Biotech investors tend to focus on small-cap companies in search of the next big breakthrough. Still, one established player is quietly strengthening its pipeline in ways that the market has yet to fully recognize.

Gilead Sciences (GILD), valued at $147 billion, is known for its leadership in antiviral therapies, particularly its HIV franchise. However, the company is now focused on oncology innovation and next-generation cell therapy, which have long-term growth potential that the market may be overlooking.

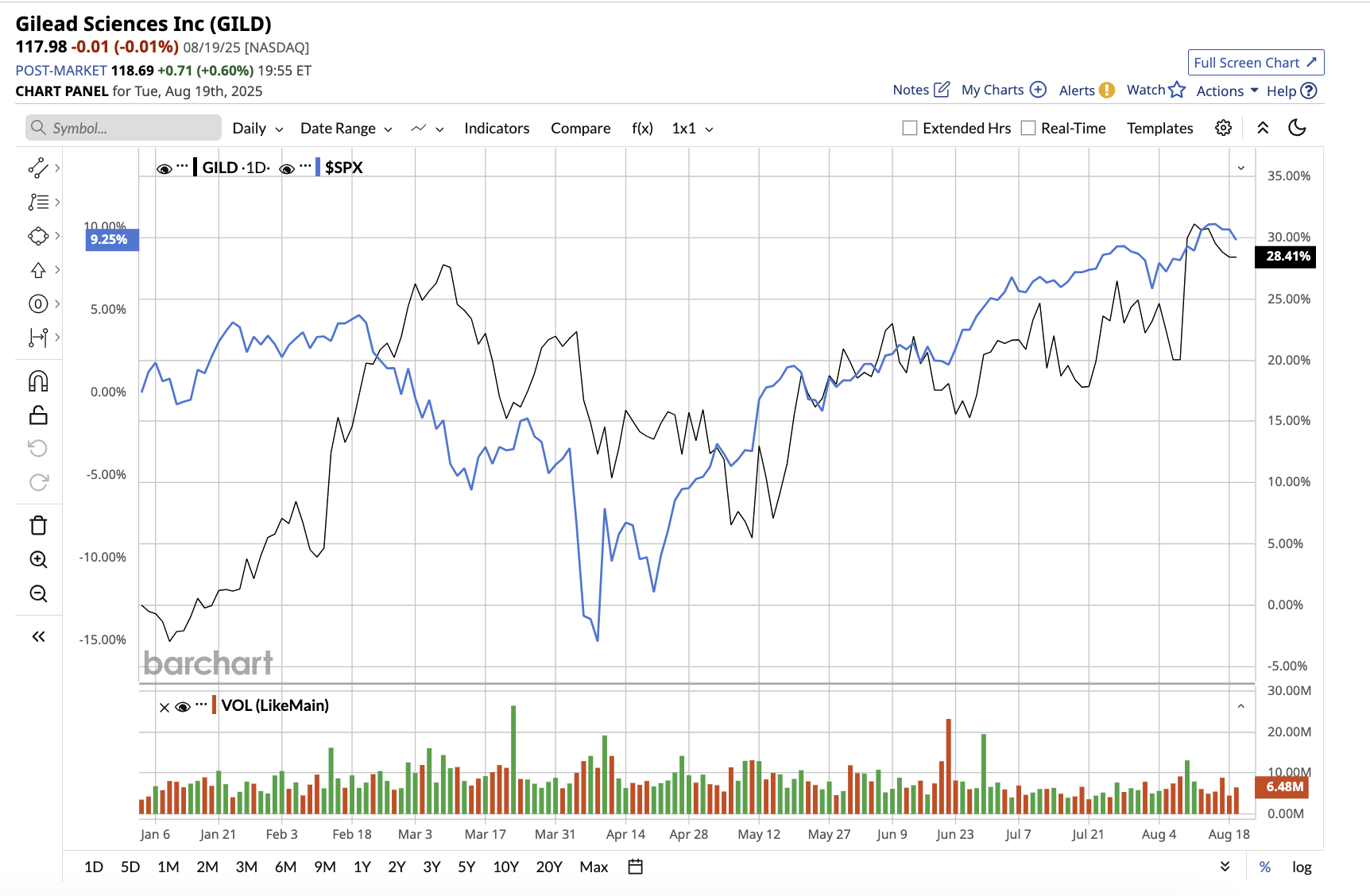

Gilead stock has surged 26.9% year-to-date, compared to the broader market gain of 8.5%. Let’s find out if Gilead stock is a buy now.

Strong Core Business Beyond COVID-19

Gilead is often seen as relying on COVID-19-related revenues from Veklury (remdesivir). However, during the second quarter, the company displayed the strength of its core business. Base product sales (excluding Veklury) totaled $6.9 billion, up 4% year over year. HIV therapies remain the cornerstone of Gilead’s business, with sales of $5.1 billion, up 7%. Additionally, Biktarvy, Gilead’s flagship HIV treatment, increased sales 9% year to $3.5 billion. These results indicate that Gilead’s growth engine is not reliant on short-term pandemic demands. Instead, its HIV franchise is expanding in both treatment and prevention, presenting a dual growth opportunity that could fuel long-term momentum.

The recent FDA approval and launch of YES2GO, a twice-yearly injectable for HIV prevention, marks one of Gilead’s most significant milestones. Looking ahead, Gilead is already testing lenacapavir injections once a year in Phase III trials. If successful, this would represent an important shift in HIV prevention by reducing dosing to a single shot per year, establishing a new gold standard in the field.

Furthermore, the company is focusing on next-generation regimens to expand its HIV pipeline, with the upcoming ARTISTRY-1 and ARTISTRY-2 phase 3 trial results potentially extending Gilead’s lead in HIV therapy even further. Beyond HIV, Gilead is establishing a strong presence in oncology with Trodelvy, a promising therapy for second-line metastatic triple-negative breast cancer (TNBC). Trodelvy’s Q2 sales totaled $364 million, a 14% increase year-over-year. Management believes expanding Trodelvy into additional tumor types, such as lung, endometrial, and gastrointestinal cancers, could unlock blockbuster potential.

Additionally, Gilead’s Kite Pharma subsidiary is developing innovative next-generation CAR T-cell therapies, though commercial adoption has been slower than anticipated. Another overlooked growth driver is liver disease, especially since the introduction of Libdelzi for primary biliary cholangitis (PBC). In the second quarter, sales doubled sequentially to $78 million.

Financial Discipline Amid Aggressive Growth

Importantly, Gilead’s core business remains robust. Gross margins remained above 85% in Q2, while operating margins stood at 35%. The company generated $720 million in free cash flow. This supported $994 million in dividend payments, $527 million in share buybacks, and continued R&D investment. The balance sheet remains healthy, with $7.1 billion in cash, cash equivalents, and marketable debt securities at the end of the second quarter.

Gilead’s financial discipline enabled it to increase its full-year revenue and earnings per share (EPS) guidance. HIV sales are expected to increase by around 3% in 2025, with new launches, particularly YES2GO and Libdelzi, playing a larger role. Total product sales could be between $28.3 billion and $28.7 billion, with adjusted earnings per share ranging from $7.95 to $8.25, in line with consensus estimates.

Despite this strong clinical and financial momentum, Gilead shares remain at a discount, trading at 14x forward 2025 earnings, which are expected to increase by 75%. This reflects investor skepticism about long-term growth beyond HIV. However, the company has begun showing that it can maintain its HIV leadership while also developing an oncology franchise and breaking ground on next-generation therapies.

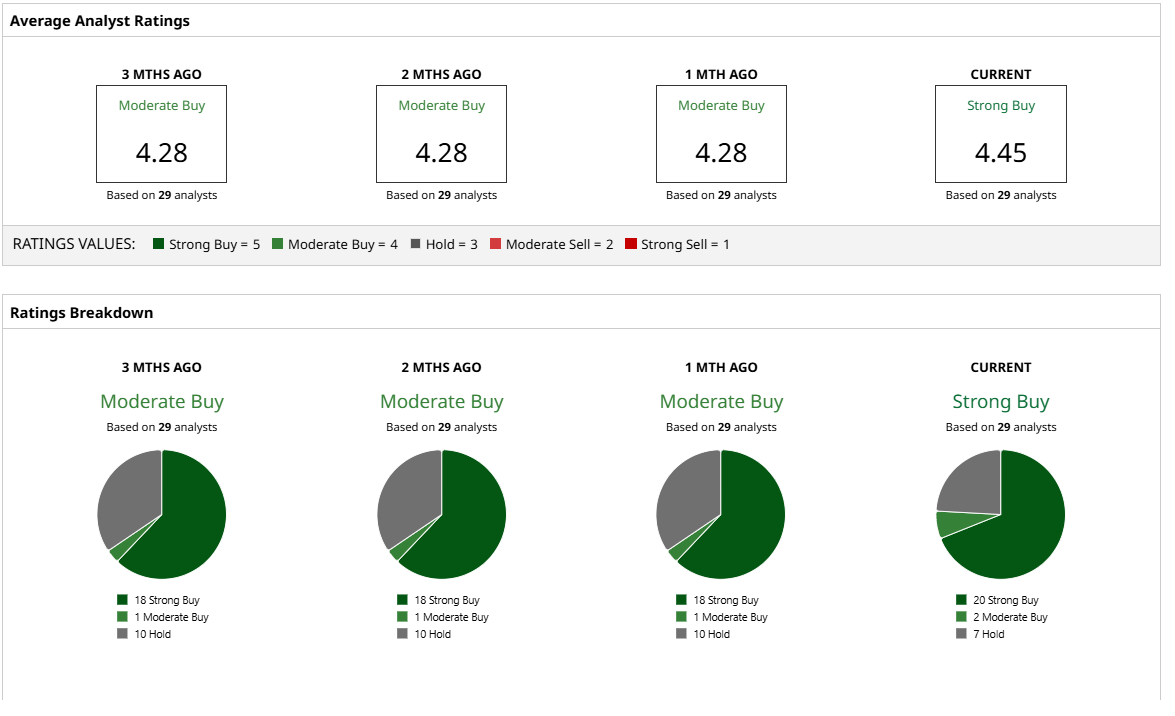

What Does Wall Street Say About Gilead Stock?

Overall, Wall Street rates Gilead stock a “Moderate Buy.” Of the 29 analysts who cover the stock, 20 rate it as a “Strong Buy,” two say it is a “Moderate Buy,” while the remaining seven rate it a “Hold.” Its average target price of $125.61 suggests the stock has upside potential of 7% from current levels. Plus, its high target price of $143 implies a 22% potential increase over the next 12 months.

The Bottom Line on Gilead Stock

With YES2GO setting a new standard in HIV prevention, Trodelvy poised for blockbuster expansion in oncology, and Libdelzi gaining traction in liver disease, the company has numerous growth opportunities. Gilead has 52 clinical stage programs as part of its pipeline, with about 16 in Phase 3 trials across oncology, inflammation, and virology. The company’s financial discipline, global partnerships, a strong balance sheet, and willingness to reinvest in innovation add layers of resilience. Gilead may be an attractive option for patient investors looking for a biotech stock with both stability and upside potential right now.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.