Sharps Technology (STSS) was once a tiny medical-syringe maker, but it now bills itself as a “leading publicly listed Solana treasury.” The company has now openly adopted what it calls a “digital asset treasury strategy focused on accumulating SOL” (the Solana (SOLUSD) token). In early September, Sharps announced it had “acquired over 2 million SOL,” roughly $400 million worth at prevailing prices. In other words, its balance sheet is now dominated by crypto rather than syringes. The company’s SEC filings and press releases trumpet Solana as “the fastest and most used blockchain in the world” and say Sharps is staking its coins to earn yield. This radical pivot has made STSS effectively a crypto proxy stock.

That shift means the company’s balance sheet is now dominated by crypto holdings rather than syringes. In filings and press releases, management describes Solana as “the fastest and most used blockchain in the world” and emphasizes that Sharps is staking its tokens to generate additional yield.

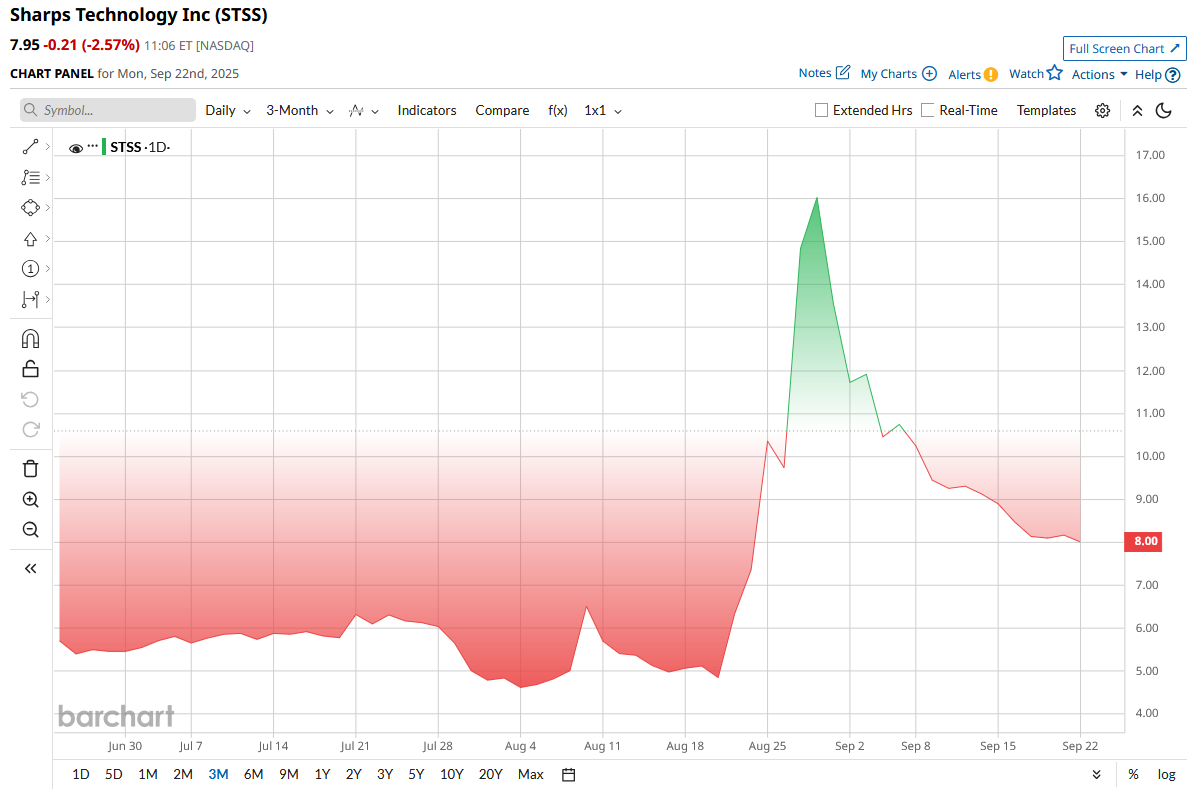

With a market cap of just $209 million, Sharps Technology has quickly become one of 2025’s most volatile small-cap names, trading almost tick-for-tick with crypto sentiment. Shares exploded 70% in a single session after the company unveiled its $400 million Solana treasury raise, spiking to nearly $13 intraday before sliding back to around $8 by Sept. 19. Earlier this year, the stock languished between $3 and $5. Even after the recent fireworks, however, STSS remains down nearly 99% from its speculative peaks last year.

Partnership With BONK and Solana Plans

Sharps Technology's most recent announcement is a strategic tie-up with BONK, a community-driven meme coin on Solana. Under the deal, Sharps will stake a portion of its SOL holdings into BonkSOL, BONK’s liquid-staking token. In practical terms, this means Sharps takes some of its $400 million SOL pile and locks it with BONK, earning the usual staking rewards while keeping liquidity via BonkSOL. CEO Mike Fetherolf and advisor James Zhang say the move “aligns with supporting the most productive… communities within the Solana ecosystem” and could “generate increased returns” for Sharps shareholders. BONK’s co-founder (Nom) echoed this, calling Sharps’ new treasury “one of the most exciting Solana treasuries in the market.”

The BONK platform itself is a notable part of Solana’s culture. BONK boasts 400+ ecosystem integrations, and its suite of products is already generating significant activity; for example, BONKBot has processed over $14 billion in trading volume and Bonk. Fun just did $28 million in quarterly revenue. The BonkSOL liquid staking token has attracted nearly 200,000 SOL since launch. Sharps argues that by partnering with BONK, it deepens its Web3 footprint and taps into the vibrant meme/DeFi crowd. In short, STSS went from selling syringes to talking about yield farming and crypto partnerships in under a year.

Sharps' Financial Overview

Sharps’ underlying financials remain tiny. The company has no meaningful product revenue to date. It is still in the commercialization phase for its syringe products. Its 10-K (end of 2024) confirms zero revenue and net losses of $9.30 million in 2024. The accumulated deficit is over $34 million as of Dec. 31, 2024.

In other words, Sharps has been burning cash on R&D and admin but has not yet sold much of anything. After ten years of operation, the balance sheet was essentially lean: total assets were only $7.3 million at year-end 2024, and working capital was barely positive. In fact, the March 31, 2025, 10-Q warns that the $5.6 million of working capital then on hand was “not expected to be sufficient” for the next 12 months.

How has Sharps been funding itself? Through equity sales. In January 2025, Sharps raised roughly $20 million (gross) in a public offering (about $18.2 million net), selling stock and warrants. This small raise (at a $420/unit price after a reverse split) was mainly used to pay off debt and keep the company afloat. After repaying a note, it actually became debt-free by Q1 2025. But $18 million is peanuts, just sustaining cash burn. The real game-changer was the August 2025 private placement: Sharps sold units at $6.50 (plus high-strike warrants) to raise over $400 million. That deal, led by crypto investors and Cantor Fitzgerald, was explicitly aimed at funding the Solana treasury.

In short, for 2024–2025, Sharps has no revenue, ongoing losses, and only tiny organic cash flow. Its liquidity situation was perilous (hence the going-concern warnings) until these recent raises. However, post-PIPE, Sharps' balance sheet is loaded with crypto assets. The company holds millions of SOL tokens and some BonkSOL now, a far different profile than a few months ago. This influx of crypto makes STSS’s market cap ($200 million+ as of Sep 2025) hard to compare to its pre-crypto book value.

Is STSS Stock a Buy? Outlook and Risks

The strategy BONK/Solana, expounded by Sharps, is bold but has tremendous caveats attached to it. On the upside, the shift is an indicator that the management believes in the Solana ecosystem. Institutional investors believe SOL will increase, and Sharps' will be winning if SOL sees a significant price increase or when staking returns become rich. As long as BonkSOL staking can be profitable, Sharps stands to potentially get a 78% per year yield on its staked SOL, not to mention SOL/Bonk tokens that have the potential to appreciate. The popularity of the BONK ecosystem among grassroots might also be beneficial; assuming the BONK adoption increases, Sharps will benefit as well. The dangers are, however, great. That, in effect, means that Sharps has at this point disregarded their legacy business, and crypto will be the only thing supporting STSS stock.

Investors seem to think Sharps is not so much a medical technology company now, but a high-wire crypto play. When you purchase STSS, you are investing in Solana and BONK; in other words, you are betting on a meme-coin-plus-staking conveyance wrapped in the law. The flipside is that it has a high potential of shooting higher should SOL/BONK rocket and Sharps increase his huge share in the company. Not to say the cons may be excessive if the prices of crypto go down or in case of meme-coin hype.

Quite simply, STSS stock is a speculative, all-or-nothing gamble.