Just when you thought the meme stock craze was over, dead and buried, it returns with a scream.

The return this week of the Roundhill Meme Stock ETF (MEME) completes a “round trip” for the small but mighty fund, which initially launched in late 2021. It lasted just years before the firm pulled it for lack of demand. And it reminds us that in this market, what was old news can be renewed again. Because in the ETF business, any theme or niche has a shot. Or two.

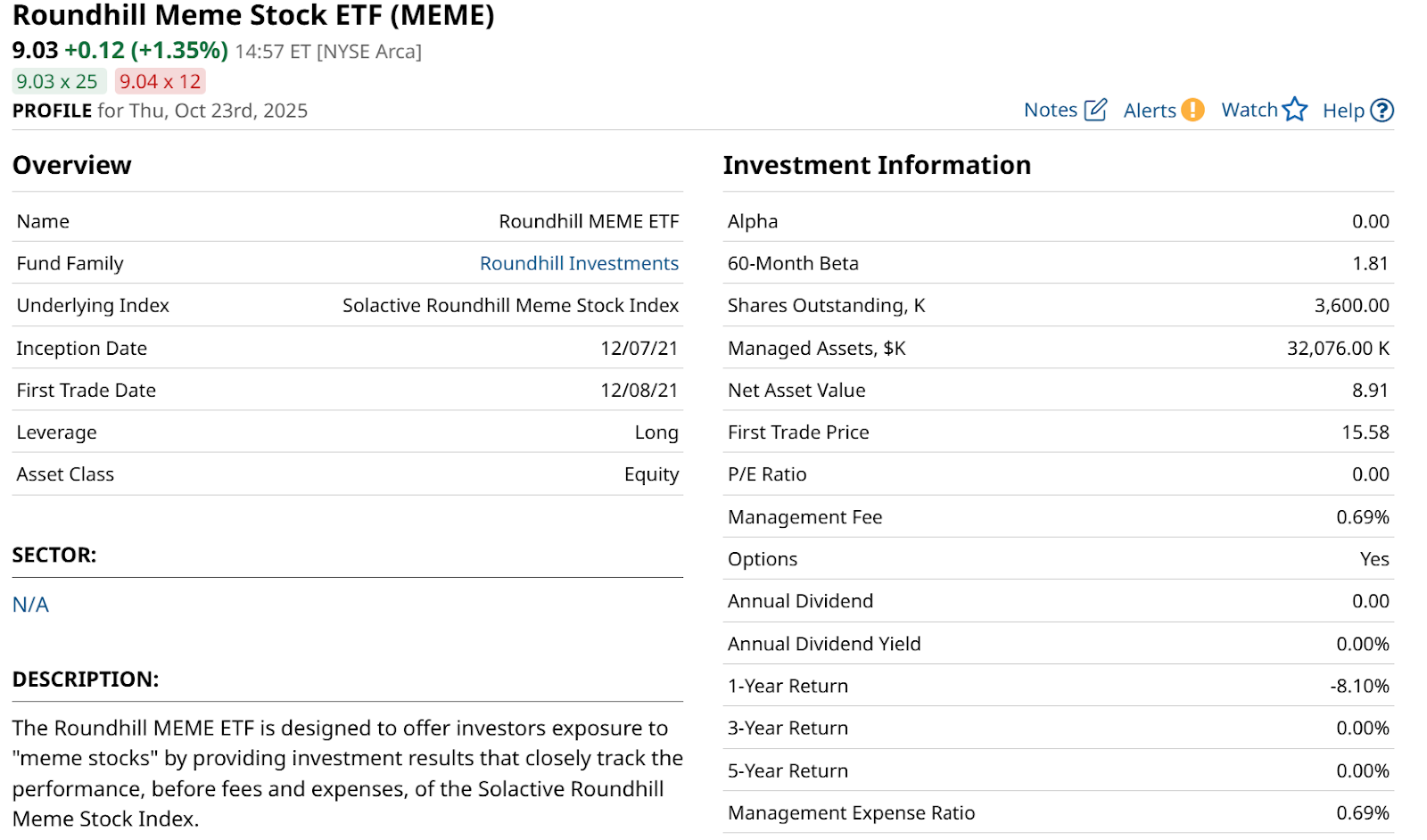

MEME closed two years ago with just $2.7 million in assets. Its relaunch has it at $32 million just weeks out of the gate. That speaks in part to a surge in investor interest for, let’s face it, anything that can move up in price.

And, in the same way that the S&P 500 Index ($SPX) makes waves when it adds or removes stocks from its roster, so too can this actively managed ETF make some noise when it does so.

In a market that seems jacked up on the concept of following the crowd, this is a juicy idea. But it’s risky, and the fund managers will be repositioning the ETF more quickly than a passive index fund.

What Is a Meme Stock?

The fund website does a nice job of summarizing this, in a single sentence. When considering a quirky yet potentially effective ETF, this is very helpful.

Meme stocks are characterized by elevated trading volumes relative to comparable public companies during periods of intense online attention and extreme price volatility, with trading activity sometimes driven more by social media momentum than by fundamental or traditional technical analysis.

MEME’s portfolio as of Wednesday’s close had 21 stocks, led by Beyond Meat (BYND) with a 10.82% weight. That comes as the plant-based meat producer’s shares surged, touching a high of $7.69 up from just $0.65 at Friday’s close.

This list and the total holdings will vary, but I think one of the most attractive parts of MEME is that someone else is doing the meme-screening for us.

I’m a devoted technical trader, and there are times when I’m searching for which stocks are most likely to be bid up for reasons having nothing to do with anything other than demand outstripping supply. I don’t have to own MEME to do that. I can just look up the holdings at any time.

That said, many investors like the idea of having a piece of their investment puzzle in meme stocks, to “ride the wave.” For as long as there is a wave, anyway. So in that regard, MEME might have a better chance to grow assets in this, its second life on planet ETF.

Is MEME a Risky ETF?

You betcha! This is what I call a “tail” position in a portfolio. Small in size, big in hope, low in expectations. Taking chances with small amounts of money. Part of that is the nature of meme-ing itself, while that risk is compounded by outsourcing the active decisions to the fund managers.

Here’s part of MEME’s explanation of risks from the ETF’s fact sheet

Meme Stock Risk. Meme Stocks are characterized by high trading volumes and significant price volatility, often driven by social media trends and investor interest. More traditional investing principles emphasize the intrinsic value of a company’s underlying business such as its cash flows, competitive position, and long-term growth prospects, when determining whether to buy or sell a particular security. In contrast, Meme Stocks often trade untethered from such fundamentals, driven instead by speculative fervor and viral momentum. While the Fund seeks to capitalize on the trading momentum associated with Meme Stocks, there is a risk that such stocks may experience rapid and unpredictable price movements that could abate or reverse quickly. Because a stock only becomes eligible for inclusion in the Fund’s portfolio after it has experienced a significant amount of liquidity and volatility, it is possible that by the time the Fund purchases shares of a Meme Stock it will have missed out on the initial gains, but will nevertheless experience any subsequent decline in value. Additionally, the identification of Meme Stocks is inherently subjective and may vary. As a result, stocks that are widely recognized as Meme Stocks may not be selected for inclusion in the Fund’s portfolio. Conversely, stocks included in the Fund may not be perceived as Meme Stocks by the broader market. Investors should be aware that investing in Meme Stocks involves a high degree of risk and may not be suitable for all investors. The volatile nature of these investments may lead to significant fluctuations in the Fund’s net asset value and could result in potential loss.

I’m normally more of a curmudgeon about ETFs like this. But it is a very free market, and the longer I trade, the more I appreciate any effort made to short-list candidates for me.

I won’t likely be owning this one, but I spend a lot of time analyzing individual stocks for trading. For those trying to get a basket that targets the meme theme, MEME is back on the market.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, as well as on Substack.