The U.S. telecommunications sector is seeing steady growth, with the market expected to expand at a 6.6% compound annual growth rate between 2024 and 2030. This outlook has made telecom stocks appealing to investors focused on income, particularly those offering strong dividend yields during periods of market uncertainty. Verizon Communications (VZ) is a standout in this space, delivering a 6.5% dividend yield that ranks it among the top 10% of dividend-paying stocks in its sector.

The company’s recent leadership change has caught investors’ attention. On Oct. 5, Verizon announced that former PayPal (PYPL) CEO Dan Schulman would replace Hans Vestberg as chief executive officer, effective immediately. This transition comes as Verizon has been delivering solid results, with its stock rising 6.5% over six months as of early August, outperforming the wireless national industry’s 2.3% growth in the same period. However, the announcement led to immediate market reaction, with shares sliding 5.1% on the day.

With a reliable dividend and a 20-year track record of consecutive dividend increases, this change at the top raises an important question for income-focused investors: Does this high-yield dividend stock represent a compelling buying opportunity under new management? Let's find out.

Verizon’s Financial Pulse

Verizon is one of the largest telecom companies in the U.S.; it runs a straightforward business built on providing wireless and broadband services to millions of consumers, businesses, and public institutions.

Over the past 52 weeks, VZ stock has slipped about 6.4%, but year-to-date (YTD), it has managed a modest gain of 3%.

On valuation, Verizon trades at a forward price-to-earnings (P/E) ratio of 9.29x, which is well below the sector average of 14.33x. This lower multiple might appeal to investors looking for value opportunities. Where Verizon continues to stand out is its dividend. It offers a forward yield of 6.54%, pays a quarterly dividend of $0.678 per share, and maintains a payout ratio of 57.27%. The company has also raised its dividend for 20 consecutive years, underscoring its commitment to consistent income returns.

Verizon’s financial performance remains stable and consistent. In the second quarter of 2025, earnings per share rose to $1.18 from $1.09 a year earlier, with adjusted EPS reaching $1.22. Total revenue increased by 5.2% year-over-year (YoY) to $34.5 billion, while wireless service revenue hit $20.9 billion, up 2.2%. Equipment sales climbed 25.2% to $6.3 billion.

The company generated $16.8 billion in operating cash flow in the first half, producing $8.8 billion in free cash flow, both slightly higher than last year. Net income came in at $5.1 billion, and adjusted EBITDA reached $12.8 billion, showing solid profitability. Even with an unsecured debt of $119.4 billion, its net debt-to-EBITDA ratio of 2.3x suggests financial stability and room to support its dividend commitments.

Verizon’s Growth Engines in a Changing Market

Verizon’s partnership with GE Vernova shows how important technology collaborations are to its long-term growth. By integrating GE Vernova’s MDS Orbit industrial wireless platform with Verizon’s network, utility companies can better modernize and protect their electrical grids. This effort improves reliability and efficiency for utilities while placing Verizon in a leading position in North America’s grid modernization movement, an area gaining momentum as industries move toward cleaner energy and smarter infrastructure.

At the same time, Verizon is preparing for the future with its new 6G Innovation Forum. This initiative brings together major global technology partners, including Ericsson (ERIC), Samsung (SMSN.L.EB), Nokia (NOK), Meta (META), and Qualcomm (QCOM) to shape the early stages of 6G development. The goal is to explore new devices, applications, and underlying technologies that can define the next generation of wireless connectivity.

On the consumer front, Verizon is rolling out its most significant customer experience upgrade to date, built around AI-driven personalization. The company is using artificial intelligence across customer support, digital platforms, and retail operations to make interactions simpler and more tailored. This initiative is part of a larger, long-term strategy that takes advantage of the scale and speed of Verizon’s 5G network to deliver more convenience and stronger customer relationships across all service channels.

Analyst Insights and What Lies Ahead

Management has set guidance for 2025 with adjusted EBITDA growth of 2.5% to 3.5% and adjusted EPS growth of 1.0% to 3.0%. This is supported by projected cash flow from operations between $37.0 billion and $39.0 billion and free cash flow of $19.5 billion to $20.5 billion. Verizon is also aiming for total wireless service revenue growth of 2.0% to 2.8% and capital expenditures in the range of $17.5 billion to $18.5 billion.

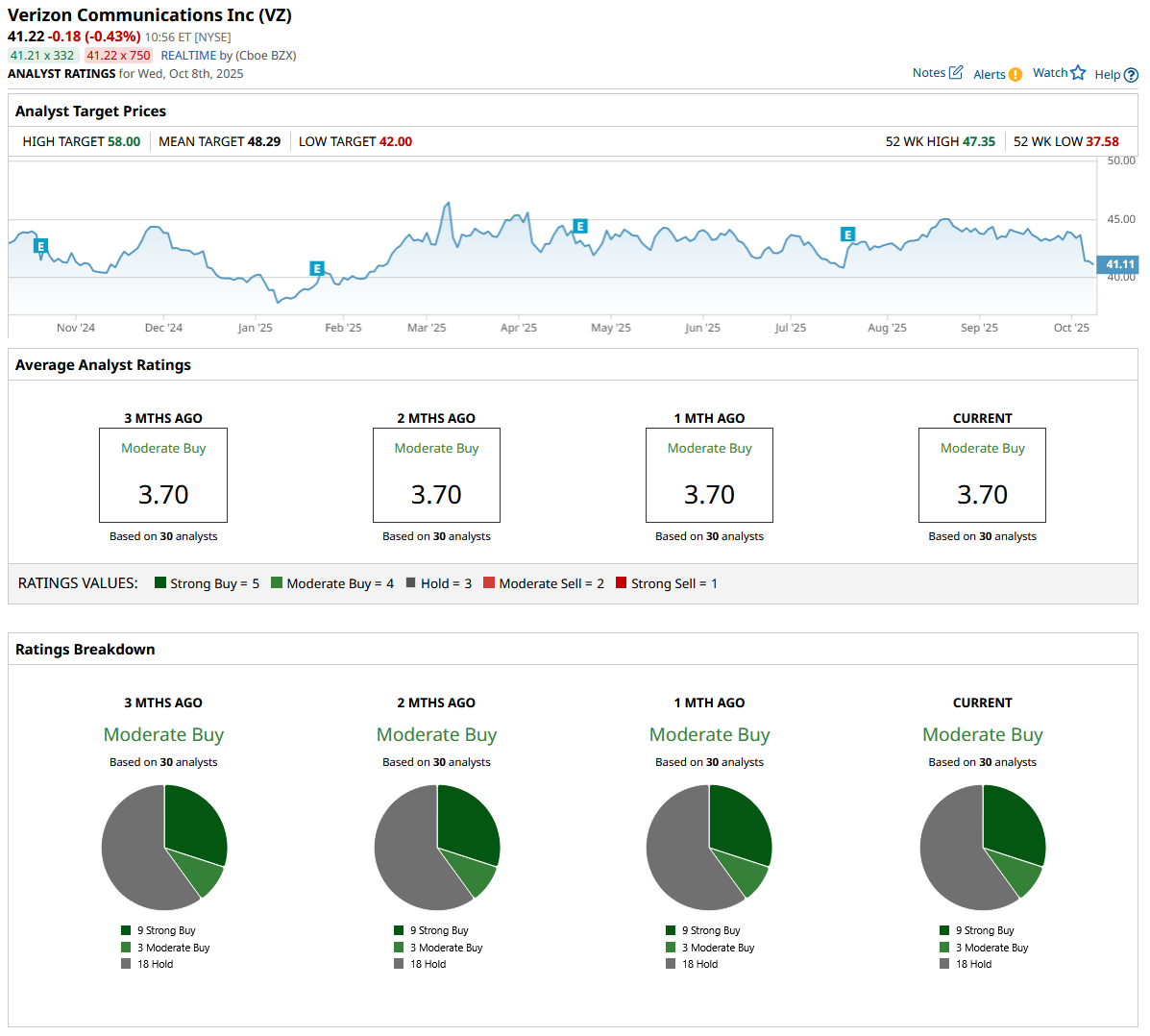

That outlook is reflected in analyst actions. Following the latest earnings release, RBC Capital increased its price target to $46 and kept a “Sector Perform” rating, pointing to stronger free cash flow and an improved full-year outlook as proof of disciplined spending and reliable dividend support. Raymond James maintained its “Outperform” rating and raised its target to $47, citing efficient cash conversion, careful execution, and confidence in hitting guidance despite ongoing pressure in the postpaid market.

The broader consensus aligns with this view. Out of 29 analysts surveyed, VZ stock holds a consensus “Moderate Buy” rating with an average price target of $48.19. From a current share price of $41.75, that target represents an estimated upside of about 15.4%.

Conclusion

All things considered, Verizon looks like a compelling option for dividend investors who want reliable income and a shot at upside, especially with Dan Schulman stepping in to steer the company through its next phase of innovation. The numbers point to steady fundamentals, robust cash flow, and a dividend that seems as dependable as ever. With analysts leaning positive and guidance solid, the odds favor shares trending higher in the coming months, particularly if Schulman’s track record in digital transformation pays off as expected. For now, VZ stock remains a buy for those seeking both yield and a measured dose of growth potential.