Affirm stock (AFRM) is up over 46% for the year to date and is outperforming the S&P 500 Index ($SPX) by a significant margin. Looking at the momentum, 2025 could be the third consecutive year in which the stock beats the broader markets hands down. The buy now, pay later (BNPL) company’s stock price has risen over tenfold from its 2022 lows. That year, it plunged 90% amid a broad-based selloff in loss-making growth names.

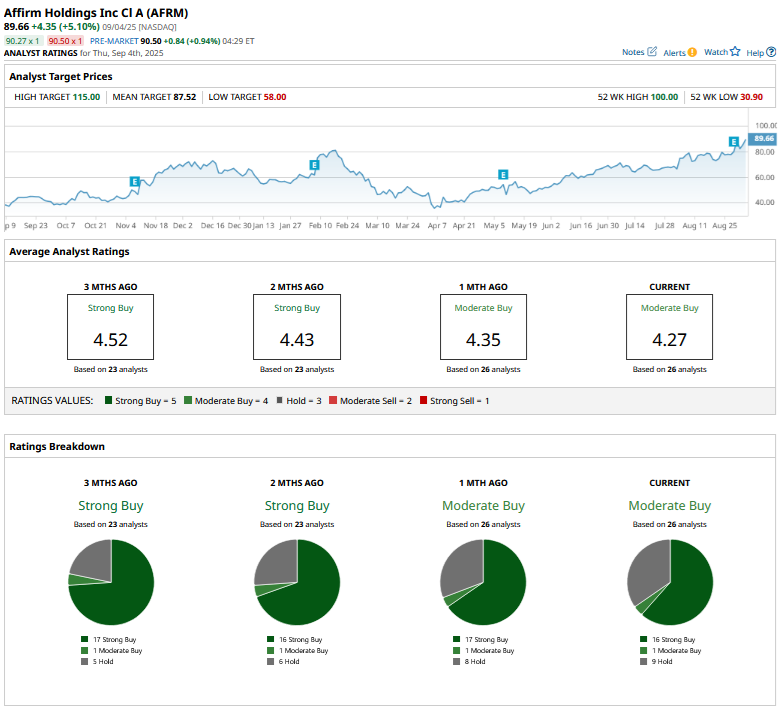

Life has, however, come full circle for Affirm. Not only has the macro environment improved significantly, but the company has also impressed with its execution, including turning profitable at the operating level, as it had guided for. The stock has largely crushed bears over the last three years and has won over several Wall Street analysts who were bearish on the company. Multiple brokerages have upgraded the stock over the last year, and it currently has a consensus rating of “Moderate Buy” from the 26 analysts tracked by Barchart.

AFRM Stock Forecast

To put that in perspective, it was rated as a “Hold” toward the end of 2023 and has since moved into “Buy” territory. While analysts have gradually warmed up to AFRM and have been raising its target prices, it has tended to trade above the mean target price, as it does now. Its Street-high target price is $115 via TD Cowen, which bumped up its target by $25 following the company’s fiscal Q4 2025 earnings last month.

Let’s now look at AFRM stock’s forecast after its breathtaking rally, beginning with a snapshot of its most recent earnings.

Affirm Reported Stellar Earnings

Affirm reported a stellar set of numbers in its fiscal Q4 2025 that ended in June. Its gross merchandise value (GMV) rose 43% year-over-year to $10.4 billion in the quarter. The metric surpassed Street estimates handsomely despite Affirm losing Walmart (WMT), one of its key customers, to rival Klarna.

Affirm’s revenues rose 33% YoY to $876 million, ahead of the $837 million that analysts were predicting, while the earnings per share of $0.20 were nearly twice what analysts were modeling. The company’s guidance for the current quarter was also encouraging as it forecast GMV between $10.1 billion and $10.4 billion and revenues between $855 million and $885 million.

The company’s CEO, Max Levchin, perhaps best summed up the quarter’s performance by terming it “exceptionally strong.” He added, “We didn't just crush this quarter, we actually set a new record in most of our metrics,” which he stressed is “unusual” as usually the fiscal Q2 is the seasonal peak for the company.

Affirm Has Managed to Grow Fast While Keeping Delinquencies in Check

Levchin also allayed fears over the health of the consumer and pointed to strong demand, while expressing confidence in keeping delinquencies low. While the Affirm CEO did not provide numbers on credit performance, he said the numbers have “been highly consistent and continue to perform really well.”

The company has been onboarding a lot of customers with its 0% APR offering, who are less profitable. In such loans, either the manufacturer or the merchant agrees to part with some of their margins to provide the goods at 0% interest rates to buyers. These loans help spur purchases and add to Affirm’s user base. In response to an analyst’s question about customers on 0% APR, Levchin said that they flip over to interest-bearing in due course.

Affirm’s Growth Story Is Far from Over

Affirm’s growth story is far from over as BNPL adoption grows. As the company said in its fiscal Q4 shareholder letter, “The size of Affirm’s total addressable opportunity still rounds up to infinity – our GMV is but a fraction of a single percentage point of US retail (and we have aspirations beyond both US and retail).”

The company has been expanding globally and has launched in the U.K., and has hinted at launching its services in other European countries. These international expansions should help keep Affirm’s top-line growth buoyed.

Affirm is also a shining example of good execution and has managed delinquencies well, despite higher interest rates and the macroeconomic slowdown. Notably, higher interest rates were a key headwind for Affirm as it raised its borrowing costs. However, the company managed to turn the corner on profitability despite multi-decade high interest rates in the U.S. As interest rates come down, Affirm’s borrowing costs should fall too.

All said, Affirm is a high beta and volatile name and could be a no-go for conservative investors. I have traded in and out of the stock on a few occasions, but feel comfortable about the stock at these levels as the company turns the corner on profitability while continuing to grow its top line at a brisk pace.

On the date of publication, Mohit Oberoi had a position in: AFRM . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.