Lithium Americas (LAC) grabbed headlines as the stock almost doubled following news of a potential investment by the U.S. government. However, investors shouldn't overlook General Motors (GM) as a compelling indirect play on this critical minerals strategy. The automotive giant's 38% stake in the Thacker Pass lithium mine positions it as a key beneficiary of government backing for domestic battery supply chains.

GM's $945 million investment in Thacker Pass, comprising $430 million in direct cash and $195 million in letters of credit, demonstrates a commitment to securing its lithium supply. With a guaranteed offtake agreement for up to 100% of Phase 1 production and 38% of Phase 2 over 20 years, GM has essentially locked in critical battery material supplies at favorable terms. Moreover, the Trump administration provides additional project de-risking through potential equity participation.

The timing couldn't be better for GM's electric vehicle (EV) ambitions. As General Motors transitions its fleet toward electrification, securing domestic lithium supplies is a strategic move, particularly given growing concerns about China's dominance of the supply chain. The government's willingness to take equity stakes in critical mineral projects signals strong policy support that could benefit all stakeholders.

Is General Motors a Good Stock to Buy?

General Motors showcased resilience despite facing macro headwinds in 2025. The automaker faces $4-5 billion in tariff impacts but has outlined a mitigation strategy that targets at least 30% offset through manufacturing adjustments, cost initiatives, and disciplined pricing.

In the first six months of 2025, GM reported revenue of $91 billion. Analysts forecast sales in 2025 to increase 9.1% year-over-year (YoY) to $187.4 billion. GM's inventory discipline strategy continues to pay dividends, as it maintains 50-60 day supply levels while competitors struggle with excess stock and heavy incentivizing. This approach has enabled GM to gain market share while maintaining pricing power, a rare combination in the automotive industry.

GM's electric vehicle strategy is showing tangible progress, with Chevrolet becoming the number two EV brand and Cadillac leading luxury EV sales. The company's battery technology investments, including lithium-manganese-rich chemistry and LFP capabilities, position it well for EV profitability as regulatory environments normalize. The $4 billion deferred revenue from Super Cruise and OnStar subscriptions represents a growing high-margin software business that's often overlooked.

The $4 billion investment in U.S. manufacturing capacity addresses tariff mitigation and unmet demand for high-margin trucks and SUVs. This expansion will increase domestic production to over two million vehicles annually, reducing tariff exposure and enabling the company to capitalize on strong demand for profitable segments. GM’s balance sheet strength, combined with disciplined capital allocation and consistent free cash flow generation, provides multiple pathways for value creation.

While near-term margins face pressure from tariffs and warranty costs, GM's structural improvements and strategic positioning suggest the company will emerge from this transition period relatively unscathed.

Is GM Stock Undervalued?

Analysts tracking GM stock forecast adjusted earnings to expand from $7.68 per share to $13.4 per share. In this period, its annual dividend is expected to increase from $0.36 per share to $0.89 per share.

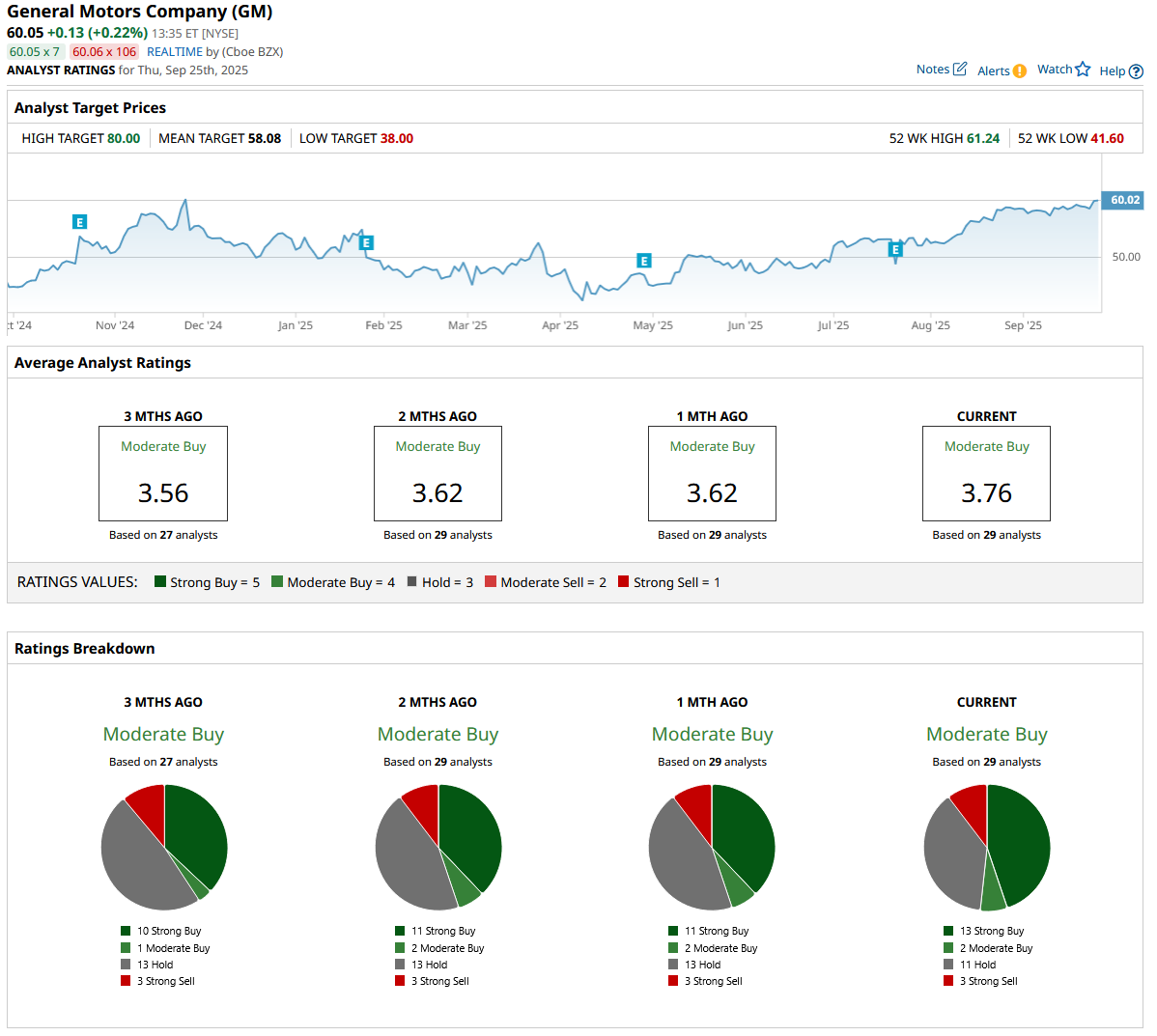

Out of the 29 analysts covering GM stock, 13 recommend “Strong Buy,” two recommend “Moderate Buy,” 11 recommend “Hold,” and three recommend “Strong Sell.” The average GM stock price target is $58.08, below the current trading price of $60.

Unlike pure-play mining stocks that carry inherent commodity and execution risks, GM offers diversified automotive exposure with meaningful upside from its lithium partnership. The blue-chip automaker's shares have already begun reflecting this optimism. Still, the long-term value creation from guaranteed access to North American lithium production could prove substantial as domestic battery manufacturing scales significantly over the coming decade.