- On Monday October 19, 1987 global stock markets crashed, with the US Dow Jones Industrial Average falling 508 points (22.6%).

- And while the crash sent shock waves across the global economy, it did not equate said economies to the stock markets, as some continue to believe.

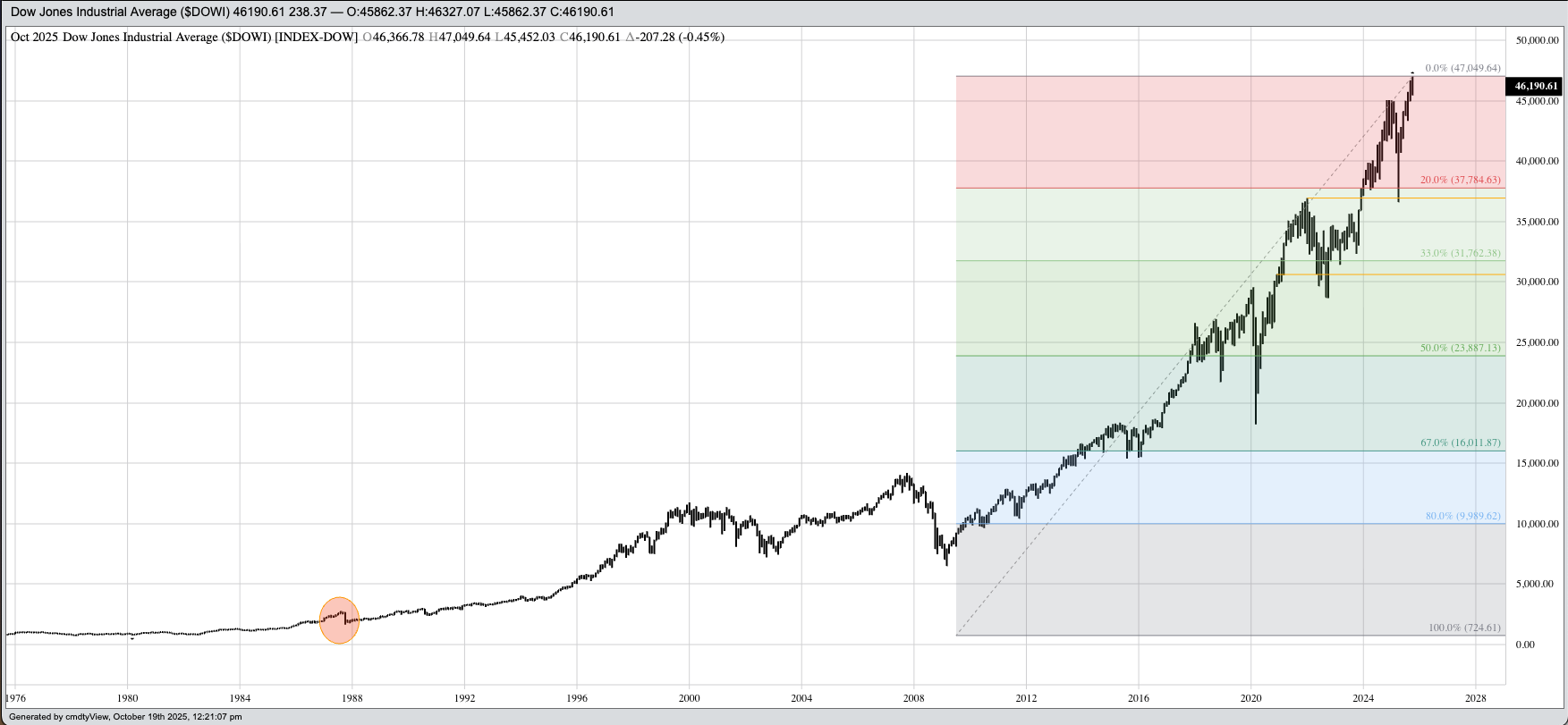

- Shortly after the dust had settled on Black Monday, buyers started to emerge, sowing the seeds for what would become my Market Rule #7: Stock markets go up over time.

I was sitting in my basement office typing away this past Sunday, October 19, 2025. For almost 40 years, I have viewed the day as an anniversary, for it was the events leading up to and culminating with what is known as Black Monday, the historic stock market crash on October 19, 1987, that started my journey in market analysis and commentary. The story is familiar to those who have followed me over the years, so I won’t retell it in its entirety here. (If you are interested, let me know, and I’ll fill in some details.) To summarize the day in a couple sentences, not an easy task I might add:

- The Dow Jones Industrial Average ($DOWI) fell 508 points (22.6%), what is still the largest one-day selloff for the Dow by percent. In fact, you have to add the next two (March 16, 2020 (12.9%) and October 28, 1929 (12.8%)) together to top what happened on Black Monday.

- The selloff initiated a change in trading rules, the new set calling for circuit breakers to halt trading on selloffs.

- US Fed Chairman Alan Greenspan at the time said, “The Federal Reserve, consistent with its responsibilities as the Nation’s centra bank, affirmed today its readings to serve as a source of liquidity to support the economic and financial system.” Imagine that. The Federal Reserve, acting as an independent body, performed its duty to stabilize the economy and monetary system in a time of crisis. Imagine if the Fed was run by – oh, I don’t know – say the Executive Branch.

Since 1987 we’ve seen the continued evolution of global stock markets, putting an even brighter spotlight on lessons learned from Black Monday. Let’s talk about a few of them.

In 1991, financial analyst John J. Murphy wrote his book “Intermarket Technical Analysis: Trading Strategies for the Global Stock, Bond, Commodity, and Currency Markets”. The premise, as you likely know, is that all market sectors are interrelated, generally moving in a cycle that is predictable. Chapter 2 discusses the 1987 stock market crash specifically, and how the other market sectors both foretold then played their normal roles in the cycle, even when one sector (stocks) made an outlier of a move. While markets have continued to evolve over the decades, particularly the takeover (in large part) by algorithms and the arrival of meme stocks, we can still see the business cycle outlined by Mr. Murphy nearly 40 years ago.

The last 10 years or so has seen a move toward autocracy in the United States. While this is alarming on many levels, for the sake of a market discussion I’ll contain my comments to the US president’s desire to have final say in any and all interest rate decisions. Not any president that might hold the job down the road, but the one individual sitting in the Oval Office currently[i]. In other words, the US president wants to neuter the US Federal Reserve along the same line that has already happened to Congress, the Supreme Court, the National Archives and Records Administration, the Office of Management and Budget, etc.. I could go on, but you get the point, I’m sure. As we saw back in 1987, and have seen many times since, the Fed plays an important, a theoretically independent role in managing US monetary policy.

Last, but certainly not least, we’ve learned time and time again the age-old lesson that became my Market Rule #7 (out of 7): Stock markets go up over time. Legendary investor and longtime Berkshire Hathaway CEO and Chairman understood this long before I arrived on the scene, as noted by his well-known quote, “Be fearful when others are greedy and greedy when others are fearful”. Long-term investors will, maybe should, or could, continue to look at global stock markets ($INX) as their best opportunity. If so, then eventually, yes, stock markets should go up over time. That doesn’t mean there won’t be volatile selloffs, for we’ve seen a number of those over the past two decades, some creating a new market term: Flash Crash. Eventually, though, investment money returns and stocks and indexes climb higher. The question becomes from what level, a subject for another day.

[i] Sorry Tony D.