Buyouts and take-private deals often spark big moves in the stock market, especially for smaller tech companies where insiders see untapped potential. When major shareholders or private investors start showing interest, it usually means something is brewing, and traders take notice.

That’s what’s happening with Grindr (GRND). According to a report from Semafor, the company’s main owners, Raymond Zage and James Lu, are considering taking Grindr private. They’re said to be working with Fortress Investment Group to arrange financing for the deal. The possible buyout price is around $15 a share, while analysts see the stock climbing as high as $22, about 70% higher than where it trades today.

With strong insider interest and big upside potential, Grindr could be a stock to watch closely in the weeks ahead.

About GRND Stock

Founded in 2009, Grindr is a global social networking app serving the LGBTQ+ community. It connects users for dating, relationships, and community interaction. With over 14 million monthly users in 190 countries, Grindr earns revenue from ads and premium subscriptions, focusing on safety, inclusivity, and expanding into lifestyle and wellness features.

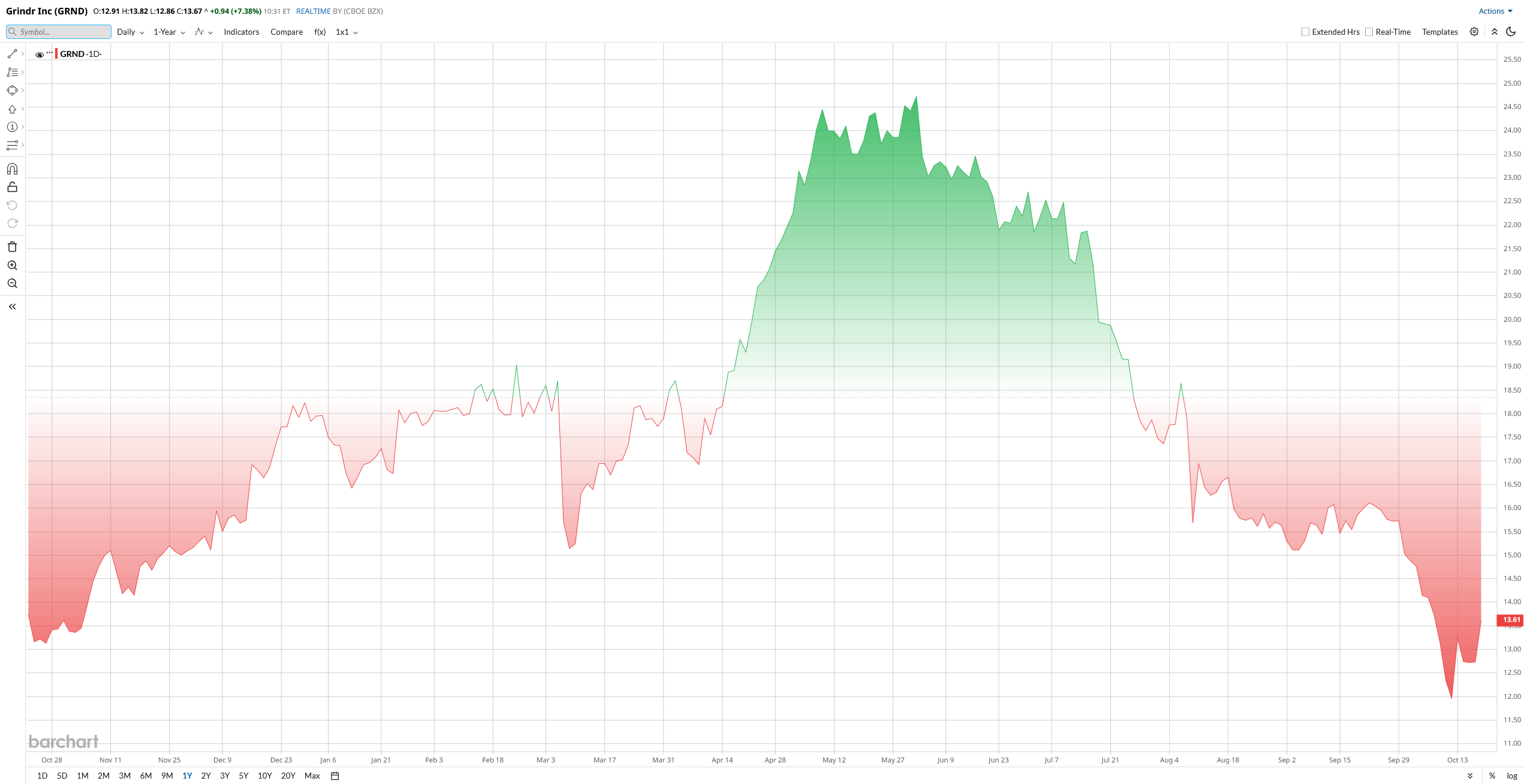

GRND stock has had a rocky ride in 2025, falling about 23% year-to-date (YTD). Shares briefly hit $24.73 in June, their highest level since the 2022 IPO, before sliding roughly 12%. The decline followed mixed Q2 results, and a short-seller report alleging inflated user counts added pressure, though Grindr denied the claims. Recent buyout rumors have revived investor interest.

GRND’s valuation is notably high, with a price-to-sales (P/S) ratio of 7, significantly above the sector median of 2, indicating the stock is expensive. Additionally, its price-to-earnings (P/E) ratio of 32 is 68% higher than the sector median, further reflecting an overpriced condition.

Why Grindr’s Story Could Get More Interesting

Beyond the buyout rumors, Grindr has a few things working in its favor. The insider-led take-private deal at around $15 a share could deliver a quick premium if it happens, and even the speculation has already lifted the stock. On the product side, Grindr is rolling out new AI-driven tools like chat summaries and smarter “discover” recommendations to keep users engaged.

The company is also expanding into travel and telehealth with its new Woodwork platform for ED treatments. International growth is another focus, especially in Asia and Latin America, where LGBTQ+ communities are growing fast. Plus, Grindr has been buying back stock, more than $300 million so far this year, which helps boost ownership value. Any positive update on these fronts could send the stock sharply higher.

Financial Overview

Grindr’s latest quarter (Q2) showed that business is still growing fast, even if the numbers weren’t perfect. Revenue jumped 27% year-over-year (YoY) to $104.2 million, mostly driven by strong in-app purchases that brought in $87 million.

Profitability stayed solid too, with $45.2 million in adjusted EBITDA, about a 43% margin, and net income of around $16.6 million. Still, earnings came in just shy of expectations at $0.10 per share versus the $0.11 analysts were looking for, which caused a small dip in the stock.

On the bright side, Grindr’s finances look healthy. The company generated $37 million in free cash flow and ended the quarter with about $121 million in cash. Debt remains manageable, sitting at roughly 1.7 times EBITDA after a refinancing last year.

Management also kept its full-year targets intact, aiming for at least 26% revenue growth and a 43% margin. Plus, the team has been busy buying back shares, with $325 million repurchased so far and $175 million still authorized.

Overall, Grindr remains profitable, cash-rich, and focused on growth, even if investor confidence has wavered a bit lately.

What Do Analysts Say About GRND Stock

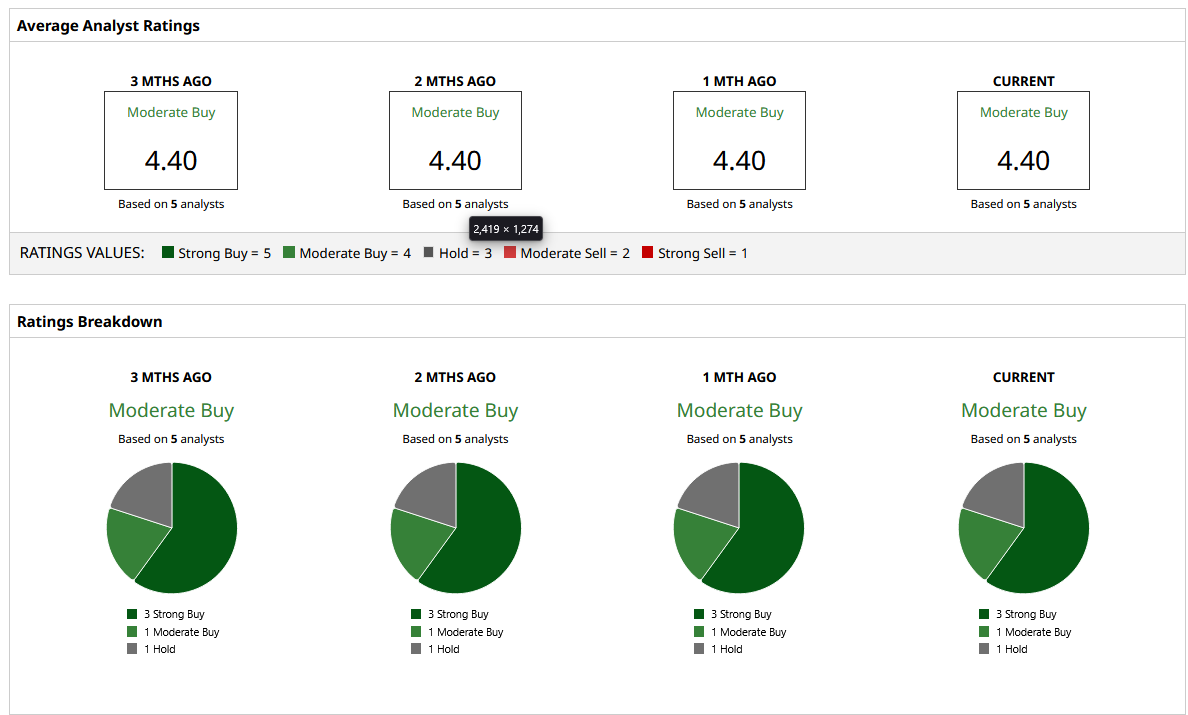

Wall Street hasn’t lost faith in Grindr, even with the recent volatility. Out of five analysts covering the stock, three rate it a “Strong Buy,” one a “Moderate Buy,” and one a "Hold," giving GRND a “Moderate Buy” consensus. The average 12-month price target sits around $22.75, roughly 65% higher than current levels.

MP Securities remains upbeat with a $23 target and an "Outperform" rating, while Raymond James trimmed its target to $20 but kept the same bullish stance. Analysts point to Grindr’s strong margins, solid revenue growth, and expansion potential in international markets and premium subscriptions. Overall, most on Wall Street still expect the stock to climb well above where it trades today.