/Close%20up%20of%20black%20and%20red%20keyboard%20by%20Daniel%20Josef%20via%20Unsplash.jpg)

Once a retail favorite in the 3D-printing frenzies of the past decade, 3D Systems (DDD) has since plummeted into penny stock territory as hopes faded and profitability proved a fleeting dream. DDD stock surged 22% this week, though, when it reported it had won a $7.65 million U.S. Air Force contract for developing a large-format 3D metal printer for producing parts relevant for flight.

The contract win is a significant validation of the company's technology for aerospace and defense applications, which are now key drivers of growth. Although a modest contract number, and just an extension of an ongoing contract, it helped revive investor hopes in DDD stock. So far in 2025, the stock has been somewhat meandering, echoing the speculative yet rewarding nature of turnaround narratives in ultra-advanced manufacturing.

About 3D Systems Stock

3D Systems is a leading player in the field of additive manufacturing, offering 3D printers, software, materials, and services for aerospace, healthcare, and defense applications. Headquartered in Rock Hill, South Carolina, it now enjoys a market capitalization in the order of a small-cap stock, a reflection of its diminished size vis-à-vis previous 3D-printing bubble times.

DDD stock is down by about 20% year-to-date (YTD), even though it enjoyed a gain in recent defense-motivated headlines. On a 52-week basis, it has traded between $1.32 and $5, a wide variation which is typical of steady volatility. Relative to its recent price of $2.42, the stock lags the S&P 500 Index ($SPX), which is up about 25% for the same period.

Valuation is a challenge. 3D Systems hasn't regularly made profits in recent years so conventional price-earnings measures are distorted. Its price-sales multiple reflects investors' pricing in both near-term turnaround risk and its susceptibility to aerospace and defense contracts. Compared with larger industrial peers, DDD remains a speculative, high-risk name without a particular valuation peg. It doesn't pay a dividend, so its profile remains firmly in the growth-or-bust column.

3D Systems Lands Air Force Contract, Reports Narrower Loss

For its most recent quarter, 3D Systems generated revenue of $95 million, with robust growth in the Medical Technology and Aerospace & Defense segments. 3D Systems also announced a milestone in its regenerative medicine collaboration with United Therapeutics (UTHR), which resulted in an additional $2 million award. Although it still reported a net loss, operating expenses were reduced by more than $20 million through restructuring and efficiency initiatives.

For the longer term, management once again pledged itself to a target date for achieving positive cash flow, 2026. Through debt retirement, refinancing, and a selective share buyback program, the company strengthened its balance sheet, allowing for greater flexibility in funding growth while maintaining low costs. Notably, 3D Systems' aforementioned extension of its $7.65 million U.S. Air Force program for developing a large-format 3D printer that generates flight-worthy parts. Launched in 2023, this program aims for continued expansion in high-speed, large-scale additive manufacturing for aerospace and defense applications. Although such a contract is relatively small, it demonstrates relevance for a company in major markets.

No date has been announced for 3D Systems' next earnings release, but investors should look for details about advancements in its defense contracts, as well as updates on its general cost-efficiency programs.

What Do Analysts Expect for 3D Systems Stock?

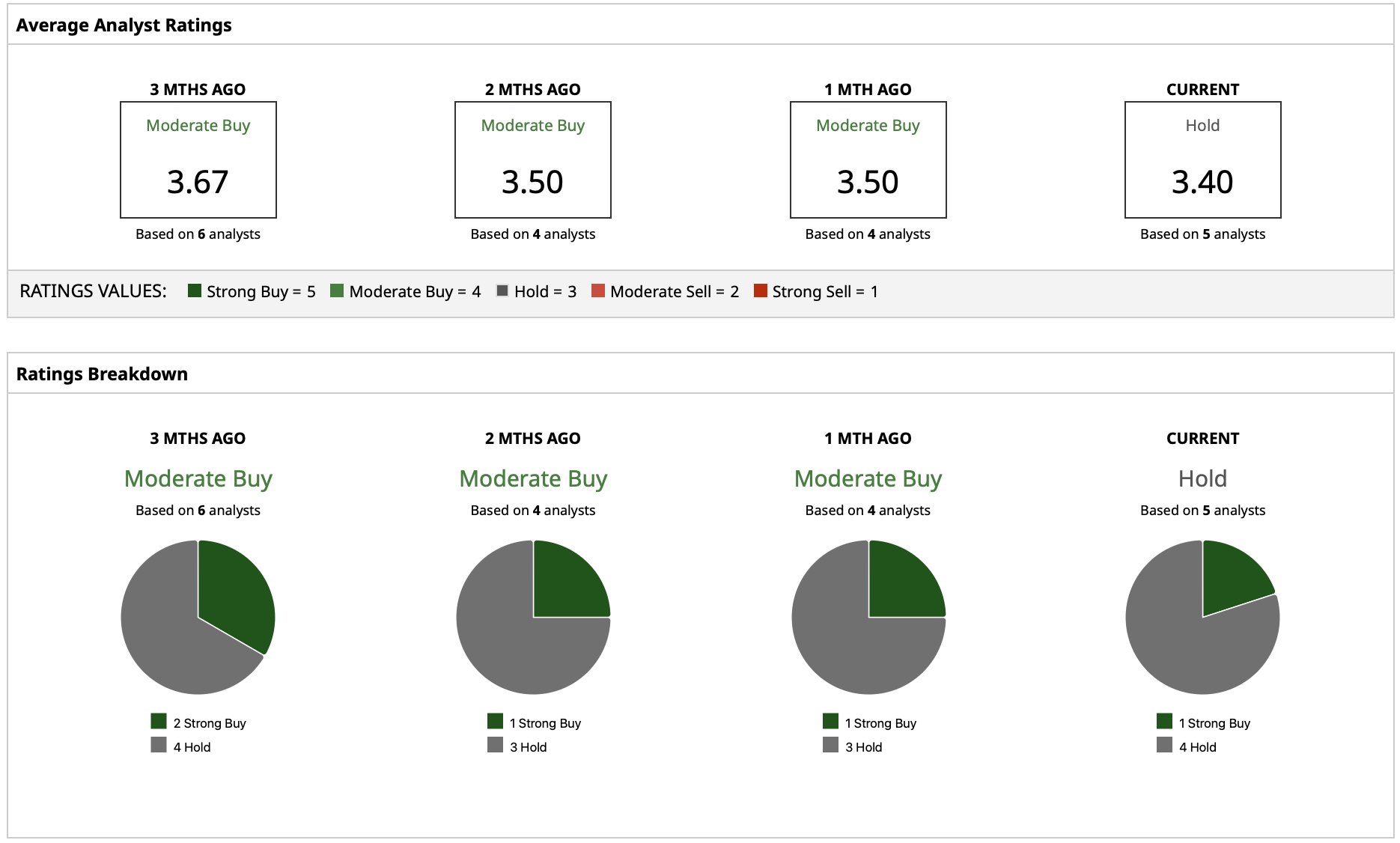

Wall Street is skeptical about DDD stock. There is low analyst coverage with a consensus “Hold” rating, and muted expectations for short-term upside. Price targets range from a low of $2 to a high of $4, with a mean of $3. With the stock most recently around $2.42 per share, the $3 mean target would support a 24% upside potential.