Over the years, corporations have embarked on a myriad of ways to stage a turnaround in their fortunes or grab the attention of the market to get a share price pop. While in the times around the pandemic, SPAC listings were quite common; the recent fad is of companies turning into Bitcoin (BTCUSD) or other cryptocurrency treasury companies to find relevance.

Now, no less than the Trump family has found a new avenue to pocket a cool $500 million from a circular deal that would provide a boost to its own cryptocurrency, World Liberty Financial (WLFI), as well.

Trump-Backed Company Purchases Trump-Backed Crypto

In a recent development, blockchain-powered fintech solutions provider Alt5 Sigma (ALTS) raised $750 million in cash to purchase the WLFI cryptocurrency. While World Liberty counts Donald Trump himself as the “Co-Founder Emeritus,” his sons, namely Eric Trump, Donald Trump Jr., and Barron Trump, are co-founders of the company. Further, another co-founder of World Liberty, Zach Witkoff, and Eric Trump are chairman and director, respectively, on the board of Alt5 Sigma, after Alt5 Sigma raised $1.5 billion from World Liberty Financial last month.

If that doesn't take the cake, Zach Witkoff is the son of Steve Witkoff, the U.S. Special Envoy to the Middle East.

But how did this circular deal result in a $500 million windfall for the Trump family? Well, through another Trump-family-backed company, DT Marks DEFI, it owns 22.5 billion WLFI tokens (out of a total of 33 billion tokens controlled by World Liberty). Alt5 paid $750 million to acquire WLFI by valuing WLFI tokens at $0.20 each—a high premium. Notably, the Trump-affiliated entity is entitled to 75% of all WLFI sales, resulting in them taking the majority share of the $750 million proceeds. This payout from selling a portion of their WLFI tokens equates to roughly $500 million in profit for the Trump family, even though the token price later dropped and is now trading at around $0.18.

This is as convoluted a corporate structure as it can be, but how does ALTS stack up as an investment on a standalone basis? Let's find out.

Unprofitable Company

Unsurprisingly, Alt5 Sigma is not a profit-making company, although its results for the most recent quarter saw an almost tripling of revenues from the previous year to $6.4 million. Meanwhile, the company reported losses of $0.49 per share compared to an EPS of $0.07 in the same period a year ago. This also marked the fourth consecutive quarter of losses for the company and the fifth out of the last six quarters.

Net cash used in operating activities for the first six months of 2024 widened to $6.73 million from just $464,000 in the prior year, as the company closed the quarter with a cash balance of $9.56 million. This was comparable to its short-term debt levels of $9.46 million.

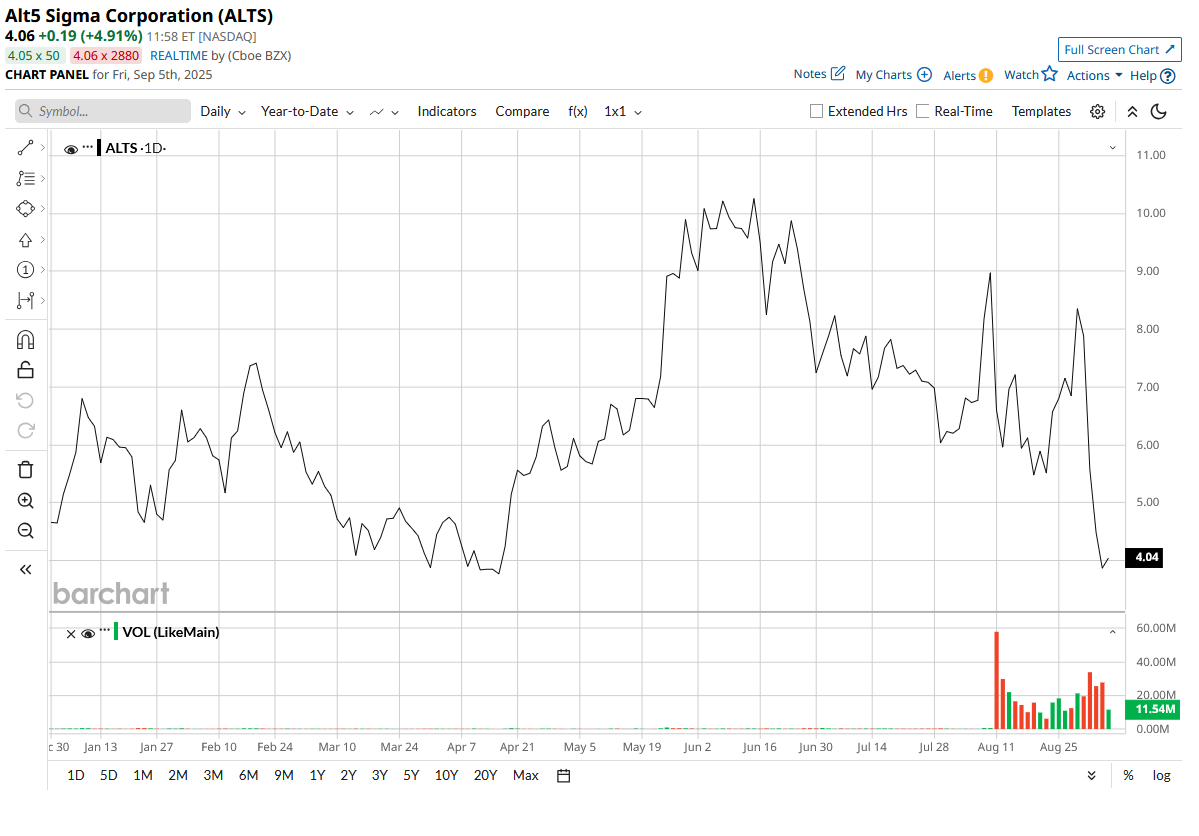

Overall, with a market cap of 4474.5 million, ALTS stock is down 11.7% on a year-to-date (YTD) basis.

Innovative DeFi Solutions Provider

For all the questions regarding its governance, Alt5 Sigma does provide some solutions that keep DeFi at its core, with some competitive advantages.

For instance, the company's enterprise-focused full-stack solution is designed to enable traditional financial institutions to launch crypto services in weeks, not years, with modular, API-driven technology. Further, better integration and architecture in the form of seamless deployment into legacy systems is there, which may not be the case for its competitors like Block (XYZ) and PayPal (PYPL).

Further, its ALT5 Pay crypto payment gateway not only allows merchants to accept digital assets, but it also gives merchants the option to convert payments instantly to fiat or retain crypto, while its “Crypto-as-a-Service” infrastructure provides turnkey integrations for regulated digital asset services, including payments, trading, stablecoin rails, custody, and regulatory compliance.

Final Take

All this is well and good, but the facts don't change. Alt5 Sigma has the material overhang of the issue of governance, with its convoluted structure remaining an issue. Moreover, rather than becoming a WLFI treasury, it would be well served if it focused on improving its existing solutions, moving back into profitability, and continuing development of its products and offerings. So that in later years, when it may not have as much of a powerful backing as it has now, it will continue to be relevant in the rapidly growing arena of decentralized finance.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.