/Computer%20board%20micro%20chip%20green%20by%20blickpixel%20via%20Pixabay.jpg)

As the artificial Intelligence (AI) boom continues to reshape the tech landscape, most investors tend to focus on headline chipmakers like Nvidia (NVDA) and Advanced Micro Devices (AMD). But another player that has been quietly powering the semiconductor revolution is Cadence Design Systems (CDNS). While it doesn’t make chips itself, Cadence provides the software tools that chipmakers rely heavily on to design and verify their next-generation processors.

And in a world where chip innovation is happening at lightning speed, such a behind-the-scenes role has become more crucial than ever. Lately, Cadence has been stepping into the spotlight. After delivering a strong earnings report on July 28, the stock surged to a new 52-week high of $376.45 just a few days later. With demand for its tools rising alongside the explosion of AI-focused chip development, Cadence is proving to be one of the lesser-known, but increasingly vital, players in the semiconductor ecosystem.

About Cadence Stock

California-based Cadence Design Systems is at the forefront of innovation, combining AI and digital twin technology to transform the design of chips and systems. Thanks to its Intelligent System Design strategy, Cadence provides essential tools that help top semiconductor and systems companies create everything from next-gen chips to complex electromechanical systems.

Its technology plays a key role across various industries, including mobile, automotive, aerospace, industrial, life sciences, and even robotics. Valued at roughly $96.5 billion by market capitalization, shares of this semiconductor software designer have gained an impressive 32.6% over the past year, outperforming the broader S&P 500 Index’s ($SPX) 15.5% return during the same stretch. This year, the stock is up 16%, while the broader index has gained 9.8% year-to-date (YTD).

Even with its impressive price performance, Cadence’s valuation could give some investors pause. The stock trades at a lofty 63 times forward earnings, more than double the sector median of 24x.

A Peek Inside Cadence’s Q2 Earnings Report

Cadence posted a stellar set of results for its fiscal second quarter of 2025, released on July 28, beating both revenue and earnings expectations, which sent the stock up nearly 9.7% the next trading day. Despite facing headwinds such as temporary export restrictions with China, the company generated $1.3 billion in revenue, representing a 20% year-over-year (YOY) increase, which was slightly ahead of Wall Street's estimates.

Management credited the impressive top-line growth to the continued expansion of its AI-driven portfolio and the strength of its long-term customer relationships. Earnings didn’t disappoint either. Adjusted EPS rose 29% annually to $1.65, comfortably beating forecasts of $1.57. Growth was broad-based, with the core EDA segment, which includes digital, custom/analog, and verification tools, posting 16% annual revenue growth, thanks to continued AI adoption.

Its IP business also shined with more than 25% revenue growth, driven by strong product traction and an expanding portfolio of silicon solutions. However, the System Design & Analysis division saw the biggest lift, jumping 35% YOY, thanks to the growing demand for Cadence’s multi-physics analysis tools and AI-optimized workflows that are delivering faster, smarter results.

The company also ended the quarter with a $6.4 billion backlog, underscoring strong visibility and customer demand. One of the key highlights during the quarter was the launch of the Millennium M2000 AI Supercomputer, featuring Nvidia’s cutting-edge Blackwell GPUs. Designed to accelerate simulation workloads at scale, the new platform is poised to drive faster innovation across various fields, including engineering and scientific research.

Looking ahead to fiscal 2025, Cadence is projecting revenue between $5.21 billion and $5.27 billion, with a non-GAAP operating margin of 43.5% to 44.5%. The company also expects non-GAAP earnings per share to land between $6.85 and $6.95, signaling continued confidence in its growth trajectory.

What Do Analysts Think About Cadence Stock?

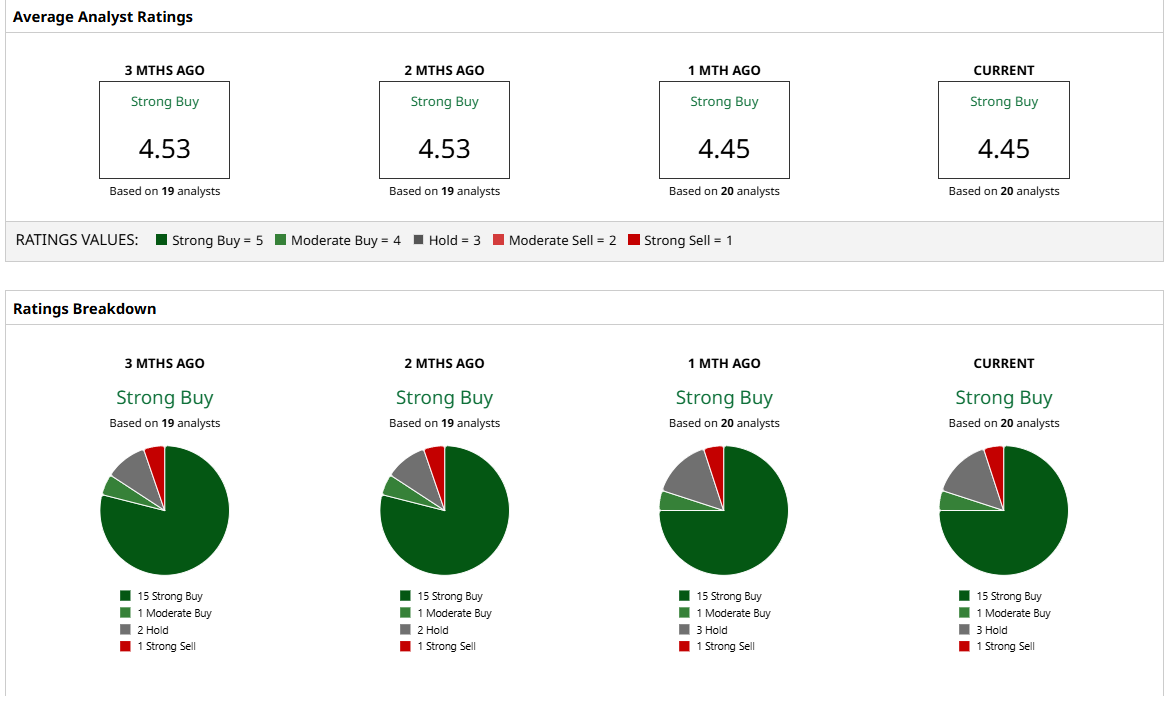

Overall, Wall Street is leaning bullish on CDNS, with the stock earning a consensus “Strong Buy” rating, reflecting growing confidence in its continued growth and industry leadership. Of the 20 analysts covering CDNS, 15 are backing it with a “Strong Buy,” one rates it a “Moderate Buy,” another three suggest “Hold,” and only one stands out with a “Strong Sell.”

Its average analyst price target of $374.47 represents 7% upside potential, while the Street-high price target of $410 suggests the stock can rally as much as 17% from its current market price.