/Hewlett%20Packard%20Enterprise%20Co%20San%20Jose%20campus-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Enterprise hardware stocks have been staging a comeback this year, thanks largely to the surge in artificial intelligence (AI) spending. Companies tied to servers, networking, and storage have seen renewed investor interest as hyperscale data centers and enterprises boost infrastructure investments to keep pace with AI workloads.

One stock standing out ahead of its next catalyst is Hewlett Packard Enterprise (HPE). The company has been in the spotlight since completing its $14 billion Juniper Networks deal, which gives it deeper exposure to AI-driven networking. Now, all eyes turn to Sept. 3, when HPE reports quarterly results. Analysts say the update could be a key catalyst for the stock as investors look for signs that networking momentum and AI-related demand are fueling growth.

About HPE Stock

Based in Texas, Hewlett Packard Enterprise is a global technology leader that provides solutions enabling businesses to capture, analyze, and act upon data seamlessly from edge to cloud. It also provides networking and storage solutions, as well as the HPE GreenLake cloud services for hybrid cloud management. The company boasts a market cap of $29.6 billion.

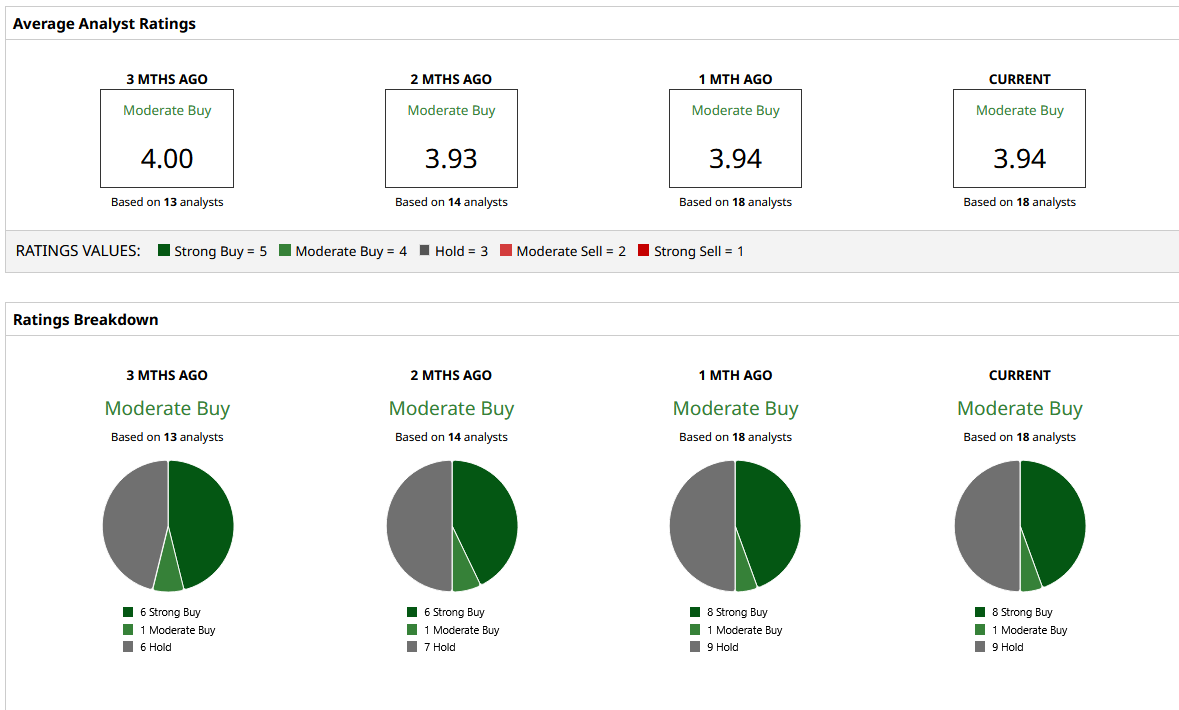

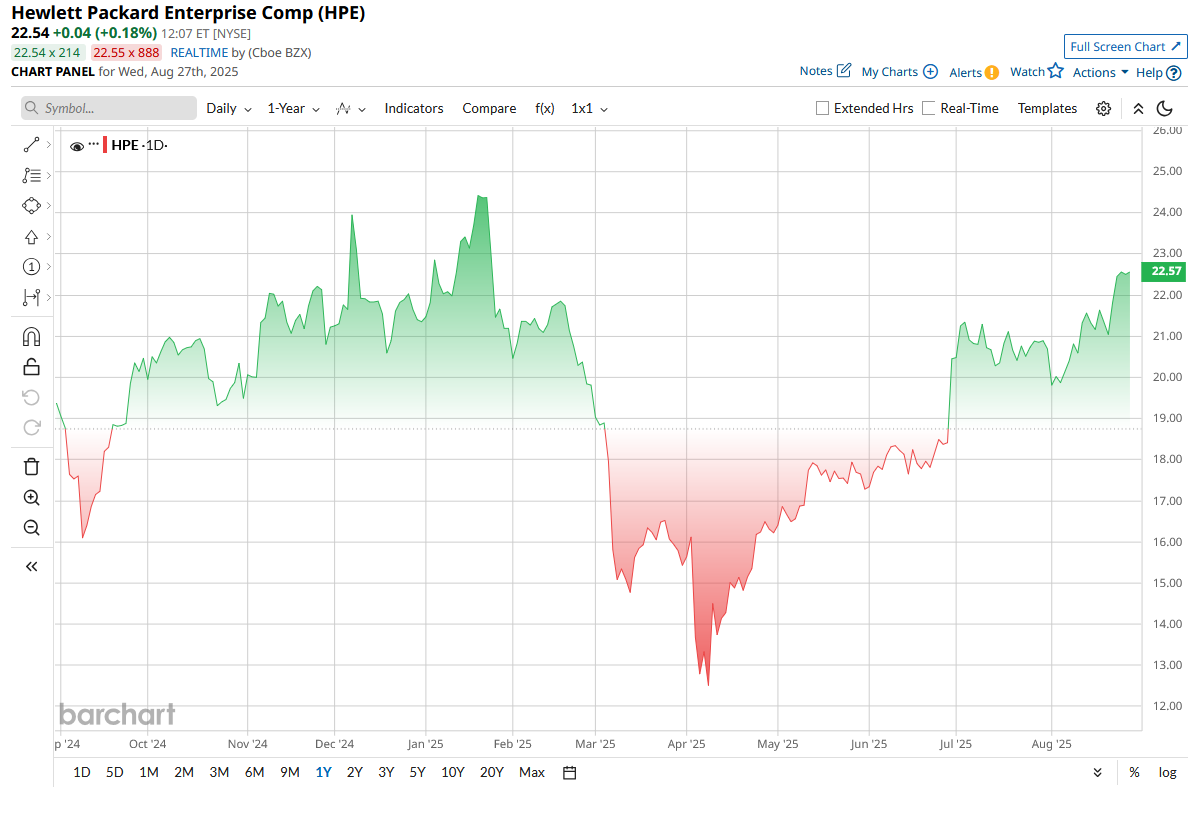

After plunging to a yearly low in April 2025, HPE stock rebounded sharply, gaining over 80% from there, bringing it to 6% up year-to-date (YTD). Recent regulatory approval and a rapid close of a major asset deal sparked investor buying.

Valuation-wise, HPE is attractively valued with a price-to-earnings (P/E) of 11, significantly cheaper than the sector median of 23, suggesting the stock is undervalued compared to its peers. Additionally, its price-to-sales (P/S) ratio of 0.81 is far below the sector median of 3.09, reinforcing its attractive pricing.

Mark Your Calendar For September 3

Previously, Hewlett Packard Enterprise delivered a solid performance, topping expectations on both revenue and earnings. The company reported EPS of $0.29, ahead of the $0.28 consensus, on revenue of $7.63 billion, representing 5.9% year-over-year (YoY) growth. The Q2 beat was fueled by strong momentum in subscription-based services and emerging AI demand. Management highlighted that GreenLake’s annualized revenue run rate surged 47% YoY to $2.2 billion, underscoring the success of its hybrid-cloud model.

However, HPE’s outlook remains cautiously optimistic. For fiscal 2025, management projects 7% to 9% revenue growth in constant currency. For Q3 specifically, the company has guided an EPS of $0.40 to $0.45 and a full-year EPS of $1.78 to $1.90. A beat on revenue, particularly from AI and server demand, or signs of improved margins, management aims to lift server margins toward 10% by Q4, which could give the stock.

HPE will release its fiscal Q3 2025 results on Sept. 3, and investors see the event as a potential catalyst. Analysts are forecasting earnings of about $0.36 per share, down from $0.45 a year earlier, reflecting ongoing macroeconomic pressures. Still, the focus is less on the near-term earnings decline and more on how HPE is executing in its core markets, enterprise servers, storage, networking, and whether its AI-driven initiatives can narrow the gap with rivals like Super Micro Computer (SMCI).

Strategic Developments and AI Focus

On the strategic front, HPE cleared a major hurdle in late June when the U.S. Justice Department settled its antitrust suit over HPE’s $14 billion Juniper Networks acquisition. The deal will close after HPE divests its Instant On wireless business and licenses Juniper’s Mist AI code to competitors.

Meanwhile, HPE continues to strengthen its AI infrastructure offerings through partnerships. It is adding Nvidia (NVDA) Blackwell GPUs in new ProLiant servers and building on alliances with companies like Graphcore for AI accelerators. These developments complement HPE’s core hybrid-cloud and Edge strategy. The Q3 report may include updates on these initiatives and could show how ramped up HPE’s AI-related sales and cost programs are.

What Do Analysts Say About HPE Stock?

Wall Street’s tone on HPE stock has turned more favorable. Morgan Stanley recently upgraded the stock to “Overweight,” raising its price target to $28 from $22 on expectations of an AI-driven rebound in enterprise spending. The firm projects EPS growth of 18% by FY26 and sees earnings potentially reaching $2.70 to $3.00 by FY27.

Other firms have also lifted their targets. J.P. Morgan initiated coverage with an “Overweight” rating and a $30 target, while Bank of America raised its target into the mid-$20s.

Overall, HPE carries a “Moderate Buy” consensus rating from 18 Wall Street analysts. The stock is currently trading near its mean price target of $23, but the Street-high target of $30 still implies an upside potential of about 36%.