/A%20corporate%20sign%20for%20AppLovin%20by%20Poetra_RH%20via%20Shutterstock.jpg)

AppLovin (APP) has become one of Wall Street’s favorite growth stories in 2025—and for good reason. Once known primarily as a mobile gaming ad platform, the company has rapidly evolved into an AI-powered advertising technology powerhouse, delivering staggering revenue and profit growth that’s left analysts scrambling to raise their targets. The stock has nearly doubled this year, joining the S&P 500 ($SPX) and emerging as one of the standout performers in the broader tech rally.

Now, analysts at Wedbush see even more upside ahead. The firm reiterated its bullish view this week, calling for “phenomenal growth” ahead as AppLovin continues to execute on its AI-driven ad platform and expand into new verticals like e-commerce. Still, optimism comes at a time when APP stock’s valuation is already lofty, and recent headlines—including an SEC inquiry into its data practices—have tested investor nerves. Yet, even after short-term volatility, bullish sentiment remains firmly intact.

So, with Wall Street calling for “phenomenal growth,” is it still worth buying APP stock after its massive run-up? Let’s dive deeper into Wedbush’s latest call, AppLovin’s recent performance, and see whether the rally still has legs.

About AppLovin Stock

AppLovin is a notable player in the advertising technology industry. The company offers AI-driven solutions designed to help businesses optimize their marketing strategies and maximize monetization. More specifically, it helps mobile apps, both in gaming and other sectors, to acquire users and monetize them through its AI-powered Axon engine and MAX mediation platform. APP’s market cap currently stands at $213.7 billion.

Shares of the advertising technology company have rallied 84.2% on a year-to-date (YTD) basis. APP stock has soared this year due to robust growth in its core advertising platform, successful expansion beyond mobile gaming, and a lucrative deal to sell its apps business. The stock’s rally was further supported by its addition to the S&P 500 Index ($SPX) in September.

Wedbush Analysts Project "Phenomenal Growth" for AppLovin

On Monday, Wedbush reiterated its “Outperform” rating and raised its price target on APP stock to $745 from $725 after hosting an advisor call. Analysts led by Alicia Reese said that the company’s “phenomenal growth will continue for the foreseeable future, with a staggering profit margin.” The analysts anticipate that AppLovin will capitalize on ongoing momentum in mobile gaming this year. Growing contributions from e-commerce are also expected to provide a boost.

“Expanding internationally late Q3, and opening its self-serve tool on October 1, should drive Q4 results higher than we previously modeled. With plenty of room for AXON [the company’s AI-powered advertising platform] and its competitors to thrive in this ecosystem, AXON 2.0 should maintain its leadership, with 20–30% annual growth easily achievable through market expansion,” according to the analysts.

Wedbush analysts noted that their advisor, Eric Seufert, emphasized AppLovin’s deliberate approach to expanding e-commerce, with the company currently prioritizing the rollout of its self-service tool and international growth. With that, the self-service and international launch is expected to deliver an incremental boost in the fourth quarter, while e-commerce expansion is anticipated to drive growth through Q4, Q1, and beyond.

Still, Seufert said public enthusiasm may be overstating AppLovin’s progress in its e-commerce expansion. He noted that average performance may initially dip as the company transitions from large, established advertisers to small and mid-sized businesses, but should rise over time as the model improves and AppLovin rolls out generative AI tools.

“Nothing from our call leads us to anticipate a slowdown in the near- or medium-term, as AppLovin’s moat is large and it will benefit incrementally as the model expands and learns. The most exciting opportunity is a couple of years out, with [Connected TV (CTV)], once AppLovin has proved adept with e-commerce,” said the analysts. Reese and her team said that while Amazon is poised to dominate the CTV full-funnel advertising space, AppLovin can remain competitive through key partnerships, such as with Roku and Netflix.

APP Stock Plunges on SEC Probe Report (Then Rebounds)

On the same day that Wedbush analysts reiterated their bullish stance on AppLovin, investors were also met with some bad news, at least at first glance. AppLovin shares fell about 14% on Monday after Bloomberg reported that the Securities and Exchange Commission (SEC) was probing the company’s data-collection practices.

The agency is examining allegations that AppLovin breached its platform partners’ service agreements by delivering more targeted ads to consumers, according to the report. The investigation is being handled by SEC enforcement officials specializing in cyber and emerging technologies. The report stated that the SEC was responding to a whistleblower complaint filed earlier this year, along with several short-seller reports, adding that neither the company nor its executives have been accused of any wrongdoing.

Still, the selloff triggered by the Bloomberg report proved short-lived, highlighting the strong investor confidence in the company. APP stock climbed over 7% on Tuesday after Citigroup advised investors to buy the shares following the selloff. Citigroup said that AppLovin’s disclosure of the probe in a regulatory filing was a positive sign, indicating that management does not view it as a material risk.

Meanwhile, Oppenheimer discovered four additional open requests related to AppLovin in the SEC’s FOIA logs, all of which were filed by Bloomberg. The firm noted that the recent Bloomberg report, along with the open FOIA requests and the possibility of additional short-seller reports, could result in near-term volatility in the stock but emphasized that its long-term bullish thesis remains intact.

How Did AppLovin Perform in Q2?

Now, let’s take a brief look at the company’s latest quarterly results. AppLovin’s second-quarter revenue surged 77% year-over-year (YoY) to $1.26 billion, driven largely by improved AppDiscovery performance. The top-line figure surpassed Wall Street’s projections by $40 million. Profitability grew even faster, with adjusted EBITDA nearly doubling YoY to $1.02 billion. Also, net income from continuing operations, which accounts for the loss tied to the App Portfolio divestiture, soared 156% YoY to $772 million.

Let’s turn our attention to the App Portfolio divestiture for a moment. On June 30, AppLovin completed the sale of its first-party apps business to Tripledot Studios for $400 million in cash plus equity and now classifies the unit as discontinued operations. This essentially means that results will highlight AppLovin’s high-margin software and marketplace segments—the areas that matter most to investors.

The company generated $768 million in free cash flow during the quarter, while net cash from operating activities stood at $772 million. Management used part of the generated cash to repurchase and withhold 0.9 million shares at a total cost of $341 million.

Looking ahead, management provided solid Q3 guidance, projecting advertising revenue of $1.33 billion at the midpoint and an impressive adjusted EBITDA margin of 81%.

APP Valuation and Analysts’ Estimates

According to Wall Street estimates, APP’s profit is expected to roughly double YoY to $9.15 per share in FY25. Also, analysts anticipate an 18.57% YoY increase in the company’s revenue to $5.58 billion.

When it comes to valuation, APP stock appears priced for perfection. The company’s valuation multiples exceed sector medians across the board, with a forward P/E of 58.81x and a forward EV/Sales of 38.69x. On the one hand, the premium can be justified given the company’s strong fundamentals—accelerating revenue growth, solid cash generation, and guidance that points to continued strength. But eventually, such a valuation leaves little room for error, meaning even minor setbacks could trigger significant downside.

What Do Analysts Expect for APP Stock?

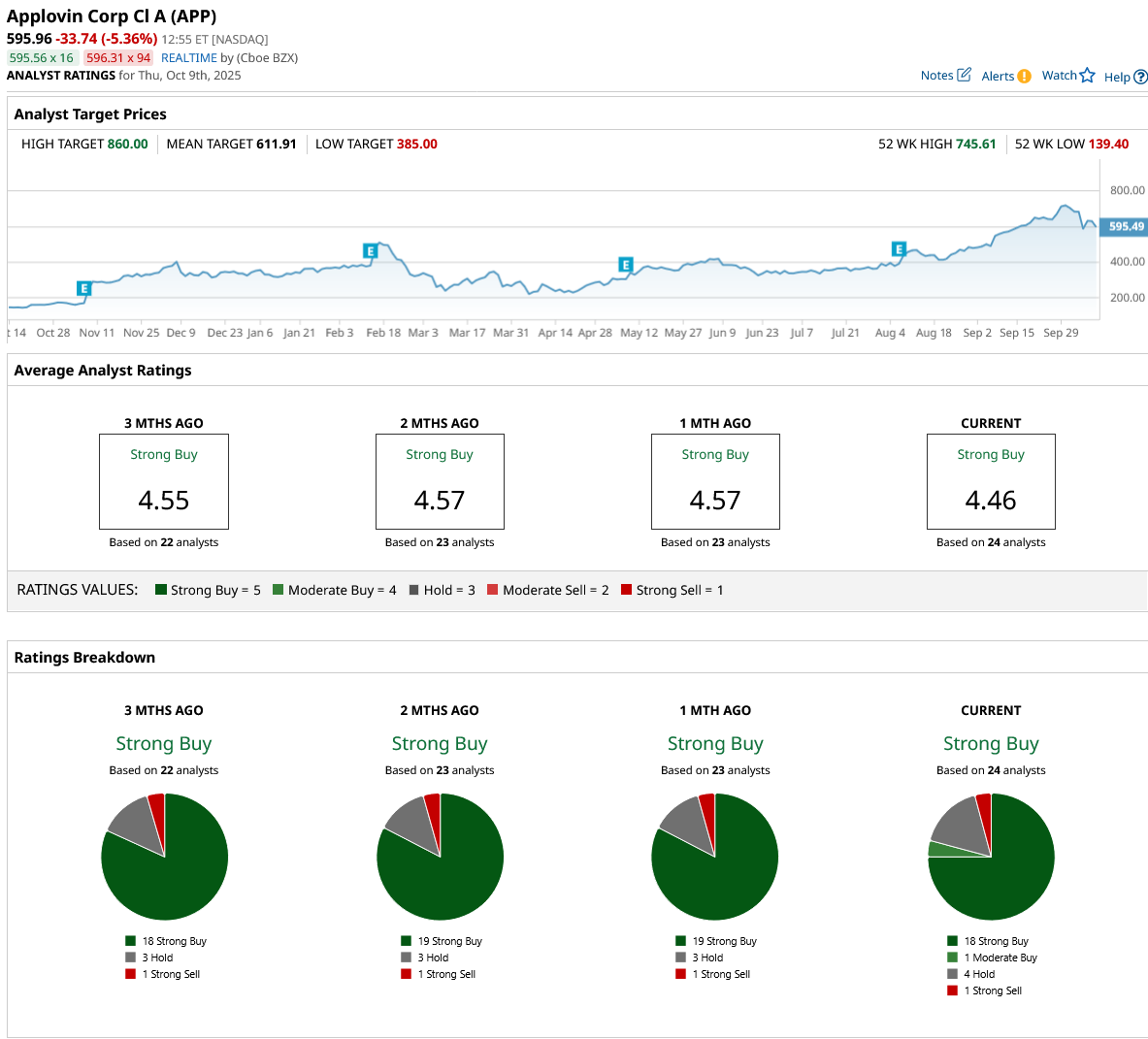

Wall Street analysts remain extremely bullish on AppLovin, with APP stock enjoying a top-tier “Strong Buy” consensus rating. Of the 24 analysts covering the stock, 18 rate it a “Strong Buy,” one a “Moderate Buy,” four suggest holding, and one assigns a “Strong Sell” rating. Following the recent rally, APP stock is trading slightly below its average price target of $611.91, though the Street-high target of $860 indicates there's still quite a lot of potential upside.