/Seagate%20Technology%20Holdings%20Plc%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

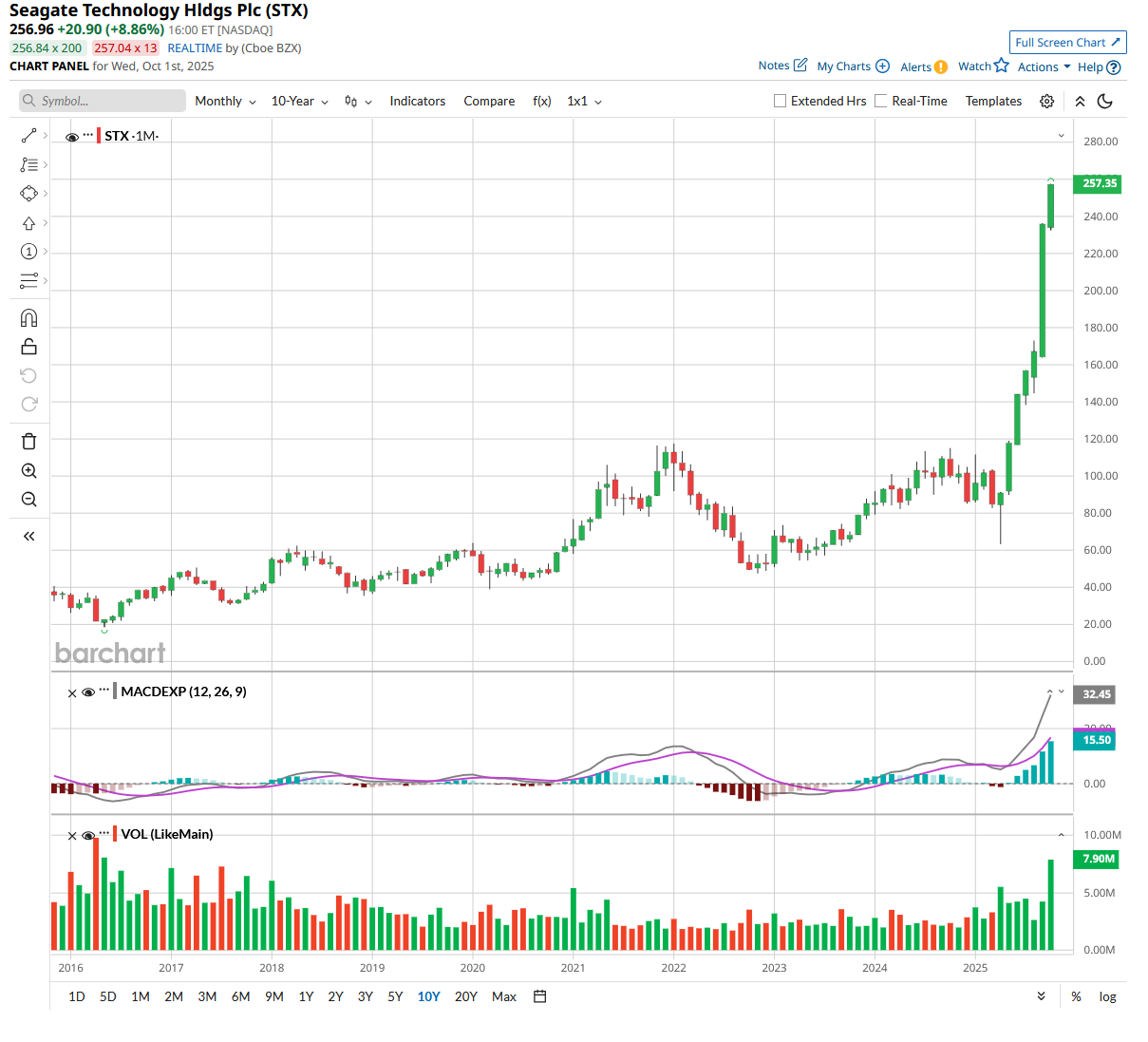

Palantir (PLTR) has dominated headlines with its 143% surge in 2025, but another S&P 500 ($SPX) stock has quietly claimed the title of top performer. Seagate Technology (STX) has rallied an astounding 196% year-to-date (YTD), outpacing even the AI software giant, which is tied to explosive demand for data storage driven by the buildout of artificial intelligence (AI) infrastructure.

The hard disk drive manufacturer is riding a powerful wave that few investors saw coming. As tech giants invest hundreds of billions in AI data centers, they require massive data storage capacity to train large language models (LLMs).

Seagate specializes in nearline storage, which costs far less than faster alternatives while still meeting the needs of AI workloads that don't require instant data access. The company shipped 137 exabytes of storage capacity to data centers last quarter, up 52% year-over-year (YoY).

In fiscal 2025 (ended in June), Seagate increased sales by 39% YoY to $9.1 billion, while gross margins expanded from 23% to 35% as supply constraints translated to pricing power. Moreover, adjusted earnings grew by 527% YoY to $8.10 per share. Management projects the data center storage market will nearly double from $13 billion in 2024 to $23 billion by 2028, with build-to-order pipelines already booked through mid-2026.

Is Seagate Stock Still a Good Buy?

Seagate's technological edge comes from its heat-assisted magnetic recording technology, branded as Mozaic. These drives pack data into smaller spaces while using less energy, translating to lower costs per terabyte for cloud providers.

Three major cloud services have already qualified the Mozaic 3 platform, with the higher-capacity Mozaic 4 entering volume production in early 2026. By the second half of next year, Seagate expects these advanced drives to outsell traditional models.

Morgan Stanley recently hiked its STX stock price target to $265 from $168, citing an elongated demand cycle that could push gross margins above 45% by early 2027. Multiple analysts have followed suit with upgraded targets based on channel checks showing sustained pricing strength.

STX stock trades at a forward earnings multiple of 22.3x, which is relatively cheap given its growth estimates. However, hard drives are commodities, and the storage industry has historically wrestled with cyclical demand.

Seagate competes primarily with Western Digital (WDC) for market share, and intense competition typically keeps margins compressed once supply catches up with demand. Additionally, a global minimum tax in the mid-teens is scheduled to take effect in fiscal 2026, which will impact the bottom line.

Customer concentration among a handful of hyperscale cloud providers also creates dependency risk. And while AI infrastructure spending appears durable for several years, any economic slowdown or pause in AI adoption could trigger sharp reversals.

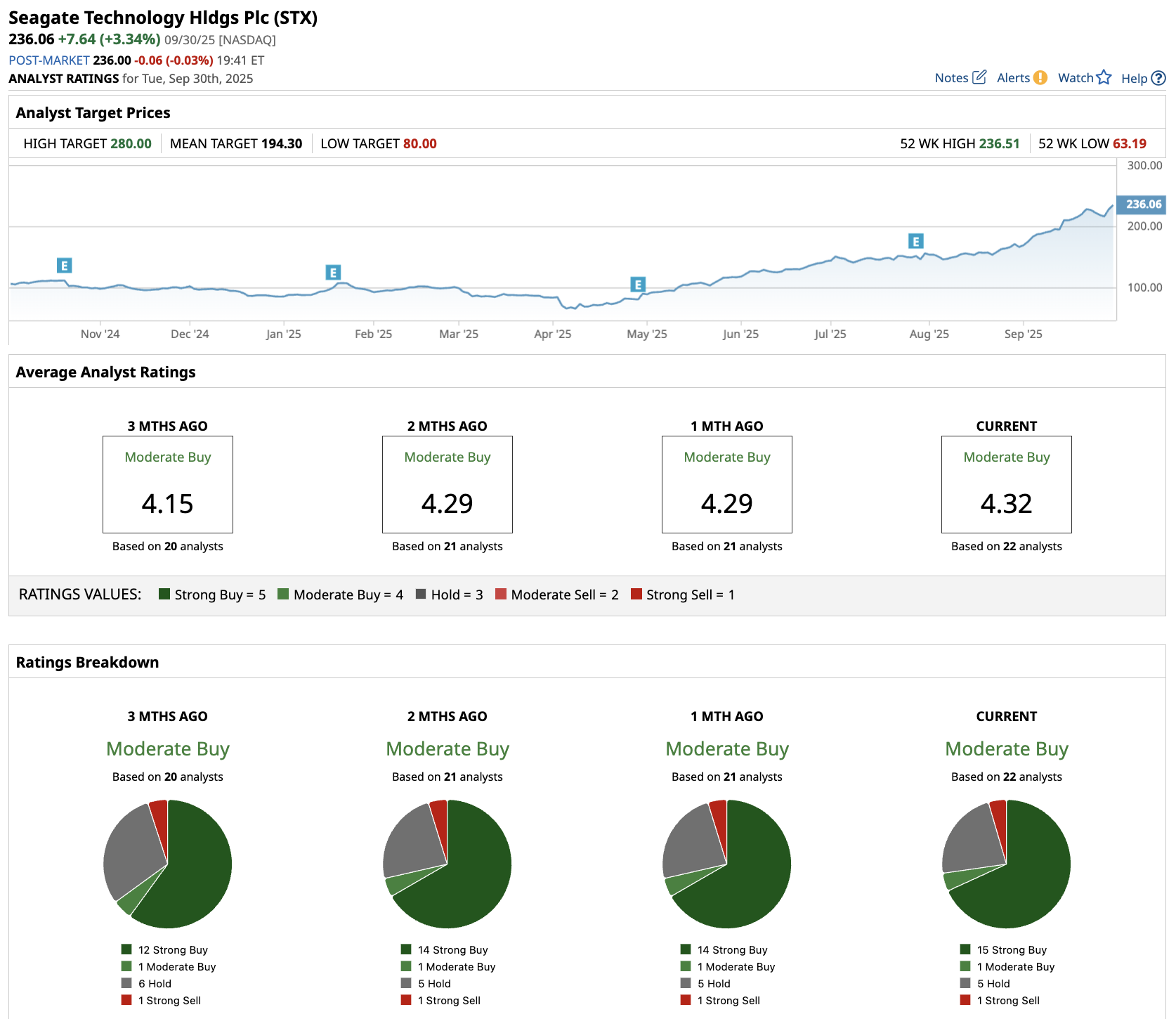

What Is the STX Stock Price Target?

Seagate's operational execution has been impressive, as it generated $425 million in free cash flow last quarter while keeping capital expenditures at a modest 3% of revenue. Management returned 75% of fiscal 2025 free cash flow to shareholders through dividends and plans to resume buybacks this quarter.

Analysts tracking STX stock forecast revenue to increase from $9.1 billion in fiscal 2025 to $12.3 billion in fiscal 2028. In this period, adjusted earnings are forecast to expand from $8.10 per share to $14.70 per share.

If STX stock is priced at 20 times forward earnings, it should trade around $300 in late 2027, indicating an upside potential of 27% from current levels. Out of the 22 analysts covering Seagate, 16 recommend “Strong Buy,” one recommends “Moderate Buy,” five recommend “Hold,” and one recommends “Strong Sell.”

For investors seeking exposure to AI beyond the usual suspects, Seagate offers an interesting alternative at a reasonable valuation. However, it's essential to understand that you're buying into a cyclical business that is currently at peak demand, rather than a secular growth story like Palantir.