide. Through its flagship chains, T.J. Maxx, Marshalls, HomeGoods, Winners, Homesense, and TK Maxx, the company offers brand-name and designer merchandise at discounted prices. Headquartered in Framingham, Massachusetts, TJX operates thousands of stores across North America, Europe, and Australia, catering to value-conscious consumers with a constantly changing assortment of apparel, footwear, accessories, and home décor.

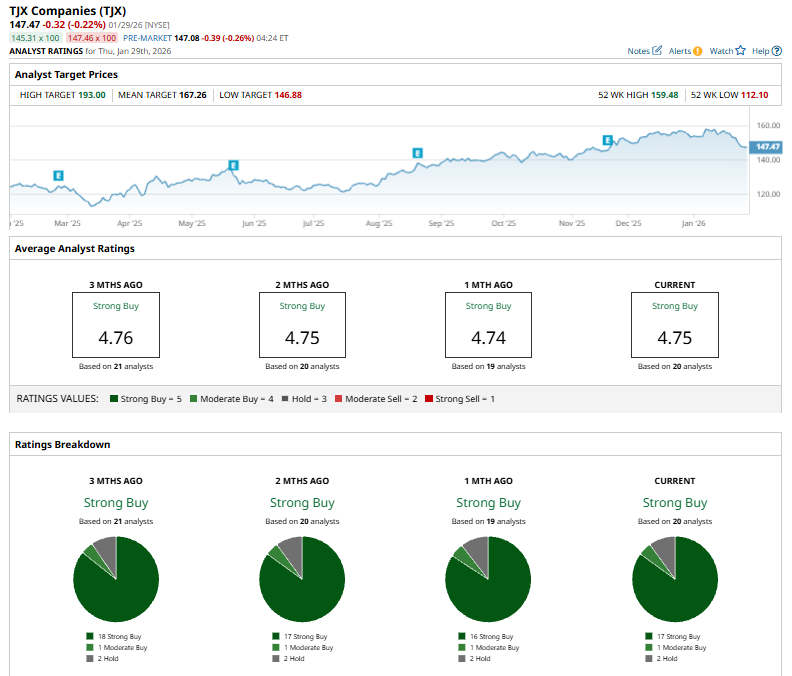

TJX Companies has emerged as a standout performer in the retail space, consistently outshining both the broader market and its sector peers. The stock prices have gained 18.7% over the past 52 weeks and 16.7% over the past six months. In contrast, the S&P 500 Index ($SPX) has climbed 15.4% over the past year and 9.4% over the past six months.

Narrowing the focus, TJX has also outperformed the sector-focused Consumer Discretionary Select Sector SPDR Fund’s (XLY) 5% uptick over the past 52 weeks and 7.9% over the past six months.

TJX has outperformed the broader market over the past year due to its resilient off-price retail model, which attracts value-conscious consumers amid inflation and economic uncertainty. Strong customer traffic, disciplined inventory management, and consistent margin expansion have supported solid earnings growth, while effective cost controls and opportunistic buying have enhanced profitability. Additionally, steady cash flow, share buybacks, and positive analyst sentiment have reinforced investor confidence, helping drive the stock’s superior performance.

For the full fiscal 2026, ending in January, analysts expect TJX to deliver an EPS of $4.67, up 9.6% year-over-year. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

Among the 20 analysts covering the TJX stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buys,” one “Moderate Buy,” and two “Holds.”

This configuration is optimistic than a month ago, when 16 analysts gave “Strong Buy” recommendations.

On Jan. 9, UBS analyst Jay Sole raised his price target on TJX Companies to $193, which is also the Street-high target. The analysts reaffirmed a “Buy” rating, reflecting continued confidence in the stock’s outlook and performance.

TJX’s mean price target of $167.26 suggests a 13.4% upside potential.