When a storied blue-chip stock like Colgate-Palmolive (CL) suddenly plunges to a new 52-week low, alarm bells ring, but some also see an opportunity. CL stock reached a low of $76.68 on Oct. 13, having shed much of the premium it once commanded.

With its hallmark brand strength, decades of dividend consistency, and resilient cash flows, is this capitulation a warning sign for Colgae-Palmolive? Or is it a chance for investors to “buy the dip” in a high-quality income name at a discounted entry point?

Let’s dig into whether now’s the moment to lean in or wait for a clearer rebound.

About Colgate Stock

Colgate-Palmolive is a global leader in oral care, personal care, home cleaning and pet nutrition products, with a heritage dating back to 1806. Headquartered in New York, New York, it operates in over 200 markets worldwide. Colgate’s market capitalization of around $62.2 billion reflects its status as a large-cap stalwart in the consumer staples space. With strong brand recognition and an established distribution network, CL stock is often viewed by investors as a defensive dividend play in volatile markets.

So far in 2025, CL stock has delivered a bleak year-to-date (YTD) performance, with a decline of 14% over that period. Over the past year, CL stock has seen a marked decline with shares down 22%, reflecting sustained downside pressure.

The stock recently touched a new 52-week low of $76.68 on Oct. 13, signaling a significant drawdown from peak levels. Amid its slide, CL has broadly underperformed the broader market, as the S&P 500 Index ($SPX) has gained 132% over the past year.

The downward trend reflects multiple headwinds from foreign exchange pressures denting revenues in key geographies to soft guidance and margin compression. While the stock’s retreat opens the door for a “buy the dip” narrative, any upside will likely depend on signs of stabilizing margins and renewed investor confidence.

Colgate-Palmolive is leaning harder into innovation and premiumization in its core oral, personal-household care lines and pet nutrition division to rekindle growth and defend its market share. However, whether these strategic levers can reverse sentiment and catalyze a rebound remains to be seen.

Despite the freefall in share price, CL stock currently trades at 21.2 times forward earnings, a premium valuation compared to the sector median.

Colgate-Palmolive has built a reputation not just as a stable consumer name, but also as a reliable dividend payer. The company has paid uninterrupted dividends since 1895. For the past 62 years, it has also raised its payout to common shareholders.

The quarterly dividend is $0.52 per share, which annualizes to $2.08. This results in a current forward dividend yield of around 2.67%. In terms of payout strategy, Colgate maintains a payout ratio of roughly 55%, reflecting a balance between returning cash to investors and retaining earnings for investment. The dividend is paid quarterly, and the next ex-dividend date is on Oct. 17, with payment to shareholders set to occur on Nov. 14.

Colgate-Palmolive's Mixed Q2 Results

Colgate-Palmolive released its second quarter 2025 results on Aug. 1. During the quarter, net sales rose 1% year-over-year (YOY) to $5.1 billion. Organic sales also grew by 1.8%, despite a 0.6% negative drag from lower private-label pet sales. On a non-GAAP basis, EPS edged up 1% to $0.92.

Still, margin pressure was evident. The firm's adjusted operating margin declined 80 basis points in Q2, landing at 21.3% and reflecting cost headwinds.

Results were mixed regionally. North American net sales were down 1% and 0.9% organically, driven by slight volume and pricing pressures. Latin America saw declines of 4.8% but organic growth of 3.4%, while Europe reported a 7.8% increase and organic growth of 2%. Finally, Asia Pacific posted modest gains, while Hill’s pet nutrition improved 3.8% with 2% organic growth.

On the balance-sheet front, Colgate held cash and equivalents of $1.2 billion and total debt of $8.8 billion by the end of the quarter.

In concert with the results, Colgate-Palmolive reaffirmed its full-year 2025 guidance. The company continues to expect net sales growth in the low single digits, now anticipating organic sales growth toward the low end of 2% to 4%, including the impact of its planned exit from private-label pet sales. On both GAAP and Base Business bases, management expects gross profit margin and advertising spend to remain roughly flat as a percentage of net sales, and EPS growth in the low single digits.

To support its long-term goals, the firm also announced a new three-year productivity program to drive future growth, with expected pre-tax charges of $200 million to $300 million by 2028, aimed at improving operating leverage and cost structure.

Analysts predict EPS to be $3.67 for fiscal 2025, up 2% YOY, before surging by almost 7% annually to $3.91 in fiscal 2026.

What Do Analysts Expect for CL Stock?

Barclays analyst Lauren Lieberman recently revised her CL stock price target down to $82 from $87, while maintaining an “Equal Weight” rating. The analyst cited “muted and decelerating” growth in certain segments of the personal care business following the Q2 results.

Goldman Sachs lowered its CL price target from $106 to $91 as well. Despite the reduction, the firm continues to have a “Buy” rating on the shares.

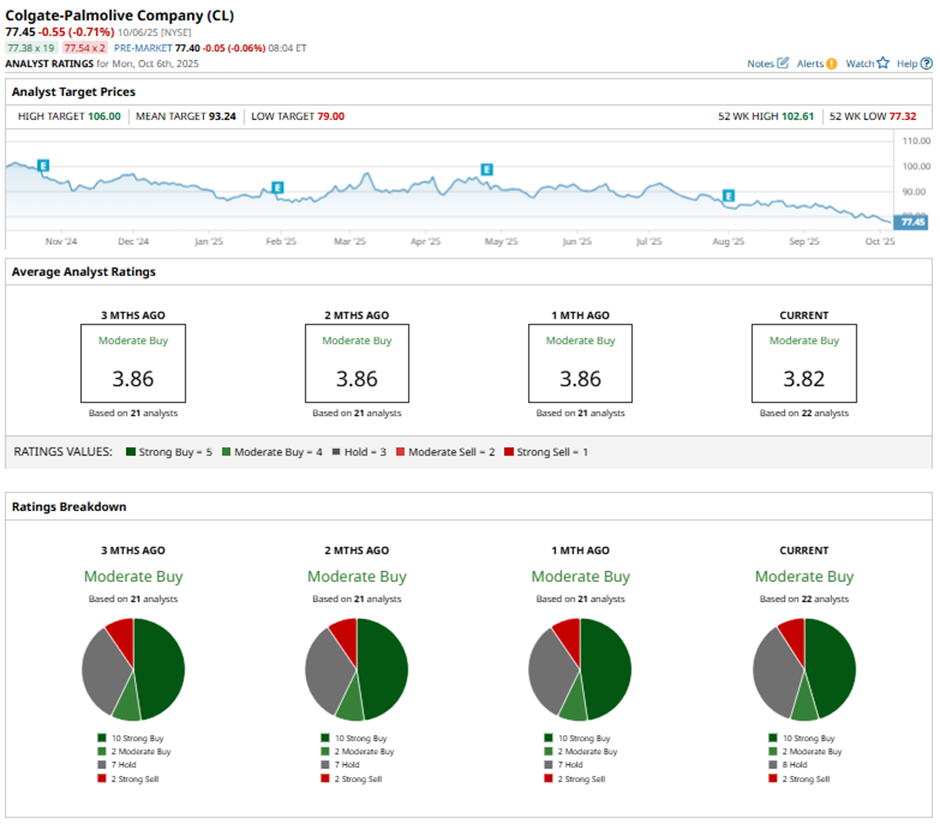

Wall Street is moderately bullish on CL stock. Overall, CL has a consensus “Moderate Buy” rating. Of the 22 analysts covering the stock, 10 advise a “Strong Buy,” two suggest a “Moderate Buy,” eight analysts have a “Hold” rating, and two provide a “Moderate Sell" rating.

The mean price target of $91.76 indicates potential upside of 17% from current levels. Meanwhile, the Street-high target price of $105 suggests that CL stock could rally as much as 34%.