CleanCore (ZONE) shares soared on Tuesday after announcing a landmark deal with the Nasdaq-listed online trading platform Robinhood Markets (HOOD).

Under this agreement, the retail brokerage’s digital asset platform will serve as the official trading and custody venue for ZONE’s Dogecoin (DOGEUSD) treasury.

ZONE is redefining crypto-native corporate finance as the first world’s first publicly listed firm to bet its balance sheet on DOGE, currently holding over 285 million meme coins.

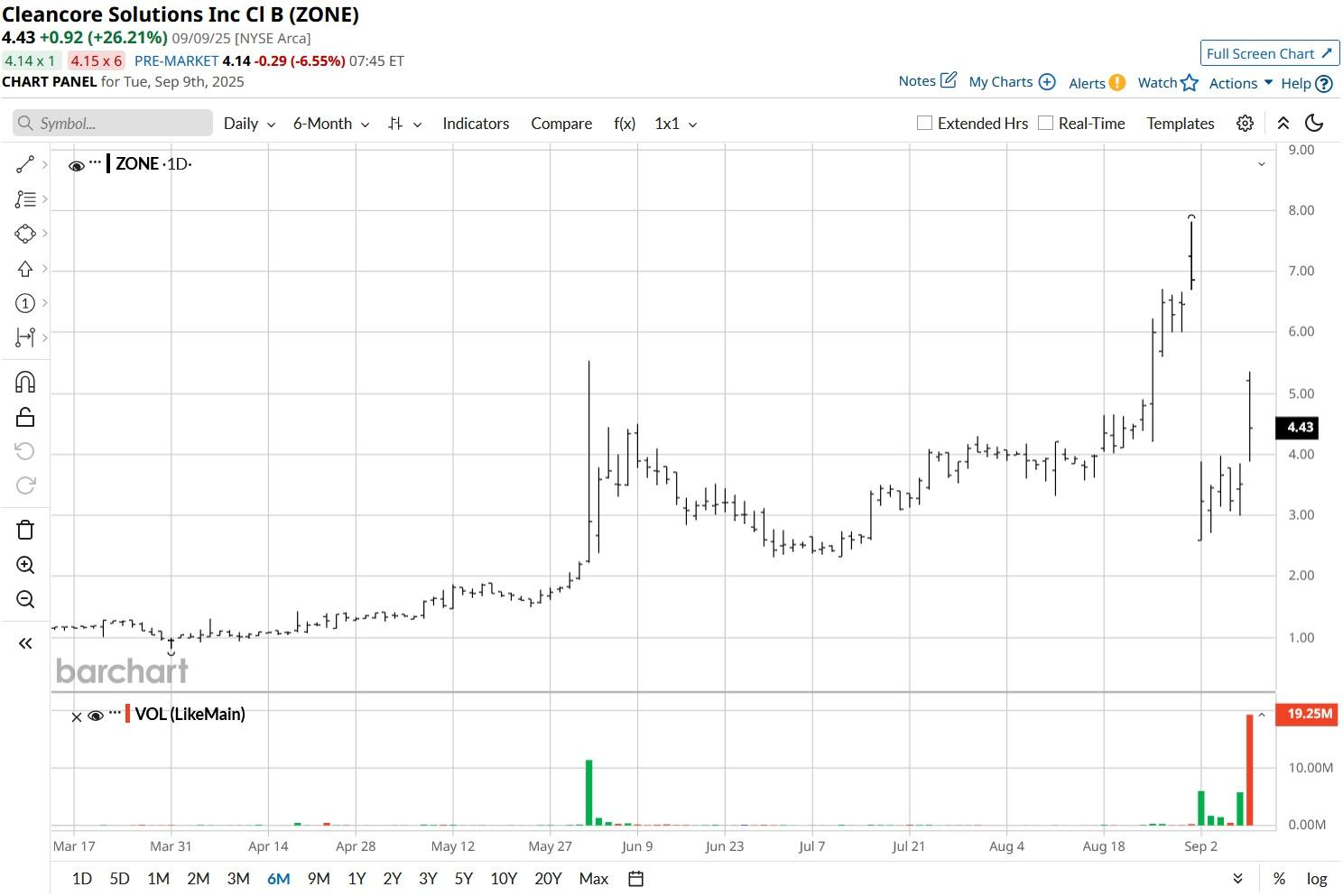

At the time of writing, CleanCore stock is up an exciting 390% versus its YTD low set in late March.

Is Robinhood Deal Meaningful for CleanCore Shares

Teaming up with a globally renowned name like Robinhood is notably positive for ZONE shares as it improves the overall credibility of the company’s Dogecoin treasury strategy.

The announcement reduces perceived risk around its crypto-heavy balance sheet, reinforcing its reputation as the first-mover in treasury innovation.

By anchoring its reserves to a trusted, regulated platform, CleanCore signals operational discipline and liquidity access, which is really the key to boosting investor confidence.

For CleanCore shares, this deal essentially transforms speculative narrative into structured strategy, potentially attracting both crypto-native and traditional investors while minimizing future equity dilution as well.

Why ZONE Stock Is More Like a Gamble Than an Investment

While CleanCore’s commitment to leveraging DOGE’s global visibility and real-time tradability sure looks promising on the surface, the underlying structural headwinds suggest investors should steer clear of ZONE stock in 2025.

Investors chasing the momentum in CleanCore Solutions may be taking significant risk given it’s a penny stock, prone to manipulation and unusually high volatility.

Additionally, CleanCore shares do not currently receive coverage from Wall Street analysts, which means limited institutional visibility, no formal earnings forecasts, and fewer catalysts for investor interest.

It can signal low credibility or liquidity, making ZONE shares less attractive to funds, brokers, and serious market participants. Finally, CleanCore’s financials remain in shambles, making it’s stock more of a gamble than a sound investment for 2025.