/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

Quantum technology is breaking out of the lab and reaching for orbit. What was once theory is now turning into real-world strategy, as governments and companies push to make space the next proving ground. With cybersecurity threats mounting and the race for global leadership intensifying, quantum is quickly becoming mission-critical. From protecting satellites to reimagining navigation and communications, the possibilities are rewriting the rules of space innovation.

That’s where IonQ (IONQ) steps in. A trailblazer in quantum computing, the company is using cutting-edge systems to tackle problems traditional supercomputers can’t touch. IonQ is widely recognized as the leading commercial player in quantum computing and networking, making bold moves to secure its future.

This week, IonQ grabbed headlines with a memorandum of understanding with the U.S. Department of Energy. The mission is to demonstrate “quantum-secure communications” from orbit, while also testing networking, timing, and sensing applications in space. It is a significant step as the U.S. ramps up investment in quantum infrastructure.

IonQ isn’t new to this game. It has strengthened its position through acquisitions of Qubitekk for networking and Capella for space tech, making it the only U.S. firm delivering commercial quantum networking systems, including projects with the Air Force Research Laboratory.

IONQ stock has been rising after the quantum space deal, but is this the right launchpad for investors?

About IonQ Stock

Founded in 2015, IonQ is spearheading the quantum revolution, leveraging its "trapped ion" technology to redefine computational power. Valued at $22 billion by market capitalization, the Maryland-based firm provides quantum access via AWS, Azure, and Google Cloud.

Unlike classical machines, IonQ’s qubits unlock exponential processing capabilities. As it pioneers compact, energy-efficient QPUs, IonQ is forging alliances with tech giants and governments, solidifying its ascent as a quantum vanguard poised to disrupt the computing landscape.

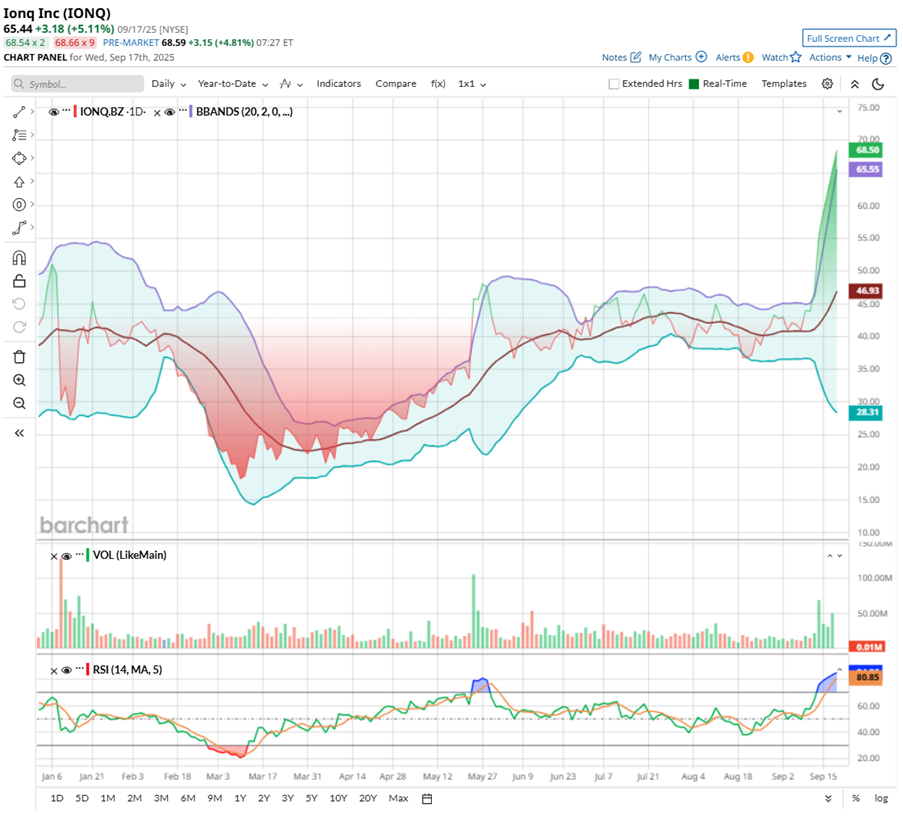

IonQ has been riding a quantum rollercoaster, soaring an eye-popping 800% over the past 52 weeks and a stellar 183% in just six months. The early stretch of 2025 wasn’t exactly smooth, but the rebound has been nothing short of dramatic. Shares are now up 77% in 2025, touching a fresh all-time high of $76.13 on Sept. 23.

The rally hasn’t just been about momentum — it has been fueled by headlines. On Sept 12. IonQ shares rose 18% after the U.K.’s Investment Security Unit (ISU) cleared its $1 billion acquisition of Oxford Ionics, a move that strengthens its global quantum footprint. Then with the news of a space-focused MoU with the U.S. DOE, shares surged even higher. IONQ also touched record highs after sealing a deal to acquire Vector Atomic, a quantum sensor firm with $200 million in government security contracts.

But the chart is starting to raise eyebrows. IONQ stock now trades well above its upper Bollinger Band, flashing signs of being stretched far beyond recent trends. Adding to that, the 14-day RSI has spiked to 85 — its most overbought level of this year. Momentum is clearly on IonQ’s side, but history shows these kinds of extreme technical readings often come before a breather or pullback.

IonQ’s valuation is in orbit, trading at 495 times forward sales. That’s not just pricey but a moonshot bet. The multiple reflects faith in quantum’s power to upend computing, but also the risk of burning out if reality lags the hype. For investors, it is less about today’s math and more about tomorrow’s revolution.

IonQ’s Revenue Climbs But Losses Deepen

IonQ’s fiscal second-quarter 2025 report felt like a classic case of running fast but burning fuel even faster. Reported on Aug. 6, revenue shot up to $20.7 million, an 82% leap year-over-year (YOY) — comfortably above Wall Street’s expectations and sitting at the high end of Q2 revenue guidance. The figure was proof that demand for quantum computing is building.

But the cost of chasing the future showed up hard on the bottom line. Loss per share widened to $0.70, compared with an $0.18 per-share loss a year ago and coming in worse than what analysts had expected. This is because operating expenses ballooned. R&D spend alone more than tripled, driving net losses to $177.5 million. Growth definitely requires firepower, and IonQ is spending heavily to stay ahead.

Still, the balance sheet offered a breathing room. IonQ exited Q2 holding $656.8 million in cash and investments. Add in the $1 billion equity raise completed in July, and the war chest swelled to $1.6 billion — plenty to fund its ambitions.

Management used that confidence to raise full-year revenue guidance to between $82 million and $100 million. The company also set Q3 revenue expectations at $25 million to $29 million.

Analysts, however, see a bumpy road ahead. Losses are anticipated to narrow by 38% YOY in fiscal 2025 to $0.97 per share, before widening again by 29% annually in 2026 to a loss of $1.25 per share. IonQ is sprinting toward the future of quantum, but the path remains costly and uncertain.

What Do Analysts Expect for IonQ Stock?

Analysts at Benchmark are turning more bullish on IONQ stock, raising their price target to $75 from $55 while keeping a “Buy” rating. The upgrade came after IonQ’s Analyst Day, where management laid out a confident roadmap toward hitting 2 million physical qubits by 2030. Benchmark praised IonQ’s Oxford Ionics acquisition for boosting its ion trap platform and noted the company's s strong balance sheet and appetite for deals, fueling its push toward quantum ecosystem leadership.

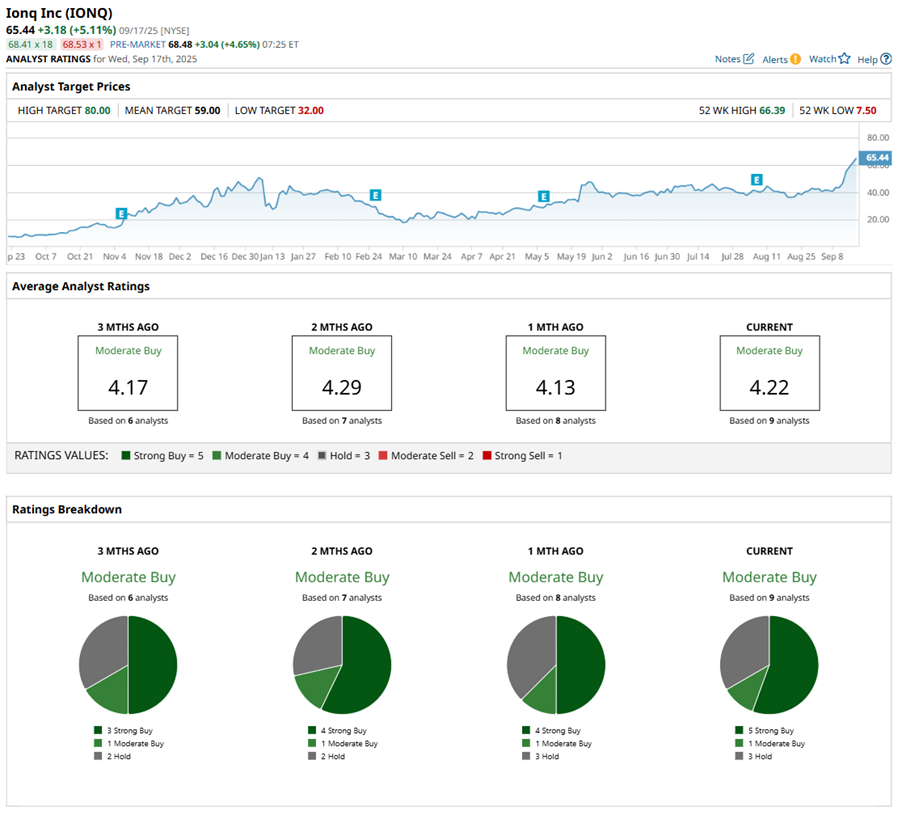

IONQ stock has a consensus “Moderate Buy” rating overall. Out of nine analysts covering the quantum computing stock, five advise a “Strong Buy,” one recommends a “Moderate Buy,” and three analysts sit on the sidelines with a “Hold” rating.

After IONQ stock’s sharp rally, shares now trade above the $64.62 average price target, hinting that momentum may have outrun consensus. However, the Street-high price target of $100 suggests 35% potential upside ahead.

Final Thoughts on IonQ

IonQ’s run has been nothing short of explosive — the stock is up 13% in just five days, driven by space ambitions, strategic acquisitions, and a strong cash position. Its bold targets are exciting, and government partnerships add credibility. But here is the catch — execution risk is high, and competition in quantum computing is only getting tougher. Valuations are already rich, so while the upside is big, the path forward won’t be smooth.