Ardelyx (ARDX) is emerging as a compelling, yet risky, small-cap biotech opportunity. The company has made significant progress with two first-in-class therapies: IBSRELA (tenapanor) for irritable bowel syndrome with constipation (IBS-C) and XPHOZAH (tenapanor) for hyperphosphatemia in chronic kidney disease (CKD) patients on dialysis.

Valued at $1.07 billion, Ardelyx stock has returned 542% over the last three years. With revenue growing and commercial execution improving, Ardelyx is positioning itself for potentially explosive growth.

Ardelyx Posts Strong Start to 2025

Ardelyx kicked off 2025 with a staggering 61% year-over-year revenue increase to $74.1 million, fueled by rising demand for its flagship therapies, IBSRELA and XPHOZAH. The company’s Q1 performance boosted investor confidence in Ardelyx's momentum and long-term market potential.

IBSRELA has entered its third full year following FDA approval. With net product sales for the quarter reaching $44.4 million, up 57% year over year, the drug further solidified its position as a differentiated therapy in the IBS-C market. Ardelyx recorded some of its highest prescription volumes to date, with significant increases in both new and refill prescriptions. The company’s commercial strategy, which focuses on raising awareness, reshaping HCP perceptions of the treatment hierarchy, and increasing prescription pull-through, is working in its favor.

Ardelyx reaffirmed IBSRELA’s 2025 U.S. net product sales guidance of $240 million to $250 million. The company believes that increasing market share, high unmet needs, and prescriber confidence will propel IBSRELA to more than $1 billion in peak annual sales. XPHOZAH also generated net product sales of $23.4 million, up 55% year over year. Management stated that after adjusting for a one-time $3.8 million returns reserve release, revenue growth was a healthy 30% year over year.

In the first quarter, the CKD dialysis market was significantly disrupted by the loss of Medicare Part D coverage for phosphate-lowering therapies. Management highlighted that despite this headwind, the company effectively managed the situation, ensuring patients across both Medicare and non-Medicare channels maintained access to the drug.

Ardelyx believes the drug has long-term potential, estimating peak sales of more than $750 million. Furthermore, following the approval of tenapanor in China for hyperphosphatemia, the company received a $5 million milestone payment from Chinese partner Fosun Pharma. Despite exceptional revenue growth, the company’s bottom line remains in the red. R&D spending increased to $14.9 million, indicating continued pipeline activity. Thus, it reported a net loss of $41.1 million, or $0.17 per share. While these losses are to be expected for a growing biotech company in its scaling phase, profitability is an important metric for maintaining a competitive position in the biotech industry. Sustained revenue growth, particularly for XPHOZAH, will be critical to reducing losses over time. Ardelyx ended the first quarter with $214 million in cash and short-term investments, giving it a healthy cushion to carry out its commercial and pipeline strategy.

Analysts covering Ardelyx expect revenue to increase by 9.2% in 2025, before climbing by 32.8% in 2026. Analysts also expect the company to report a profit of $0.05 per share by 2026.

What Does Wall Street Say About ARDX Stock?

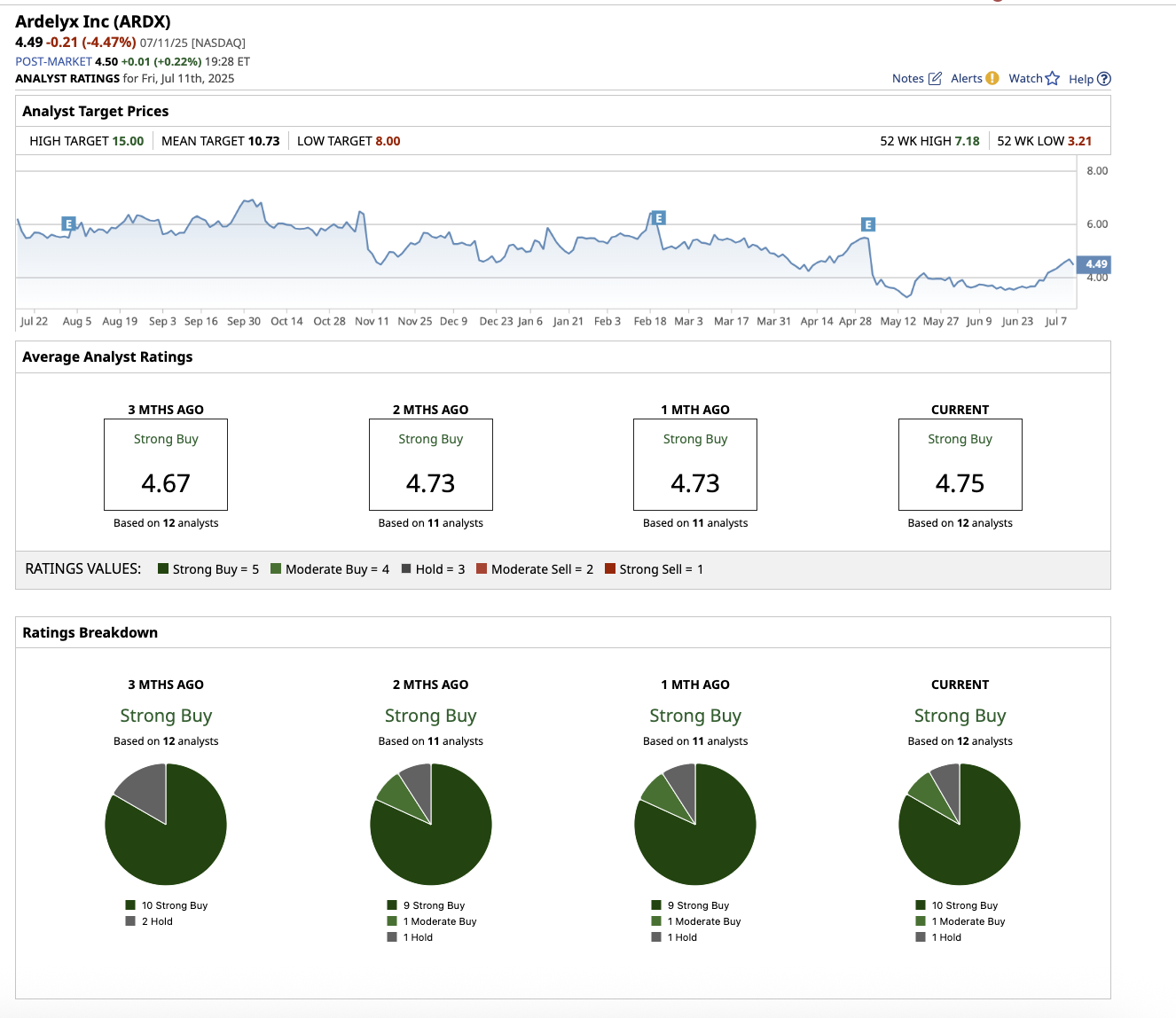

Overall, Wall Street analysts rate Ardelyx stock a “Strong Buy.” Of the 12 analysts covering ARDX, 10 rated it a “Strong Buy,” one says it is a “Moderate Buy,” and one rates it a “Hold.” The average target price of $10.73 indicates that the stock has 139% upside potential. Furthermore, with a high target price of $15, the stock has the potential to rise by 234% from current levels.

The Bottom Line

While the company is not yet profitable, its strong double-digit revenue growth and expanding market share in high unmet-need categories indicate that it is hitting its stride. Furthermore, Ardelyx’s billion-dollar peak sales potential for both IBSRELA and XPHOZAH suggests that the company is transitioning from a clinical-stage biotech to a commercial force in gastrointestinal and renal therapeutics. If it continues to grow its dual-product portfolio, a 10x return is possible within the next five years. However, it is better suited for long-term investors with a high risk tolerance.