Rare earth metals have quietly become the backbone of the modern economy, powering everything from electric vehicles (EVs) to wind turbines and advanced defense systems. As global demand accelerates, supply risks have surged, especially with China tightening its grip on rare earth exports. That’s why investors are increasingly watching for U.S.-based companies that can secure domestic access to these critical materials.

One surprising name leading this charge is General Motors (GM). While better known for its long automotive legacy, GM began investing in rare earth production back in 2021, a move that’s now paying off. This makes GM the only major U.S. automaker with a homegrown magnet source, insulating it from China’s export curbs. By “reducing reliance on China,” GM gains a strategic edge as rare earth elements become chokepoints in global trade.

This rare earth initiative, alongside GM’s broad EV pivot, has captured investors’ attention and could boost the stock’s appeal in the auto sector.

About GM Stock

With a market cap of around $54 billion, General Motors is a leading U.S. automaker with brands Chevrolet, GMC, Buick, and Cadillac. GM operates in three segments (GM North America, GM International, and GM Financial) and makes cars, trucks, SUVs, and EVs. Under CEO Mary Barra, GM is aggressively shifting to electric vehicles via its Ultium platform and advanced driver-assist tech (OnStar, Super Cruise).

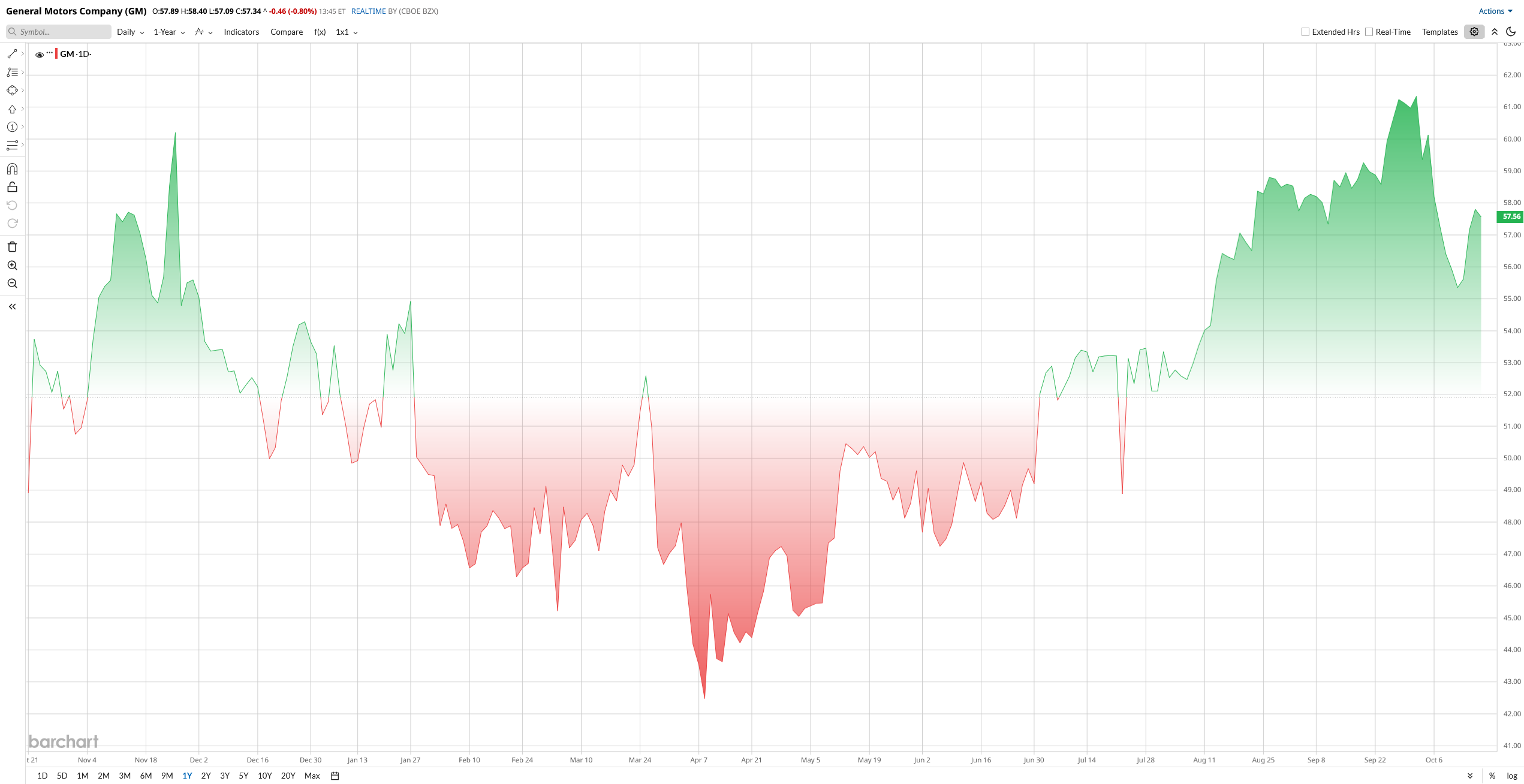

GM shares are up about 8% year-to-date (YTD) and 17% over the past year, outperforming the broader auto sector. Strong U.S. vehicle sales and a disciplined EV investment strategy have buoyed the stock. For example, GM’s robust North American pickup/SUV sales and its cash-generative internal combustion engine (ICE) business helped drive better-than-expected Q2 results.

The most compelling thing about GM stock is its valuation. The company's valuation remains attractive with solid EV momentum. The stock trades near a mid-single-digit P/E of 9x and around 0.3x sales. That P/E is roughly half the average for large automakers, and GM’s price/book of 0.8x is below 1. In short, GM looks cheap in terms of both earnings and assets. Such valuation considers cyclical headwinds, but it suggests limited downside if GM executes on growth.

Moreover, GM has strengthened shareholder returns by boosting its quarterly dividend 25% to $0.15 per share, yielding about 1.05% forward. The automaker’s annual payout stands at $0.60, with a modest 5% payout ratio, signaling sustainability. Despite a five-year decline in growth, GM’s renewed dividend policy reflects confidence in cash flow and long-term profitability.

GM’s Rare Earth Move Aims to Cut Costs and Tariff Risks

The push for rare earth metals by GM also supports its future EV strategy. A local magnet supply reduces cost/supply risks to the motors, which could enhance the margin of new EVs. The domestic magnets tie in with the U.S. EV incentives and national security objectives, which implies that GM can have policy tailwinds. Practically speaking, control over the supply chain of key materials will enable GM to avoid production stalling or battery and drive tariff strikes. That would speed up the release of EVs in GM and ensure profits against the commodity fluctuations.

Overall, analysts believe that this plan would enable GM to more seamlessly satisfy the increasing demand for EVs, increasing its revenues and making investors more confident that this company has an all-electric future.

GM Tops Q2 Earnings Expectations

GM beat Q2 expectations despite tariff-related headwinds and a decline in core earnings, reaffirming its fiscal 2025 guidance at the time. However, the company later lowered its outlook, citing up to $5 billion in potential tariff exposure.

GM now expects adjusted EBIT between $10 billion and $12.5 billion for 2025, reflecting a $4 billion to $5 billion tariff hit. Net income is projected at $8.2 billion to $10.1 billion, while adjusted automotive free cash flow is seen between $7.5 billion and $10 billion.

Q2 results also showed the impact of tariffs and product mix challenges. Revenue came in at $47.1 billion, roughly flat from last year, while net income fell 35% to $1.9 billion as higher warranty and tariff costs weighed on profits. Adjusted EPS was $2.53, down 17% year-over-year (YoY) but about $0.19 above estimates. Free cash flow dropped nearly 47% to $2.83 billion, mainly due to more than $1 billion in tariff payments.

North America remained GM’s profit engine, earning $2.4 billion in adjusted EBIT, while its international arm turned a corner with $204 million in profit, helped by a rebound in China. GM Financial earned $704 million, down 14%.

General Motors continues to face hefty tariff impacts of up to $6.7 billion annually due to its reliance on imported parts and batteries, alongside cash flow challenges tied to plant retooling.

On the bright side, GM Energy is showing strong momentum. The unit has reported about 30% month-over-month (MoM) revenue growth since January 2025 and a fivefold surge in charging-product sales. Notably, seven out of ten GM EV buyers now purchase a GM Energy charging product.

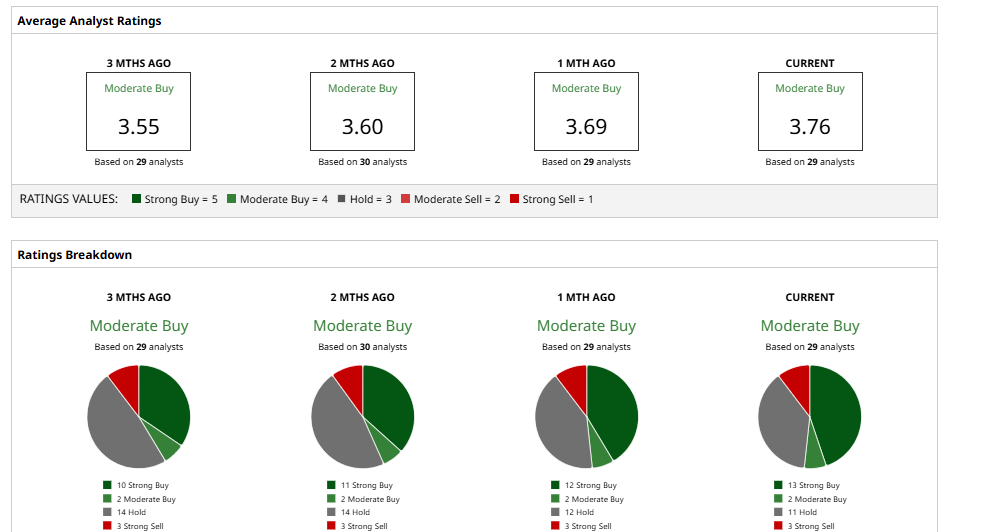

What Do Analysts Say About GM Stock?

Wall Street remains bullish primarily on General Motors’ outlook. Recently, Goldman Sachs lifted its target to $74 with a “Buy” rating, pointing to resilient sales and steady pricing so far this year.

Similarly, J.P. Morgan also raised its target to $80 and reiterated an "Overweight" stance, expressing confidence in GM’s long-term EV strategy.

Overall, analysts maintain a moderately bullish stance. Of 29 analysts covering the stock, the consensus rating stands at “Moderate Buy,” with an average 12-month price target of $61.85, suggesting roughly 7% potential upside from current levels.