/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

SoFi (SOFI) has seen significant growth in value, rising by more than 230% over the past year. This surge reflects SoFi’s ability to consistently expand its member and product base, a strategic pivot toward capital-light revenue streams, its commitment to lower funding costs, and strong risk management.

That surge, however, has pushed SoFi’s 14-day Relative Strength Index to 75.73 on the weekly chart, a technical level that suggests the stock is now overbought. For investors, that raises the possibility of a short-term pullback as the market digests recent gains.

Nevertheless, the long-term prospects for SoFi stock appear promising. Its diversified revenue sources and strength across its financial services, lending, and technology platforms provide a significant runway for long-term growth.

SoFi’s Diversified Revenue Model Is Firing on All Cylinders

SoFi’s recent quarterly performances reflect the strength of its diversified revenue model. Its top-line growth rate has accelerated, while its member base and product base have expanded significantly.

For instance, SoFi’s second-quarter results highlighted acceleration in revenue growth rate to 44%, marking its fastest pace in more than two years. At the same time, SoFi’s earnings surged significantly. The momentum in SoFi’s business is driven by new member additions and deeper engagement from existing customers. During the quarter, SoFi added 850,000 new members, bringing its total to 11.7 million, a 34% increase from last year. At the same time, members adopted a record 1.3 million new products, pushing total products to more than 17 million. Roughly 35% of those were cross-sold to existing members, reflecting the strength of its platform and its strategy to expand wallet share across its growing customer base.

Another key catalyst is SoFi’s innovation in its Financial Services offerings and its fast-rising Loan Platform Business (LPB). The LPB leverages SoFi’s infrastructure to originate customized loan portfolios for third parties. By moving these loans off its balance sheet within days, SoFi avoids additional capital requirements and credit risk, while earning fees for each transaction. In just over a year, the business has scaled to an annualized pace of $9.5 billion in originations and more than $500 million in high-margin fee revenue. Management believes LPB could reach $1 billion in annual revenue, with even greater potential if SoFi succeeds in tokenizing loans to make them broadly tradable in smaller increments, potentially opening up lending as an asset class to everyday investors.

SoFi’s Tech Platform is another growth driver as it enables rapid product development, cost efficiencies, and new partnership opportunities. Beyond financial services, its tech platform is also gaining traction with new clients, which augurs well for growth.

Meanwhile, SoFi’s Lending segment continues to expand, particularly in personal loans, where it is gaining share. Furthermore, growth opportunities across its loan types remain solid, and SoFi is enhancing its product offering to capitalize on them.

SoFi is also focusing on crypto and blockchain, which will likely support long-term growth. The company is investing in talent and technology to provide faster, more affordable, and more secure financial solutions. Its potential initiatives include stablecoins, crypto-backed borrowing, expanded payments, staking features, and blockchain infrastructure services. Management views digital assets as a transformational opportunity for both SoFi and its members.

Financially, the fintech is on solid footing. In the quarter, SoFi’s total assets rose $3.4 billion, including $3.1 billion in loan growth. Cash and equivalents stood at $2.7 billion, while deposits expanded $2.3 billion to $29.5 billion. Lower funding costs from deposit growth continue to support margins.

SoFi’s Hot Streak: Pullback Ahead or Just the Beginning?

SoFi’s 230% surge over the past year reflects its transformation into a diversified fintech powerhouse, with strong momentum across financial services, lending, and technology businesses. Its ability to grow members, expand product adoption, and innovate with capital-light revenue streams, such as the Loan Platform Business, points to durable long-term potential.

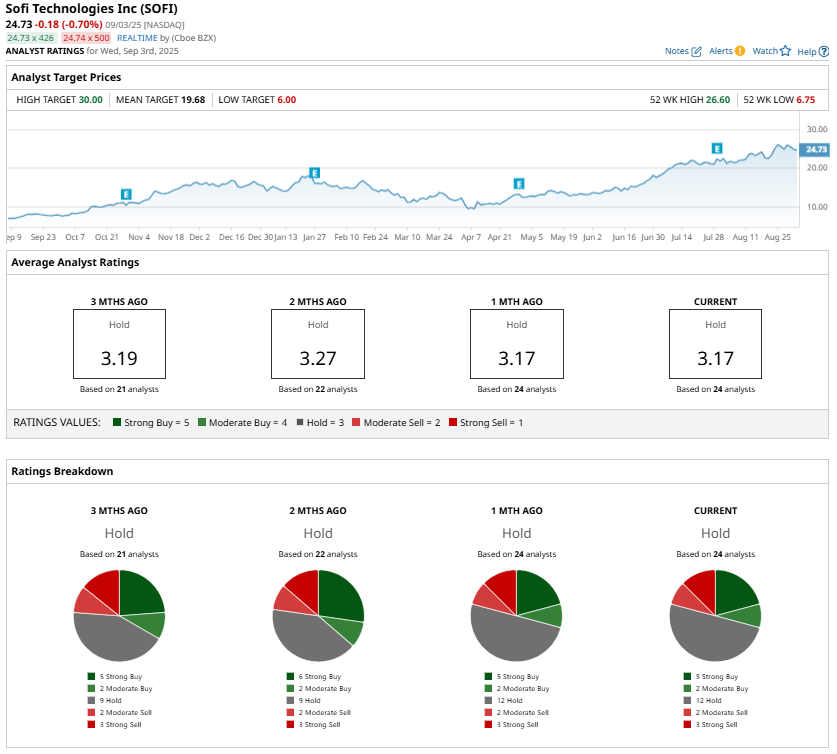

That said, the stock’s recent run and the current technical readings suggest it may be running a little too hot in the near term. Further, analysts maintain a “Hold” consensus rating.

Thus, for investors with a short-term lens, taking some profits or waiting for a potential pullback may prove prudent. Still, for those with a long-term horizon, SoFi remains a compelling growth stock in the fintech space.